Subscribe to Bankless or sign in

One of the most exciting developments of this past year has been the increasingly breakneck growth trajectory of Hyperliquid.

The exchange not only continues to mark new highs across success metrics but has done so through a novel combination of new network designs — the latest being its much-hyped, Hyperliquid-native USDH stablecoin.

What is USDH?

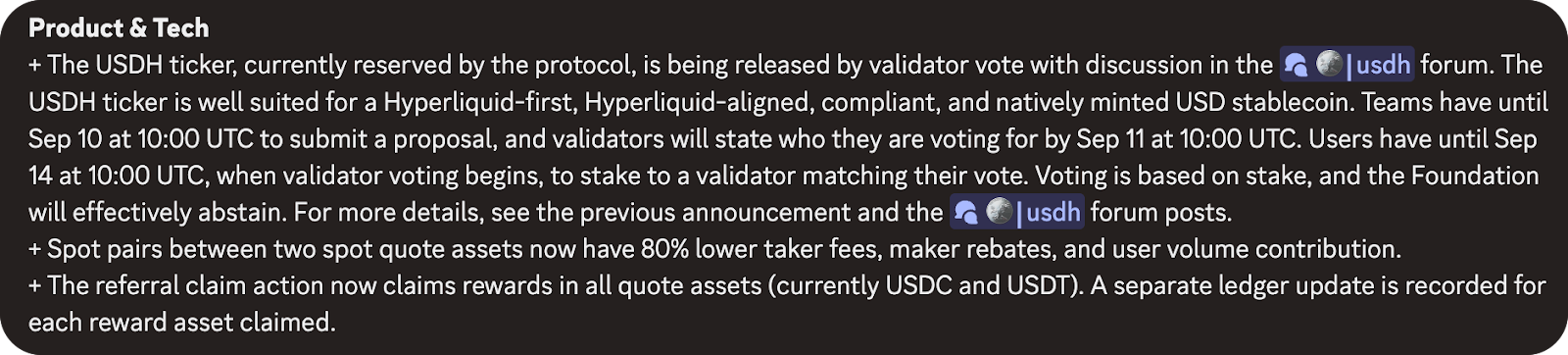

Last Wednesday's Request for Proposal invited stablecoin issuers to pitch Hyperliquid's community on issuing and stewarding USDH — an initiative designed to stimulate spot markets, reduce USDC dependence, and improve exchange efficiency.

When launched, the native stablecoin will be used in select spot pairs and reduce their trading fees by 80%. It’s a play to build out the HyperCore (Hyperliquid’s flagship exchange) into a full-service exchange, helping level out its spot volumes which currently lag behind its dominant perps business.

Arguably more important though is how USDH will allow ![]() Hyperliquid to address critical vulnerabilities surrounding its relationship with USDC. The exchange currently holds a whopping ~8% of Circle’s USDC supply in its bridge, a dynamic which not only creates deep reliance on a third party, but also leaks ~$100M annually to

Hyperliquid to address critical vulnerabilities surrounding its relationship with USDC. The exchange currently holds a whopping ~8% of Circle’s USDC supply in its bridge, a dynamic which not only creates deep reliance on a third party, but also leaks ~$100M annually to ![]() Coinbase (as the U.S. exchange has a claim to 50% of Circle’s revenue), while seeing none of the yield circulated back into its own ecosystem. A native stablecoin would eliminate this drain, as well as recycle the ~$200M in revenue generated from USDC back throughout Hyperliquid to drive growth (though the best manner to do this is still up for debate).

Coinbase (as the U.S. exchange has a claim to 50% of Circle’s revenue), while seeing none of the yield circulated back into its own ecosystem. A native stablecoin would eliminate this drain, as well as recycle the ~$200M in revenue generated from USDC back throughout Hyperliquid to drive growth (though the best manner to do this is still up for debate).

