Subscribe to Bankless or sign in

Two weeks ago, I wrote about Bittensor's halving (which was completed successfully) and a series of subnets to monitor as the network sorts itself out in the aftermath.

One of those was Synthdata, a subnet building a predictive intelligence network launched by the "lost-to-time" L2, Mode.

I, like many others, am mesmerized by the predictive potential of AI and have taken stabs at testing out different products that claimed to have achieved this goal. Infinite Games' predictive agent Aeon – I lost money. Taoshi's signals – I made money, then I lost money.

I share these to demonstrate that many teams have — and will continue to — drive towards predictive intelligence using decentralized AI. Obviously achieving this would be a goldmine, but also it feeds the hunger we all have to gaze into the crystal ball.

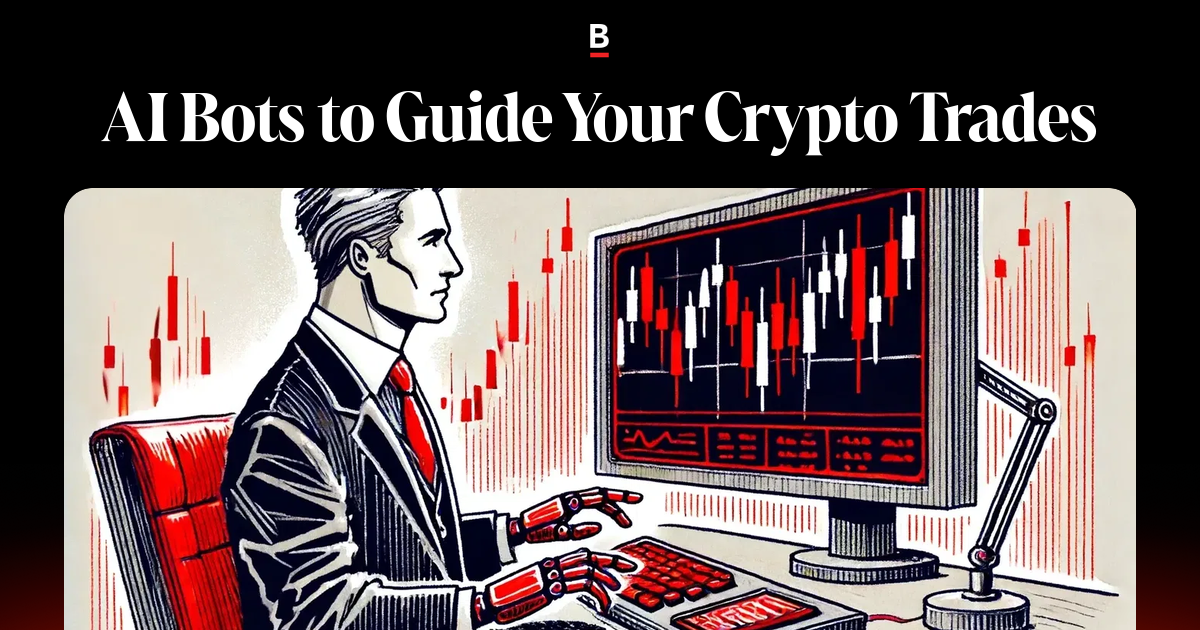

While these are "selfish" motivations, I'll put forth a more "selfless" one borrowed from nof1's recent article: these “unpredictable” financial environments produce a better benchmark to test AI against. AI now scores in top percentiles in coding, reasoning, writing, and math olympiads — all controlled environments that can be memorized, pattern-matched, or gamed through training data. Real-world environments — like markets — cannot, or at least are much more difficult to.

This was the impetus for nof1 creating Alpha Arena, a trading competition where LLMs were provided portions of $320K to trade with. (Most have failed horribly, though Grok's has posted some nice returns.)

And while many teams are building toward predictive intelligence, very few have demonstrated success. Though, so far, Synthdata has and is continuing to, which is why I'm diving deeper.

