Subscribe to Bankless or sign in

![]() Starknet just flipped the switch on

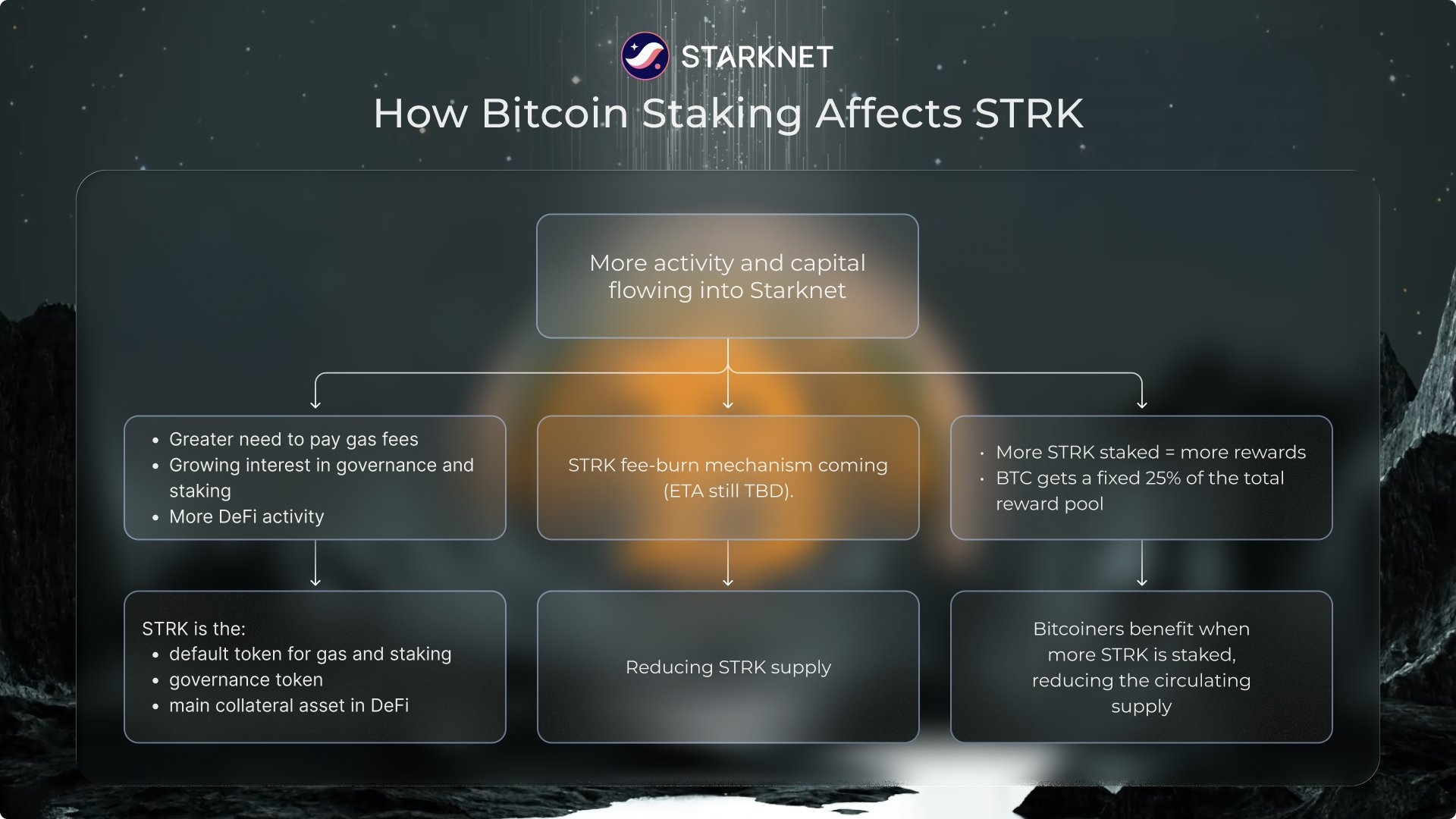

Starknet just flipped the switch on ![]() Bitcoin staking. Wrapped BTC can now help secure the network, flow into DeFi strategies, and earn STRK rewards.

Bitcoin staking. Wrapped BTC can now help secure the network, flow into DeFi strategies, and earn STRK rewards.

For a $2T asset that’s been mostly idle (less than 2% of BTC is used onchain!), this rollout's a major unlock. Starknet's big idea is to make Bitcoin productive now while laying the groundwork to become a dual Bitcoin- Ethereum execution layer in the future.

Ethereum execution layer in the future.

What’s new

Starknet’s fresh BTCFi rollout has a few core pillars:

- 🟠 BTC staking live — WBTC is supported out of the gate, and governance can approve more wrappers like LBTC, SolvBTC, and tBTC over time.

- 💸 100M STRK incentives — ~$14M in “BTCFi Season” rewards are now open for earning and are attracting attention, capital, and development.

- 🏦 Institutional participation — Re7 Capital has launched a BTC-denominated yield strategy integrating with Starknet apps like Ekubo.

Why it matters

Many Bitcoin Layer 2 visions hinge on future opcode upgrades like OP_CAT, which may take years to materialize.

That obstacle isn't one Starknet wants to stand by for. Hence by routing wrapped BTC through bridges and oracles into staking and credit systems, Starknet's kickstarting its BTC DeFi flywheel without waiting for protocol changes.

BTC has historically been sidelined in DeFi, but making it a first-class collateral on a high-throughput ZK rollup opens the door to Ethereum-class UX for perps, basis trades, credit, and more. Faster finality, lower fees, and full composability, but all centered on BTC.

It's still the early days, of course. But if Starknet can eventually align settlement across both Bitcoin and Ethereum, it can become a powerful hub for BTC innovation. And staking is one of the first steps forward here.

How to participate

Getting started with Starknet's BTCFi scene is straightforward, as there are just a few steps to dive in. To begin:

- 💰 Prep your BTC — Move your desired funds into WBTC or retrieve a wallet with existing WBTC holdings.

- 🌉 Bridge to Starknet — Transfer your WBTC to Starknet via a supported bridge like LayerSwap or Rhino.

- 📥 Time to stake — Once your BTC is on Starknet, you have two main ways to stake...

- Delegate to Validators. Anyone can participate by delegating wrapped BTC to validators through wallets like Ready or Braavos or on platforms such as Voyager. Simply choose a validator, delegate your tokens, and start earning a share of staking rewards.

- Acquire Liquid Staked BTC. Alternatively, you can use a liquid staking provider like Endur to receive a liquid-staked BTC token. These tokens accrue staking rewards while remaining usable in DeFi, e.g. as collateral in lending markets or to LP in perps protocols.

What to watch

The real test for Starknet’s BTCFi play will be adoption. Early signs are promising, as the L2's total value locked (TVL) has surged over the past two weeks. Yet the next phase will hinge on how sticky that momentum becomes once incentives taper.

Will activity hold once the 100M STRK rewards wind down, or will liquidity flee? Can Starknet apps like Ekubo, Vesu, and Extended maintain rising volumes after this bump?

We'll have to wait and see. Yet there's no denying that Starknet has positioned itself as one of the few teams capable of pulling this BTCFi vision off successfully. If the L2's shipping pace and partner traction continue, it has a real shot at becoming a major BTC layer. Don't sleep on this crossroads!