Was curious and

— Omar (@TheOneandOmsy) September 10, 2025Circle has made ~$120m of cumulative revenue from USDC on Hyperliquid. Currently, Circle earns ~$620k/day of revenue, and pays token holders exactly nothing. At $5.6b, Hyperliquid represents 7.6% of USDC outstanding https://t.co/Lu84hPIeHu pic.twitter.com/BCqXN97Ggr

Why Teams Are Fighting for the Opportunity

Proposals closed today, marking the end to the first wave of the fierce competition to steward USDH. But, if you’re unfamiliar with the exchange, you may ask why teams are in Discord, attempting to promise Hyperliquid’s ecosystem the moon in order to get the chance to launch its native stablecoin.

Well, Hyperliquid averages $57B in weekly volume, is making more money than the NASDAQ at its current rate, and is seeing periods where it alone is responsible for 35% of all blockchain revenue. It’s also the most profitable company in the world by revenue per employee as of August. In other words, earning a slice of this opportunity is well worth the fight for ambitious teams.

Quite the data point that I haven't really seen mentioned anywhere:

— Kevin Mills (@__kfm__) September 2, 2025

Nasdaq net income in 2024: $1.1B$HYPE net income at current rate: $1.3B

If they keep this up, they've flipped $NDAQ profitability.

