Subscribe to Bankless or sign in

Today we’re going to go over a different kind of DeFAI — not the application of AI to DeFi, but of DeFi to AI.

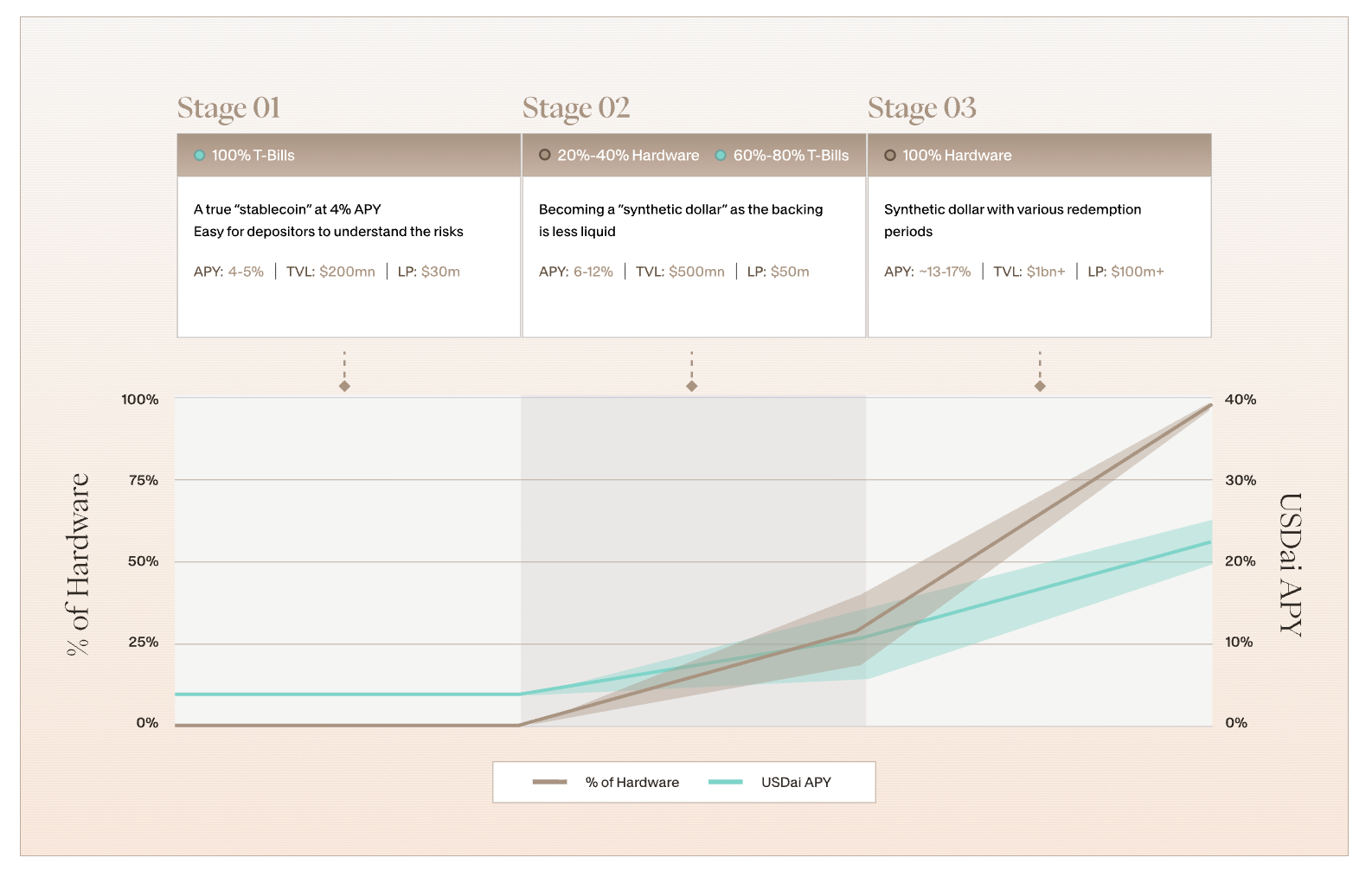

With the market ripping and everyone (hopefully) securing profits, stablecoin farms look more attractive. Why let capital sit idle when you can earn 15-20% APY? That's where USDai comes in — a protocol financing the AI hardware boom through decentralized lending, offering double-digit yields on stablecoins.

Below, we'll break down what USDai solves, how it works, and three strategies for generating yield while qualifying for its airdrop.

