Subscribe to Bankless or sign in

In a grim bit of irony, the very day ![]() Binance published its long-awaited postmortem on the record-setting 10/10 liquidations, crypto investors were subjected to another brutal flash crash.

Binance published its long-awaited postmortem on the record-setting 10/10 liquidations, crypto investors were subjected to another brutal flash crash.

On Friday, BTC broke down into the low 70s, dropping below MicroStrategy's cost basis of $76K. ETH dropped below $2K, shedding over 13% in a single day. More than $2.5B in leveraged positions were wiped out.

If you were locked into Twitter over the weekend, you'll know crypto was by no means the only asset class that suffered. Gold and silver saw historic volatility, with silver posting one of its largest single-day drops in 275 years. When selling strikes several asset classes at once, it often points to something broader. Here it appears to be institutions pulling back from risk across the board, particularly in markets that had grown dangerously leveraged over the preceding months.

Crypto, as usual, was leading the way down.

Here's what went down👇

New Blood at The Fed

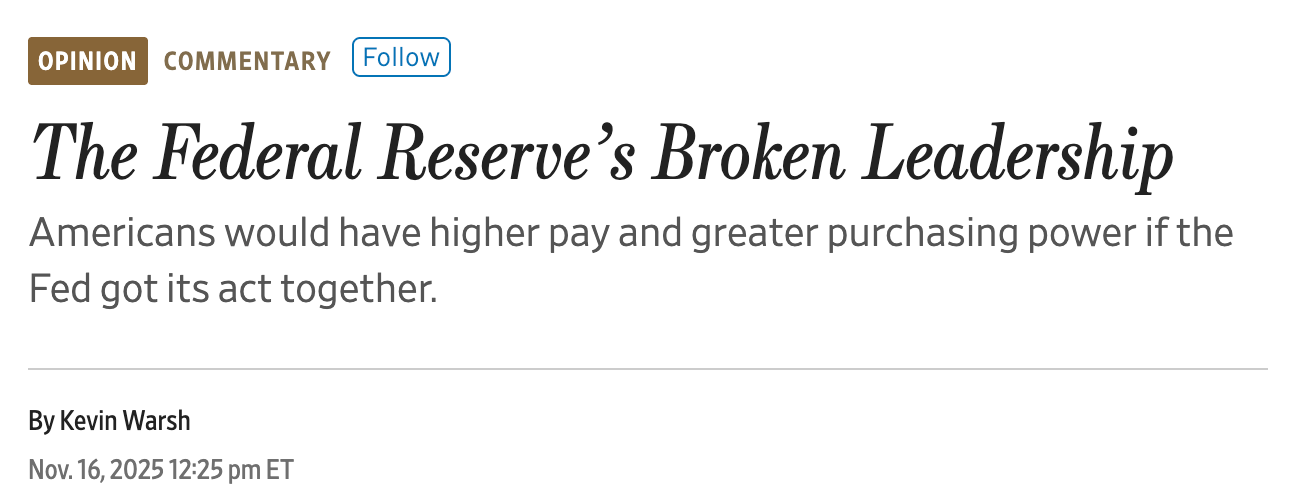

Late Thursday, prediction market  Polymarket leaked confirmation that Kevin Warsh would be the next Federal Reserve Chair, with Trump confirming the appointment the next morning. Markets reacted immediately — and harshly.

Polymarket leaked confirmation that Kevin Warsh would be the next Federal Reserve Chair, with Trump confirming the appointment the next morning. Markets reacted immediately — and harshly.

Warsh built his reputation as a "hard money" advocate during his time at the Fed in the late 2000s, calling for the central bank to shrink its balance sheet and tighten policy after the financial crisis. That reputation spooked investors, who started pricing in the possibility of higher interest rates and tighter monetary policy under his leadership.

But context matters here, and there's reason to think markets overreacted.

Warsh's hawkish stance came when he wasn't actually in charge. Now, Warsh will be entering the Fed against the backdrop of Trump's constant meddling in monetary policy. Warsh, who early reports have said had long been gunning for the Reserve's top job, appears to have wooed the President by very publicly airing disapproval of Powell's rate cut skittishness.

