Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

- 📊 ICE Invests $2B in Polymarket. The NYSE parent’s $2B deal values the prediction market platform at $9B and makes ICE the global distributor of Polymarket’s event data, marking one of the largest institutional entries into DeFi.

- 📈 S&P Global Unveils Hybrid Crypto Index. The new S&P Digital Markets 50 blends 15 major tokens with 35 crypto-related equities, with Dinari set to issue a tokenized version onchain via its dShares platform.

- 🪙 Meanwhile Raises $82M for

Bitcoin Life Insurance. The BTC-denominated insurer closed an $82M Series B co-led by Bain Capital Crypto and Haun Ventures, bringing 2025 fundraising to $122M as it expands globally and develops bitcoin-linked retirement tools.

Bitcoin Life Insurance. The BTC-denominated insurer closed an $82M Series B co-led by Bain Capital Crypto and Haun Ventures, bringing 2025 fundraising to $122M as it expands globally and develops bitcoin-linked retirement tools.

| Prices as of 1:00pm ET | 24hr | 7d |

|

Crypto $4.26T | ↘ 3.1% | ↗ 6.2% |

|

BTC $121,295 | ↘ 3.2% | ↗ 7.3% |

|

ETH $4,490 | ↘ 4.4% | ↗ 9.1% |

Over the past week, Solana's community has rallied around MetaDAO, the flagship futarchy platform demonstrating what happens when you let markets decide governance proposals.

While MetaDAO may be new to some, the project’s been proving out futarchy (few-tar-key) for a few years now — a governance model where prediction markets evaluate whether proposals will be "+EV" (positive expected value) for an organization.

Futarchy predates crypto, but recent excitement around prediction markets and ongoing debates about token launch design have sparked renewed interest. Add in MetaDAO's standout price action, and suddenly everyone's paying attention.

Let's break down what futarchy is, how MetaDAO implements it, and why it might solve long-standing problems with token launches.

What Is Futarchy?

First off, Futarchy is a governance system first proposed by economist Robin Hanson — (who’s an advisor to MetaDAO) — in the early 2000s. The core idea? "Vote on values, but bet on beliefs."

In practice, this means communities collectively decide what "success" looks like — higher token value, more users, whatever metric matters — then use prediction markets to determine which proposals will actually achieve it, rather than simply voting on them.

Hanson originally imagined this for governments and companies, where markets could predict policy outcomes. Just as with prediction markets, the premise for futarchy is that adding in financial incentives leads to better information than traditional voting.  Vitalik Buterin has championed the idea of futarchy for DAOs since 2014, seeing it as a way to ditch hierarchies for market-derived intelligence.

Vitalik Buterin has championed the idea of futarchy for DAOs since 2014, seeing it as a way to ditch hierarchies for market-derived intelligence.

As we all know, traditional DAO voting suffers from low turnout, whale dominance, and short-term thinking. Futarchy could fix this by making decisions economic. Think a proposal is good? Bet money on it. Get it right, profit. Get it wrong, lose.

It's capitalism applied to group decisions — rewarding insight and expanding participation beyond token holders to anyone willing to put capital at risk, crowdsourcing “superior” insight through market involvement.

How Futarchy Works in MetaDAO

On Solana, MetaDAO takes futarchy from theory to practice.