- It should be noted that other subnets may have demonstrated success here, and given how inaccessible most of these subnet dashboards are to anyone not steeped in the field, I may have missed them! My true purpose here is to plead: make your results readable and less displayed as bulk data dumps. It feels intentionally opaque.

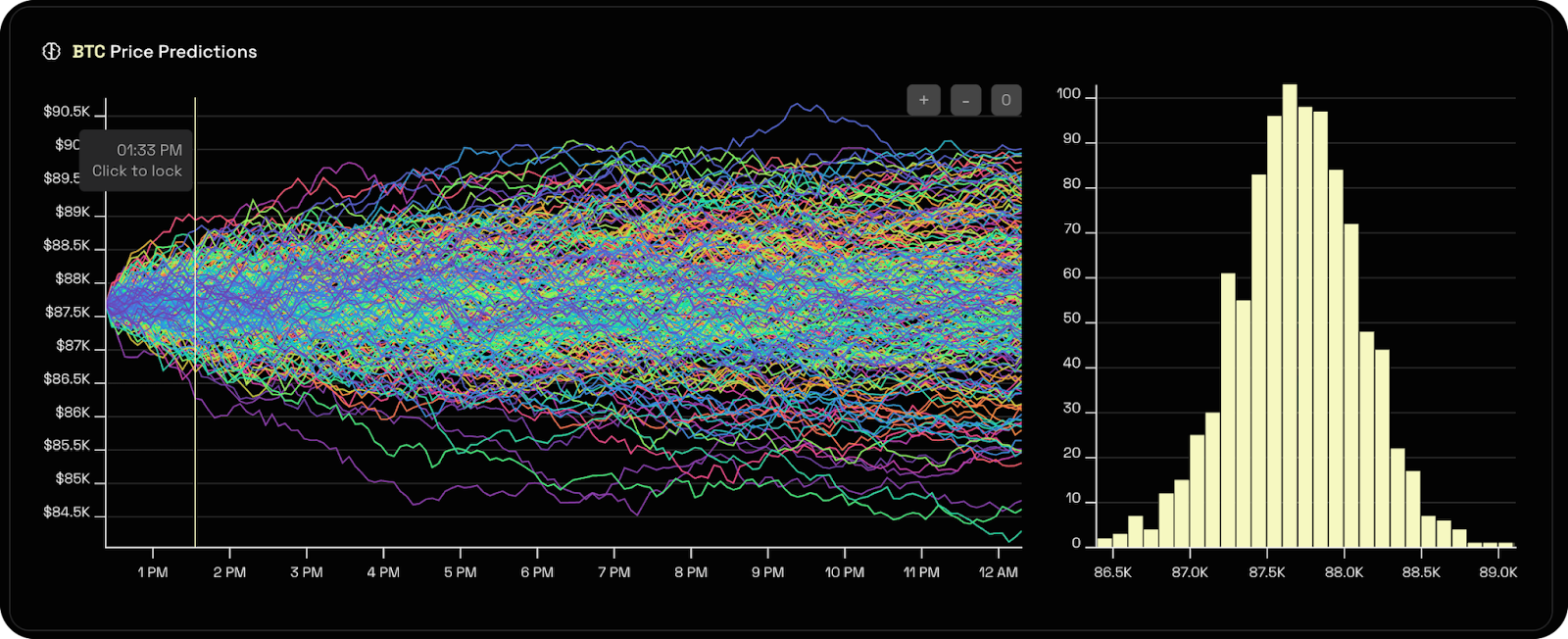

What Synthdata Actually Does

Synthdata is a decentralized network for predictive financial intelligence. Miners compete to model uncertainty for short-term price movements across assets — BTC, ETH, SOL, XAU (gold) — and that modeling feeds downstream applications: options pricing, liquidation probabilities, liquidity provision strategies.