Powell's reluctance to cut rates obviously has earned the ire of the White House, and Trump and his administration have indicated a pivot toward more quickly lowering interest rates to crank the AI boom into hypergrowth. Two weeks ago, Treasury Secretary Bessent said he wants the new Fed chair to be a "supporter" of the AI productivity boom – i.e., someone willing to let the economy run hot.

The Warsh news didn't land in a vacuum. A partial U.S. government shutdown added to the risk-off mood, even if it appeared to be quickly resolved. Meanwhile, reports of an explosion at Iran's Bandar Abbas port raised geopolitical tensions .

Combined with uncertainty around the new Fed chair, these factors created the conditions for a broad selloff. Investors didn't wait to sort out what mattered most — they just hit the sell button.

Historic Metal Moves and the China Factor

While crypto grabbed some headlines, the real historic action was in precious metals.

Silver's single-day drop last Friday ranks among the largest in its recorded market history. At the same time, gold volatility spiked to levels only seen during the 2008 financial crisis and the COVID crash in March 2020. Leveraged funds and crowded options positioning turned what could have been an orderly pullback into an explosive and historic drop.

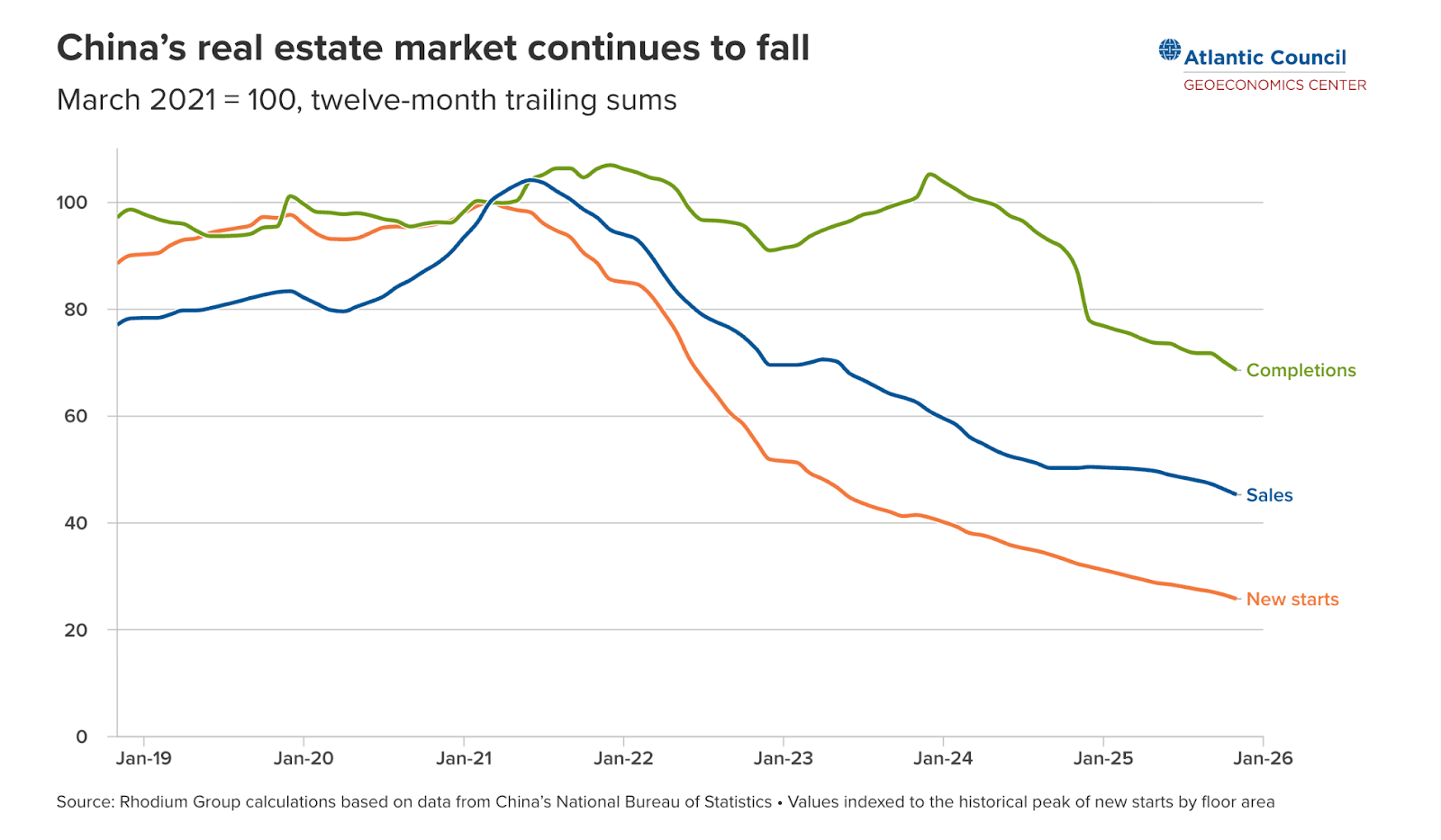

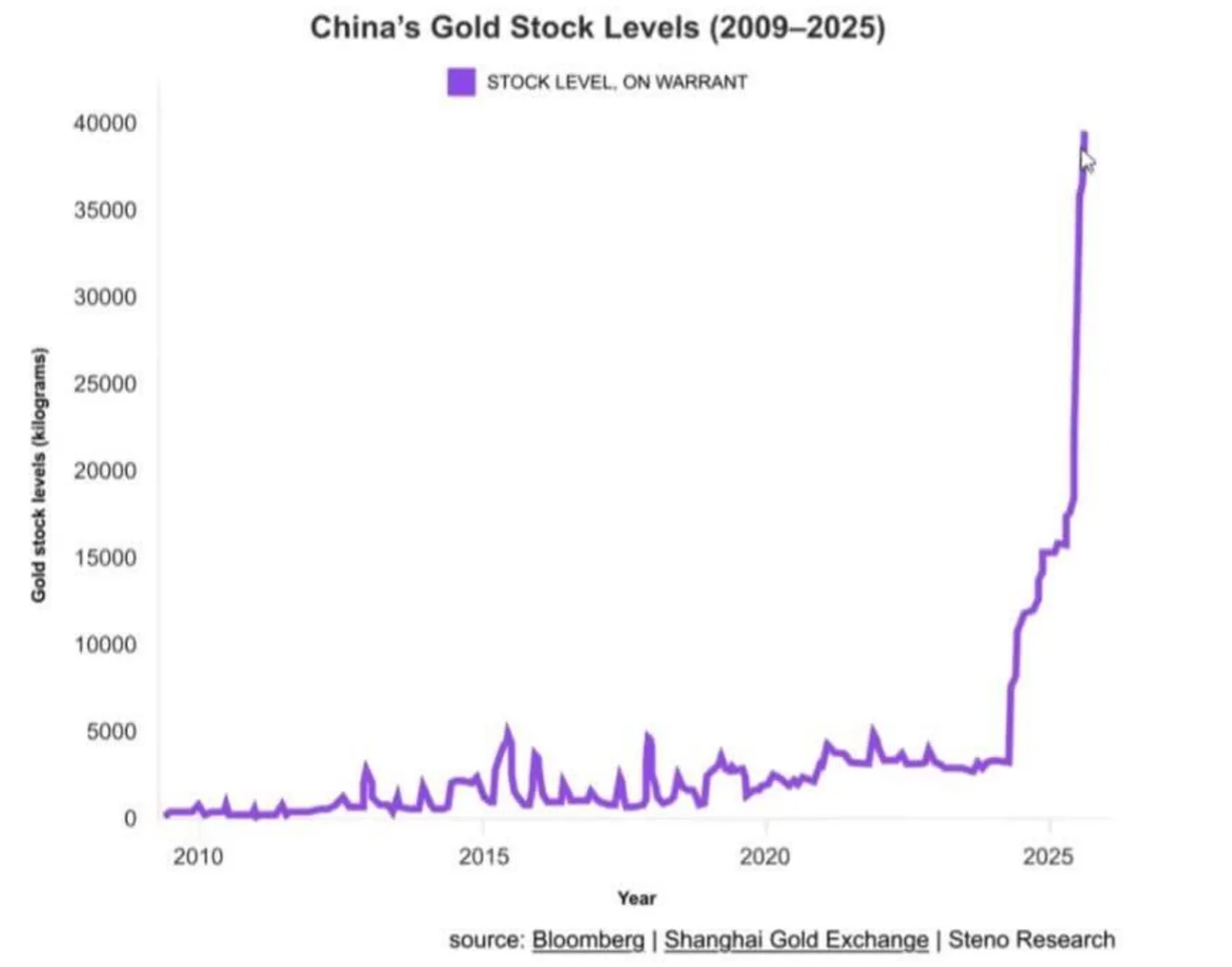

To understand why metals have been so volatile, you have to understand China's role in the rally that preceded this crash. Chinese investors have been a major force behind the gold and silver rally over the past year. With the country's property market still in free fall and the banking system sitting on hidden losses, wealthy households have been looking for ways to protect their savings. Gold and silver fit the bill — especially since access to ![]() Bitcoin is heavily restricted onshore.

Bitcoin is heavily restricted onshore.

It's worth zooming out to see just how significant Chinese demand has become here. China's economy is roughly two-thirds the size of the U.S., yet its central bank holds far less gold — only about 10% of its reserves are in gold, compared to 80% for the United States. That gap has been closing fast. According to charts shared by Capriole Investments, over the past two years, China's gold reserves have increased nearly tenfold as the country has gone on a buying spree.

The demand isn't coming from the government alone. The numbers tell the story at the retail level too. Silver in China had been trading at a 42% premium over international prices. As Alex Campbell framed it: "If you're a rich Chinese household, do you want more money in a zombie banking system with trillions of hidden losses? Or are you okay buying physical silver at elevated levels and risking a drawdown?"

China only has one Silver fund and the demand is so rampant it had to shut off subscriptions so it's now at 42% premium pic.twitter.com/2Z4NrJCs2D

—Eric Balchunas (@EricBalchunas) January 28, 2026

For months the pattern held that New York would sell, Shanghai would buy, and prices would recover. Western sellers would take profits, and Chinese demand would absorb the supply.

That pattern broke on Friday. When China opened, instead of buying the dip, investors there sold gold in size. The local Chinese silver ETF was halted. The rescue bid that Western bulls had come to rely on simply didn't show up. Without that backstop, prices fell through the floor.

Bitcoin: Outflows Accelerate

Back in crypto, the damage was severe.