The Problem

The AI supercycle needs capital.

Elon Musk says there's a $490B gap between the money needed for planned AI projects, like Stargate's $500B plan, and the funding currently available. Right now, that gap is dominated by traditional finance: loans, bonds, convertible preferred equity. Banks and institutions control the flow.

This gap provides an opportunity for crypto-native capital to step in where TradFi moves too slowly. USDai hopes to accomplish this, providing over-collateralized loans to GPU operators backed by tokenized hardware — all while paying you yields from the rental income.

How USDai Works

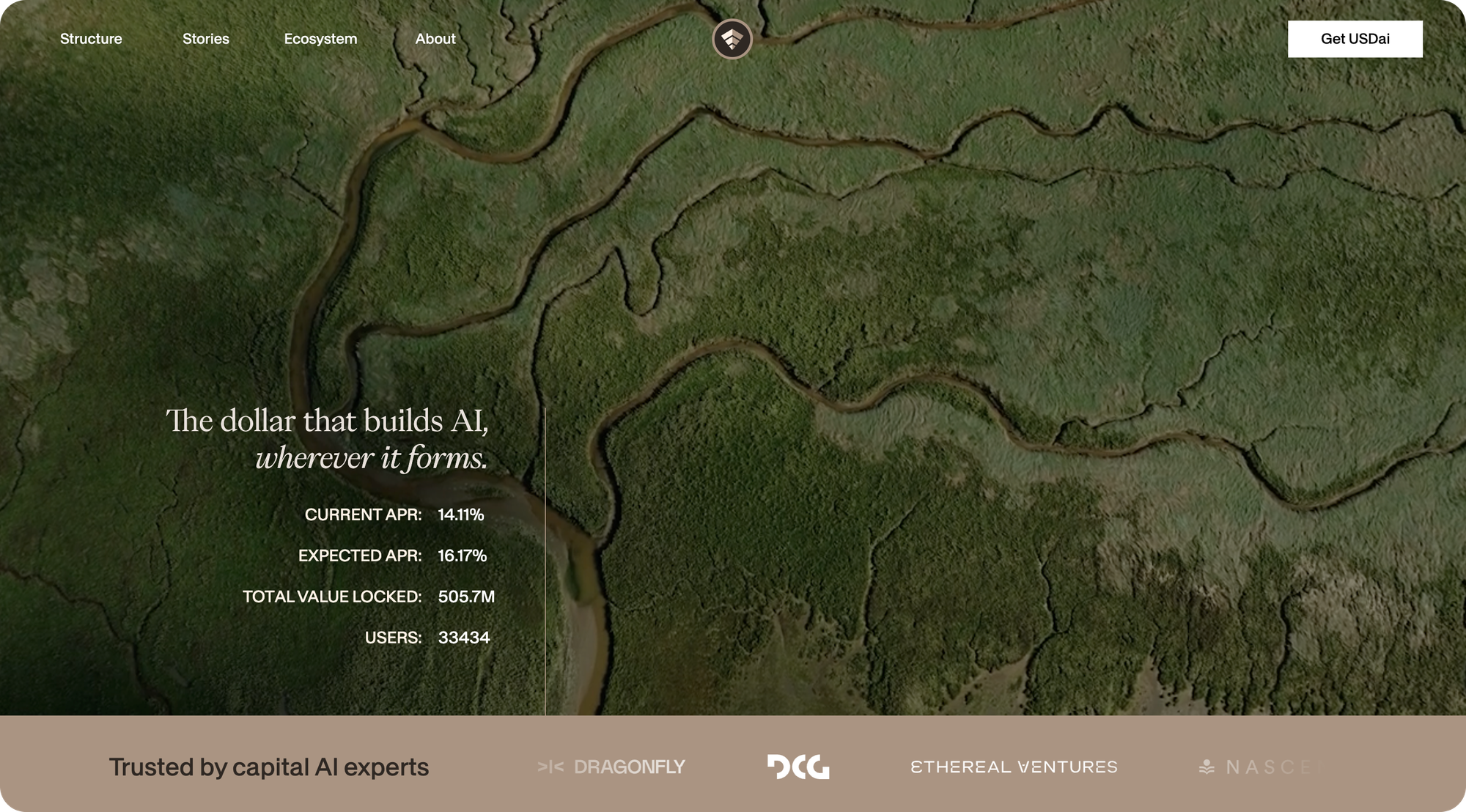

To be clear though, USD.ai isn’t a typical lending platform. It doesn’t give loans to people or companies. Rather, it funds AI hardware expansion directly by turning the equipment (like GPUs) into tokenized assets.