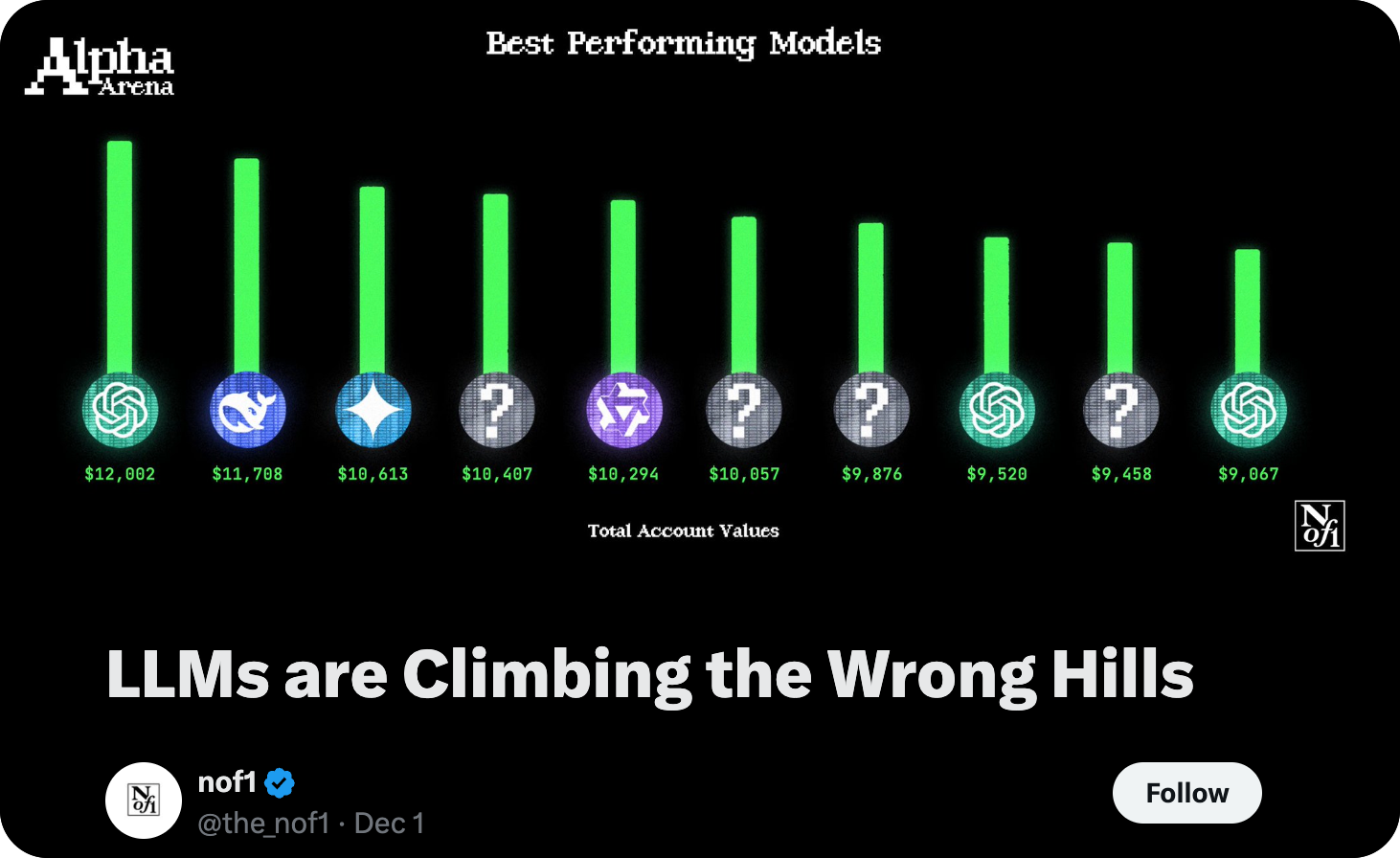

Validators continuously send requests asking miners questions like, "Where might BTC be over the next hour?" Each miner independently generates 1,000 possible price paths, minute by minute. Some show price going up, some show price going down, most landing somewhere in between.

The key mechanic: miners do not assign probabilities to paths. Each path carries equal weight. Probability emerges from how many paths land in a given outcome. If 620 of 1,000 paths end higher than the starting point, that implies 62% odds of Up. No miner declared "62% confident" — that number fell out of the simulation. This design prevents confidence manipulation and forces honest uncertainty modeling.