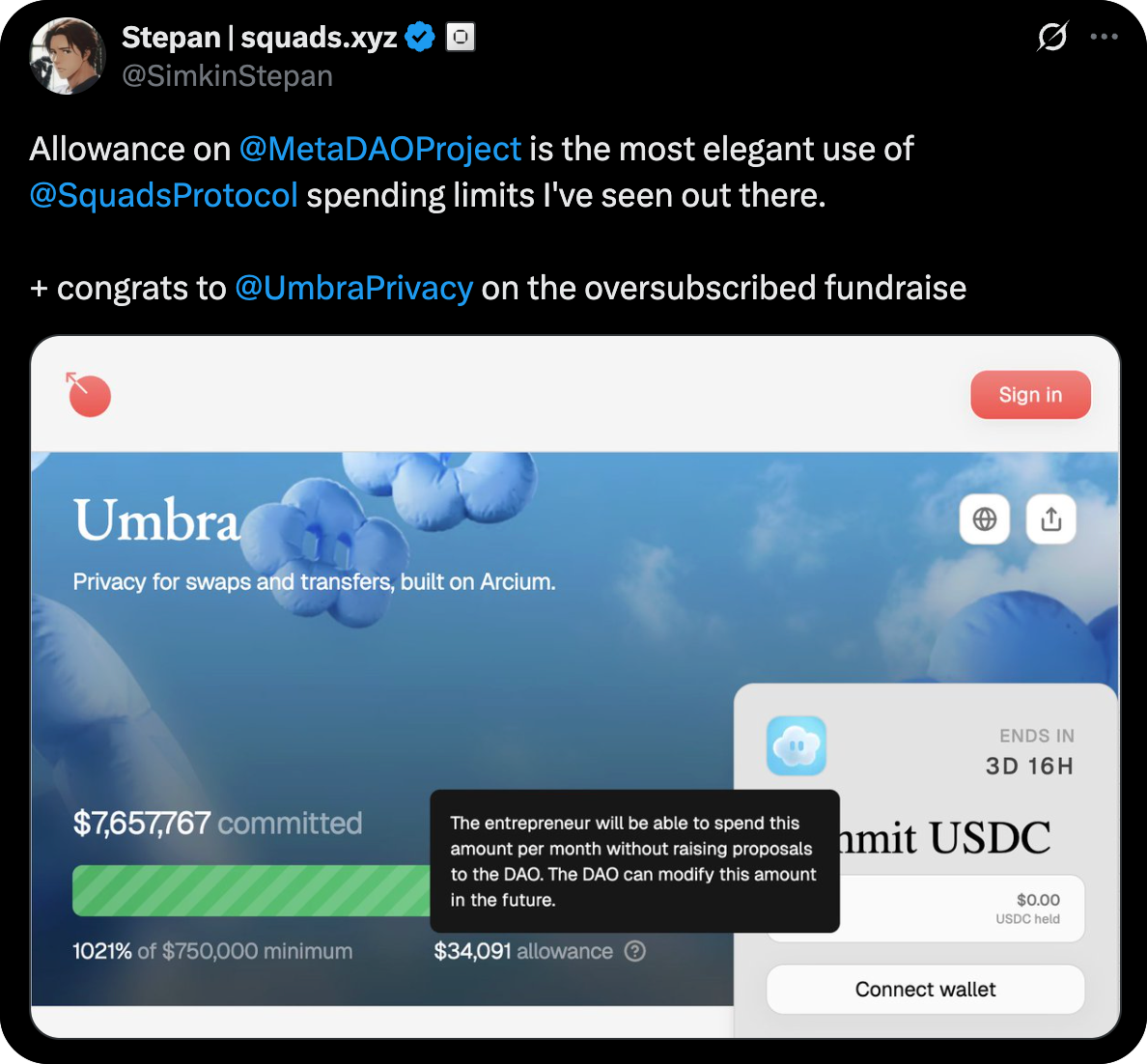

Launched with a modest $10K treasury and expanding to investment from Paradigm, the protocol now offers "Futarchy as a Service," letting other projects like Drift, Jito, and Sanctum, among others, use its tools for token launches and governance.

- Propose an Idea: Anyone can suggest a plan, like "Mint 10% more tokens for marketing." No approvals needed — it's open, with small fees to prevent spam.

- Launch the Market: A prediction market opens. Traders deposit USDC and receive two derivative tokens: "PASS" (betting the proposal boosts the token price) and "FAIL" (betting it hurts). Trading these tokens pushes prices up or down based on collective belief.

- Betting Period: The market runs for days or weeks. If PASS trades at least 3% higher than FAIL (using a time-weighted average), the crowd thinks it's +EV.

- Resolve and Act: If PASS wins, the proposal executes automatically. Winners redeem their tokens for gains; losers' bets go to zero. If FAIL wins, nothing happens.

Real examples: MetaDAO once passed a token burn against the team's wishes to fix overvaluation. Spin-off mtnCapital liquidated its treasury via market approval, refunding holders when momentum stalled. It's efficient, transparent, and gives holders actual say.