Here’s how it works in simple terms:

- Deposit stablecoins (USDC, USDT) and receive USDai 1:1.

- Your capital sits in U.S. Treasury bills earning interest while GPUs are manufactured or prepared for tokenization.

- Once ready, GPUs are tokenized via USD.ai's CALIBER system. These tokens become collateral for your USDai, legally separated from borrower control and repossessable if loans aren't repaid.

- Operators — smaller AI infrastructure companies financed by USDai — rent out GPUs and use income to repay financing.

- Rental income becomes yield (up to 20% APY) when you stake USDai as sUSDai.

- If operators can't pay, USD.ai reclaims tokenized GPUs and sells them.

Behind the scenes, “Curators” add first-loss protection and vet deals through a process called FiLo, ensuring solid investments. A system called QEV makes sure everything stays fair and transparent if assets need to be sold.

In short, you’re funding AI hardware through DeFi, earning profits from GPU rentals, with the hardware itself as secure collateral — like a mortgage for the AI boom.

Allo & Alignment

Now, an added perk atop the yields is that, as a tokenless protocol, USDai runs an Allo points farming campaign for its upcoming token launch. There are two different paths to pursue though, with two alignments and two different rewards. Here’s how it all fits together.

- Allo = your points. Every dollar deployed generates daily points across strategies — minting USDai, staking sUSDai, providing liquidity, looping.

- Alignment determines your side: ICO Alignment (Brown) — Hold USDai to earn token allocation in the ICO (requires KYC); Airdrop Alignment (Teal) — Stake sUSDai for yield plus free token grant.

Switch anytime, but when the game ends at $20M total yield distributed, rewards split by final position:

- 70% to ICO Alignment

- 30% to Airdrop Alignment

Three Strategies for Farming Allo Points

I recently came across Berasearch’s “USDai Points Farming for if you're scared of Pendle,” a simple, straight-forward guide tailored to different risk tolerances.

While there’s room to get “fancier” by combing through USDai’s masterlist of strategies, Berasearch’s provides an approachable path to push off from if you’re so inclined.

Here are three that stood out:

Play 1: The Staker's Hold

Pick your alignment, collect your multiplier.

- Mint USDai (if deposits open) or buy from DEXs.

- ICO Alignment: Hold USDai, earn 5x Allo multiplier.

- Airdrop Alignment: Stake USDai → sUSDai, earn 2x Allo multiplier + ~20% yield.

Risk: Low. Holding stablecoins or staked stablecoins.

For: Anyone with conviction on one side. Want token allocation? Go brown. Prefer passive yield plus free tokens? Go teal.

Catch: Committing to alignment means giving up either staking yield (ICO) or betting on the smaller airdrop pool (30%).

Play 2: The LP Provider

Earn trading fees plus amplified Allo.

- Acquire USDai or sUSDai.

- Provide liquidity on supported DEXs like Curve or Balancer.

- Earn trading fees + 10x Allo multiplier.

Risk: Moderate. Impermanent loss if USDai/sUSDai depeg or paired assets swing. Liquidity is locked.

For: DeFi natives comfortable with LP mechanics wanting higher multipliers. Works for both alignments.

Catch: Impermanent loss is real. Manage positions actively. But 10x multiplier beats basic holding.

Play 3: The Aggressive Loop

Levered yield, amplified Allo, maximum degen.

- Mint/buy USDai, stake for sUSDai.

- Deposit sUSDai into Euler Finance.

- Borrow USDC against collateral.

- Swap USDC → USDai.

- Stake for more sUSDai.

- Repeat.

Earn levered yield while stacking 10x Allo multipliers on every sUSDai dollar.

Risk: High. Leverage, borrowing costs, liquidation risk if sUSDai depegs.

For: Experienced DeFi users comfortable with money markets. If LTV and health factor don't scare you, this amplifies farming significantly.

Catch: You’ll have to monitor frequently. Liquidations happen and borrowing costs eat profits. Overall, the strategy only works if Allo points outweigh looping costs.

Overall, if you're parking stables anyway, USDai offers a way to put that capital to work in one of the few sectors where real-world demand meets crypto-native innovation, while earning standout returns while doing so.

Pick your strategy, manage your risk, and decide if you want exposure to what could be the next wave of infrastructure financing.