As such, there's no single "Synth model." There's an open competition, with miners free to use whatever approach captures real price behavior best.

How Miners Are Judged

Miners aren't judged immediately or on profit. They're judged after reality happens, by validators, using CRPS (Continuous Ranked Probability Score) — a method for evaluating how well someone modeled uncertainty, not whether they guessed right.

CRPS penalizes three failures: being wrong (reality far from most paths), being overconfident (paths too tight, reality outside), and being vague (paths spread everywhere "just in case"). You cannot game it by always being confident, always being vague, or getting lucky once.

Scores feed into a leaderboard where recent performance matters more than old. Rewards flow to miners reliably honest about the uncertainty of outcomes. Consistent accuracy compounds.

Proving It Out on Polymarket

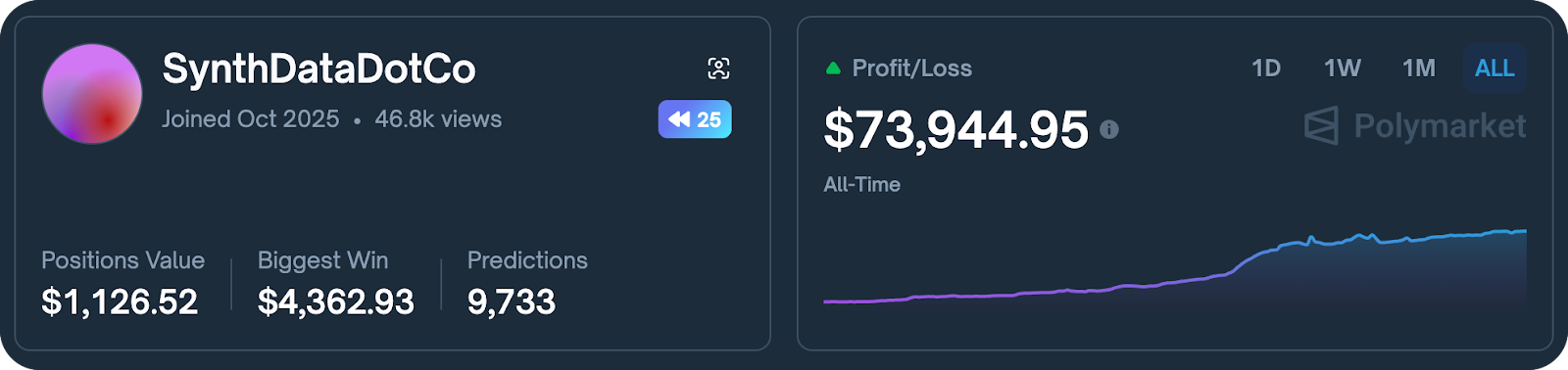

To demonstrate the system works, Synthdata runs a public  Polymarket account trading the BTC Hourly Up/Down market.

Polymarket account trading the BTC Hourly Up/Down market.

Synth already has implied odds from its paths.

If 620 of 1,000 end higher, that's 62% implied probability of Up. Say Polymarket prices Up at 55 cents (implying 55%). Synth sees a gap — its models suggest 62%, the market says 55% — so it buys Up. Not because it knows BTC will rise, but because it knows the odds are mispriced.

Using this method, it has turned $3K into $73K.

What This Points Toward

The Polymarket account serves as a compelling proof of concept for the network’s broader vision of predictive financial intelligence.

Of course, questions remain. Going from $3K to $73K is astoundingly impressive, but the sample size is limited. Edges erode. What works in one regime may fail in another. Polymarket's hourly markets prove much thinner than larger markets like 0DTE options which Synth looks to support (though it hasn’t established a similar account-based proof of concept for, to my knowledge.)

Still, the system design is compelling and, personally, feels more sustainable than those providing “long/short” signals. Whether it matures into something durable or burns out like others remains to be seen. But Synthdata has receipts, and that alone makes it worth watching.