How Futarchy Fixes Token Launches

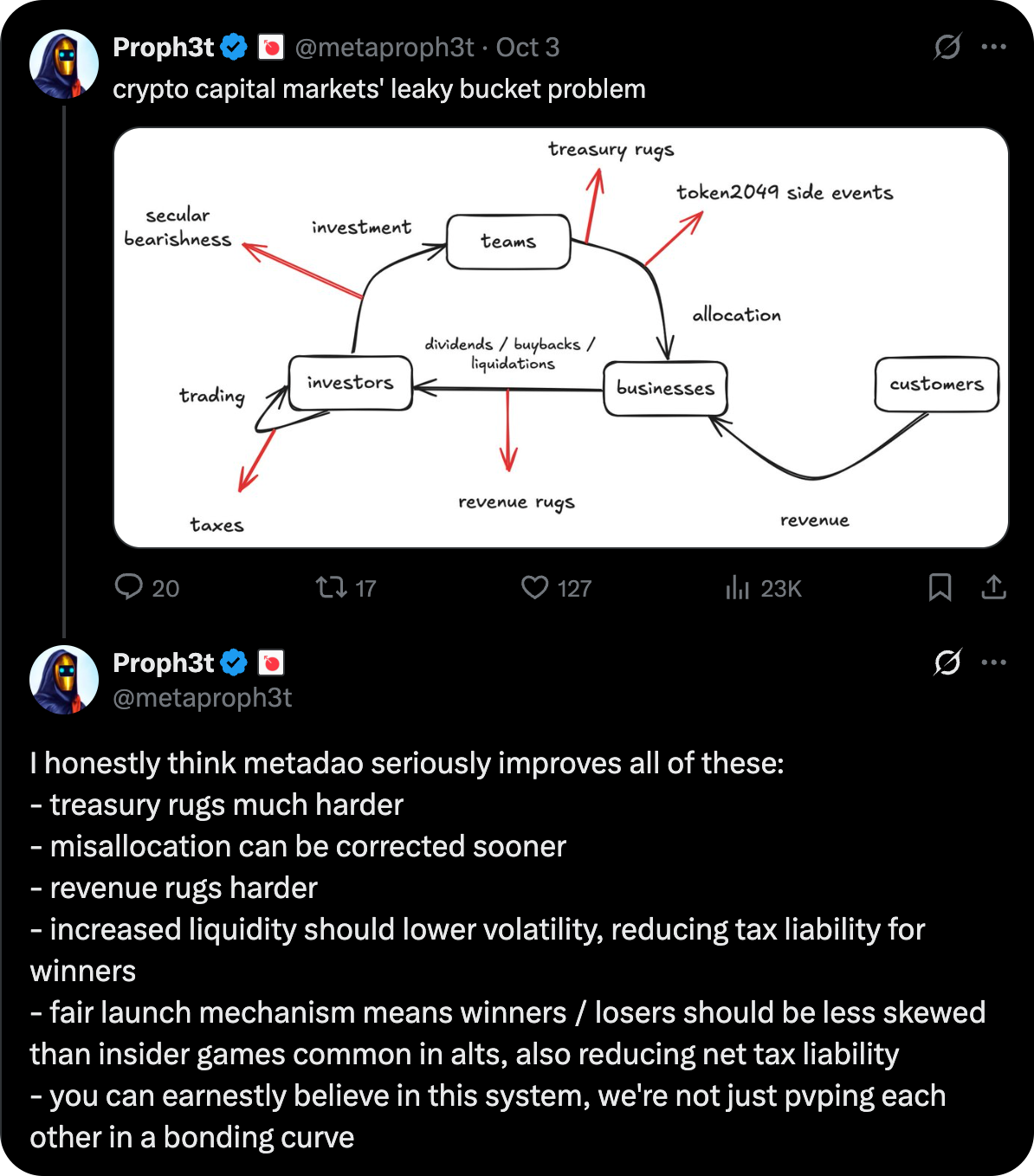

It’s perhaps an understatement to say token launches have been heavily scrutinized this cycle.

From low-float, high-FDV disasters to bonding curve commodification on Pump(.)fun, teams keep experimenting with new ways to develop “fair” launches — yet launches still often flop. Founders grab huge allocations, dump on retail, or make self-serving decisions. Tokens end up as "governance fluff" with no real power.

