Subscribe to Bankless or sign in

TokenWorks is a dev studio experimenting around onchain financialized ideas. They pioneered in 2025 with a trio of headliner protocol launches:

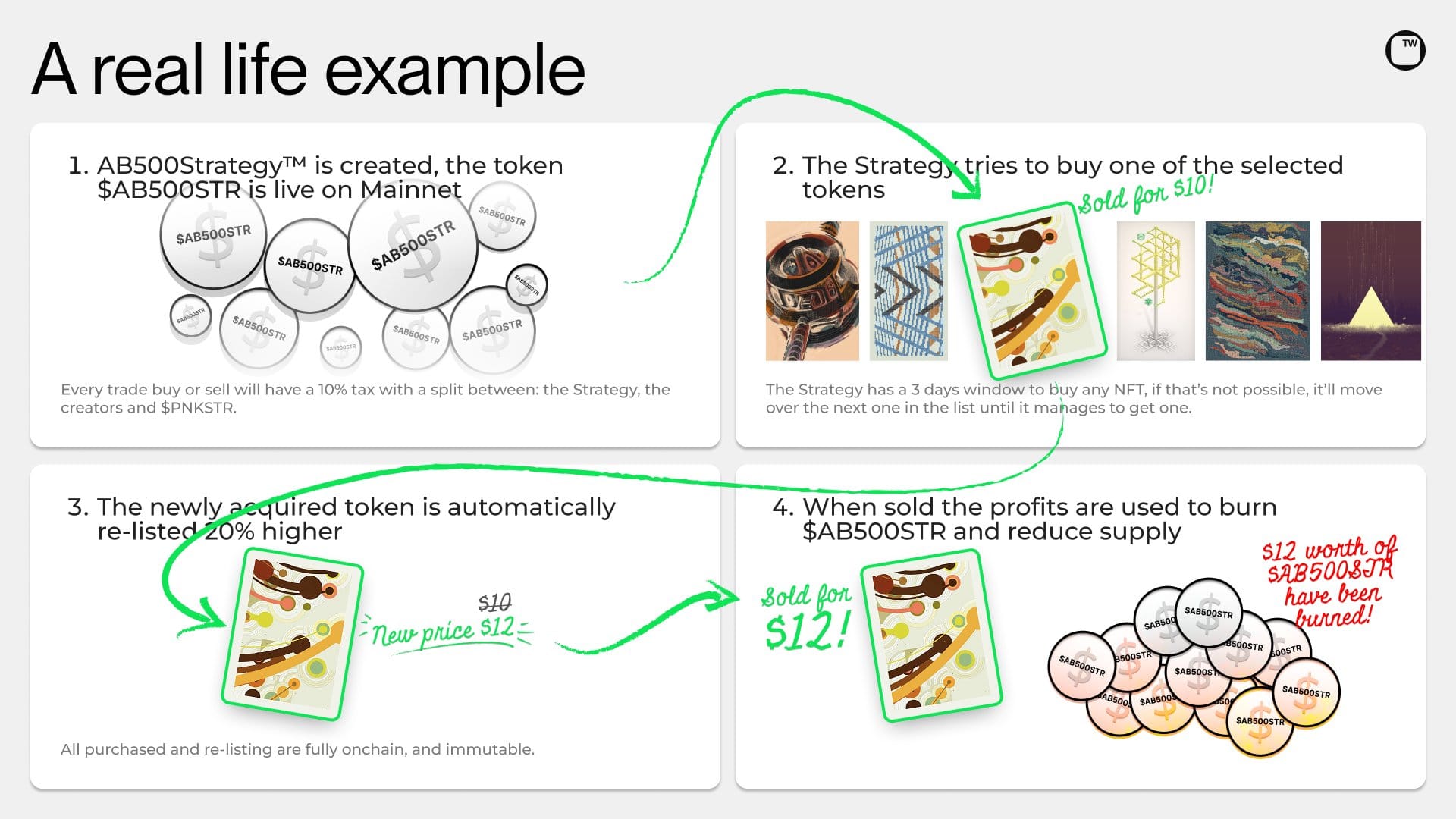

- PunkStrategy (Sept. 2025) — Introduced $PNKSTR with a 10% trading fee. The protocol accumulates ETH, buys the cheapest CryptoPunk it can, and relists it for a 20% premium, 'round and 'round. Upon any sales, all proceeds are used to burn $PNKSTR

- NFTStrategy (Sept. 2025) — Extended the $PNKSTR playbook to a curated set of top NFT collections like Bored Ape Yacht Club, Pudgy Penguins, and Chimpers. These strategies were also designed to route a portion of revenue back to original creators via onchain royalties.

- TokenStrategy (Dec. 2025) — Unveiled a permissionless launchpad for deploying strategy tokens for NFT collections or ERC-2os you've created. The rollout also notably debuted Recursive Strategies, which aren't tied to external assets but rather buy and burn their own tokens.

Accordingly, TokenWorks is a team to watch in 2026, and they're already off to a hot start in the new year. For instance, today they announced that anyone can now deploy any ERC-20 strategy they want.

This matters because previously the TokenStrategy platform would only let you deploy such a strategy if you controlled the underlying ERC-20 smart contract. However, projects renouncing control of their coins for immutability is a common pattern in the  Ethereum ecosystem.

Ethereum ecosystem.

As such, TokenWorks just "upgraded the TokenStrategy launcher to handle this case [...] If the Strategy is not deployed by the owner, the creator fee is also used to buy the underlying token."

It's a nice tweak that has the potential to meaningfully expand the strategy meta. Yet TokenWorks has something even bigger in the works for later this month: the arrival of IndexStrategies.

Like the name suggests, IndexStrategies will focus on buying a range of specific assets instead of just buying CryptoPunks, or just buying Bored Apes, etc.

TokenWorks has already revealed that the first IndexStrategy will be $AB500STR, which will accumulate works from Art Blocks 500 — i.e. the 500 official generative art releases Art Blocks has facilitated.

$AB500STR will rotate through all Art Blocks collections in sequence, starting with Chromie Squiggles. Then each collection will get a three-day purchase window. If an NFT is acquired, or the window expires, the strategy advances to the next collection. Once all 500 projects have been cycled through, the loop will restart from the beginning.

Like other NFT strategies, $AB500STR enforces a 10% trading fee, which is split between the strategy, buy-and-burns of $PNKSTR (as the ecosystem token), and creator royalties. The main wrinkle here? The royalties are distributed evenly across the +300 AB500 artists instead of just going to one collection creator as is seen with regular and singular NFT strategies.

And, of course, when sales occur after relistings, proceeds will be used to buy and burn $AB500STR, and this earn, buy, sell, and burn loop will run for as long as Ethereum runs.

This kind of setup is ideal for someone who wants long-term exposure to some of Ethereum's most iconic gen art collections but without breaking the bank or manually curating buys.

However, $AB500STR is also just the first of the IndexStrategies releases. In time, this model could be expanded in all sorts of directions. For example, consider tokenized Pokémon cards. Imagine a $BS1999STR that accumulates across the 102 cards of the legendary 1999 Pokémon Base Set series, all onchain.

Ultimately, then, we'll have to see where things go from here, but IndexStrategies do point the way to new cultural experiments.

And while speculation can be extractive from culture in various ways, TokenWorks flips this so speculation is taxed into accumulation + royalties. Traders fund collectors, and artists get paid even when marketplaces don't enforce royalties. That's a really interesting dynamic that's worth tracking closely in the months ahead, in my opinion.