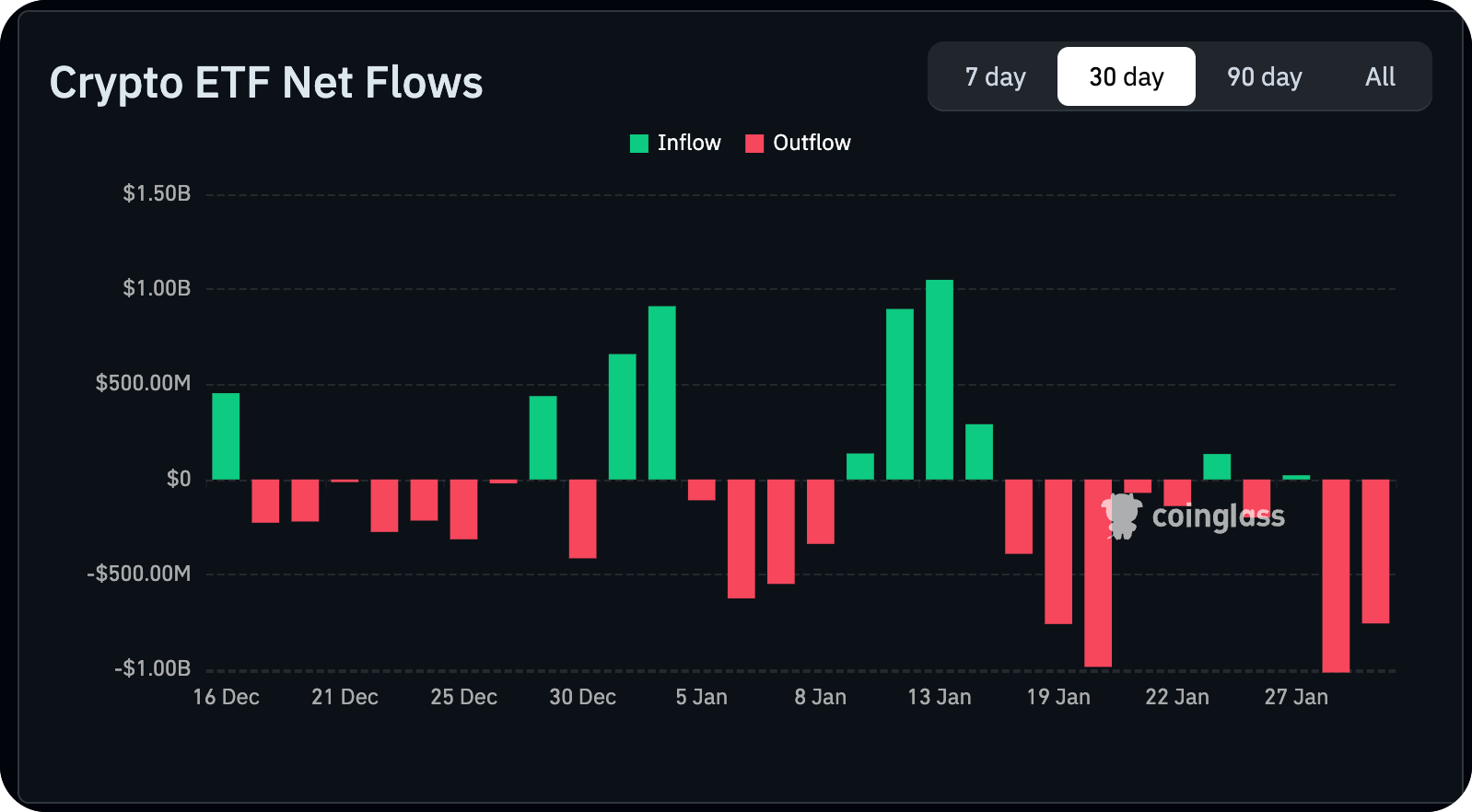

U.S. spot bitcoin ETFs — our dearly regulated investment vehicles supposed to bring steady institutional demand — saw roughly $1.49B exit during the final week of January. Thursday's $818M outflow was the largest single-day redemption of 2026. For the full month, bitcoin ETFs lost approximately $1.6B, making January the third-worst month on record for these funds.

That's a stark reversal from early January, when ETFs pulled in over $1.16B in the first two trading days alone. The selling wasn't confined to bitcoin. Spot ether ETFs lost around $353M for January, with $253M of that exiting last Thursday alone. The synchronized outflows make it clear institutions were reducing crypto exposure broadly, rather than rotating between assets.

The Warning Sign

There's a pattern worth paying attention to here.

Historically, as investor Quinn Thompson shows in the chart below, every time Bitcoin drops 20-30% or more, equities tend to follow. Given that crypto markets trade 24/7, react faster to macro shifts, and carry more leverage than traditional markets, our dear industry tends to act as a “canary in the coal mine,” warning us of issues likely to show up elsewhere.

Gold volatility sitting at crisis-level readings reinforces the concern. These kinds of spikes in precious metals have historically preceded broader market turmoil, not followed it.

None of this means equities will definitely crash. But when crypto, gold, silver, and insider behavior all flash warning signs at once, it's worth paying attention. The question now is whether this is another false alarm or the start of something bigger. Whatever the outcome, it’s likely best to switch to being an observer for some time and let the markets sort themselves out.