Among its offerings, MetaDAO provides projects that use its platform with a launchpad which seeks to solve these pervasive token issues by equipping them with built-in rights from day one.

- Fair Starts: Projects launch with high-float tokens, meaning broad public distribution and often zero upfront team allocations. There's no rigid fixed supply — markets decide if minting more tokens would be beneficial, to raise new funds, for example. This makes raises adaptive, avoiding the trap of locked supplies that stifle flexibility.

- Real Ownership: Token holders control the IP, treasury, and key decisions through programmable smart contracts. They can propose anything — team salaries, strategic pivots, full treasury liquidations. For example, if a founder slacks off, holders can push through a refund proposal that passes if the market agrees it's the smart move. This solves what Felipe from Theia Research calls the "Tokenholder Rights Problem" — letting holders get their money back if the founder stops working.

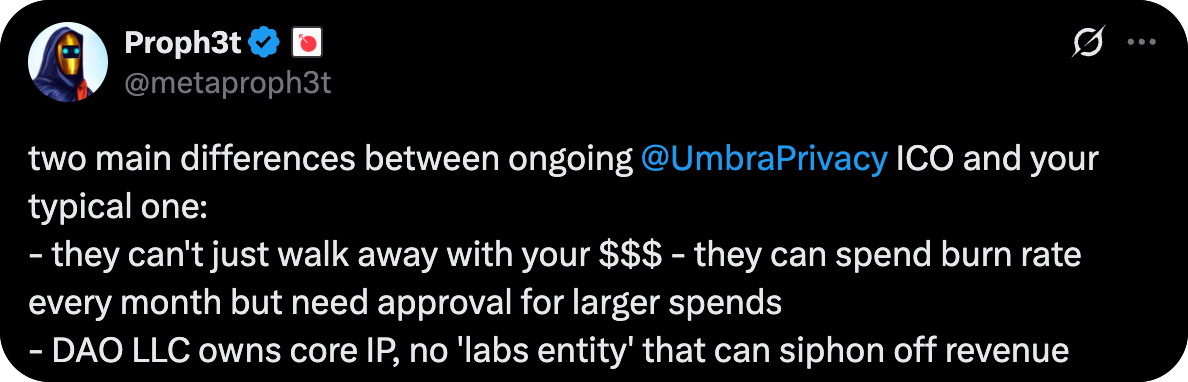

- Protection Built In: Unlike classic DAO “governance theater,” with fake votes or endless Discord debates, futarchy enforces real accountability. Traders put money on the line, naturally weeding out bad ideas. This accountability mechanism is particularly powerful for new launches, enabling pay-for-performance models where teams earn rewards tied to verifiable milestones. For example, a recent MetaDAO proposal outlined that founders Proph3t and Nallok would receive 2% of token supply for every $1B increase in META's market cap, up to 10% at $5B.

This connects to the vision of Internet Capital Markets, a push forming for implementing blockchain-native asset ownership and fundraising into the next wave of corporate governance. The problem? Token holders largely don't have real claims to the projects they’ve bought into. MetaDAO's futarchy changes this, letting any market participant help determine the path forward of an onchain organization, whether or not they hold a large amount of its token supply.

As a result, founders can focus on building without governance distractions. Holders can secure verifiable rights and potential refunds. As Colosseum’s Mike Rinko puts it, it renders tokens "valuable, mintable, and founder-friendly."

The Path Forward

Overall, futarchy looks to transform tokens from speculative assets into functional tools with genuine utility and protections. Traditional tokens fail to deliver on decentralization promises, leaving holders with little recourse against mismanagement. Futarchy embeds market-driven accountability directly into token design.

This gives holders real rights to influence outcomes, recover value through liquidations when needed, and ensure adaptive supply responding to proven growth opportunities. Economic incentives reward contributions and penalize poor decisions — fostering sustainable projects in a way governance theater never could.

As more launches adopt this model, we’ll see if tokens can evolve into reliable vehicles for shared ownership.

Whether futarchy becomes the dominant governance model remains to be seen. But for projects serious about building lasting value and giving holders genuine influence, it's proving to be the most credible alternative we've seen yet.

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.

Mantle

Mantle