Not bad for a 2 year old exchange with a team of 11. pic.twitter.com/halJwit6vS

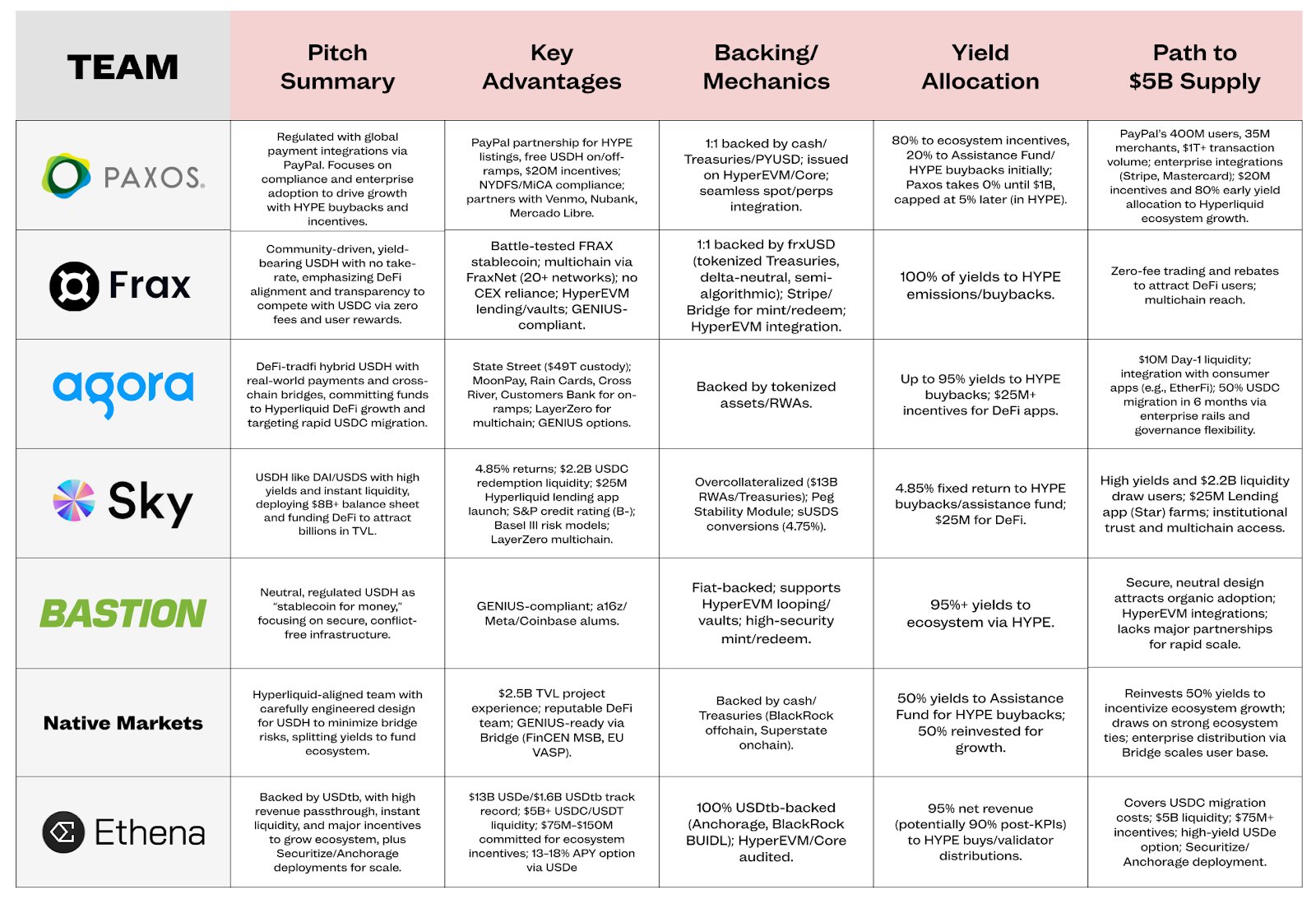

Below are the leading teams who’ve made their pitch along with a breakdown of what they’re promising:

The Leading Contenders

While all these proposals bring something to the table, typically some mixture of revenue share and regulatory readiness, three in particular stand out when evaluated against Hyperliquid's stated criteria for a "Hyperliquid-first, Hyperliquid-aligned, compliant, and natively minted USD stablecoin."

In other words, as Reciprocal Ventures investment team member James Evans puts it:

- Is Hyperliquid their home base?

- Will USDH growth equal Hyperliquid growth?

- Will it reduce regulatory risk?

When measured against these standards, three teams emerge with the strongest cases, though to varying degrees: Native Markets, Ethena, and Paxos. Let's examine what each brings to the table:

- Native Markets stands out as most Hyperliquid-native, fitting the exchange's organic spirit and led by Max Fiege (

Liquity alum, highly respected HYPE contributor), with MC Lader (former

Liquity alum, highly respected HYPE contributor), with MC Lader (former  Uniswap Labs COO) and Anish Agnihotri (

Uniswap Labs COO) and Anish Agnihotri ( Paradigm researcher). Their proposal outlines revenue splits between HYPE buybacks and growth incentives, with careful regulatory configuration.

Paradigm researcher). Their proposal outlines revenue splits between HYPE buybacks and growth incentives, with careful regulatory configuration.

Overall, their edge comes equally from Max's social capital and demonstrated alignment they’re taking by bootstrapping rather than receiving backing, building something first and foremost organic, rather than incentivized. Some question the timing of their immediate bid after the RFP announcement, making some think they had prior knowledge of the proposal going live.

Regardless, Native Markets is probably the closest fit, echoing Hyperliquid's organic growth ethos — though questions remain about if bootstrapping will provide enough firepower for USDH growth.

Hyperliquid currently loses >$200m a year to firms who treat it as an afterthought at best.

— max.hl (@fiege_max) September 8, 2025

I'm co-founding Native Markets to reclaim this value leakage for the ecosystem and to kickstart Hyperliquid's next chapter. pic.twitter.com/oU6RYXE4E9

- Ethena brings DeFi credibility. While initially electric, excitement around the proposal has dwindled as voting begins, partly because their focus remains broader than Hyperliquid. Though they've shown involvement through ecosystem partnerships and understanding of the growth catalysts to focus on, concerns remain about divided attention given their product suite.

Their proposal leans heavily on distribution muscle, promising a minimum of $75M to grow the stablecoin, bolstered by promises to bring institutional players like Securitize and Anchorage Digital onto Hyperliquid, potentially juicing the chain’s total value much further.

Overall, Ethena's case rests on its track record as well as the fact that it pulls weight both in DeFi and TradFi, though its broader focus and more traditional funding roots means less perfect alignment with the exchange’s standards.

—Ethena Labs (@ethena_labs) September 9, 2025

- Paxos gained momentum this morning after releasing their V2 proposal hours before submissions closed, moving from "safe choice" to "we only win if Hyperliquid wins." V2 strengthens their first proposal’s discussion of a

PayPal partnership, adding promises of HYPE listings on PayPal/Venmo, free global on/off-ramps, and $20M in incentives. Further, they introduced a new tiered revenue system which would start with them collecting 0% fees until $1B TVL, splitting the profits between buybacks and a pool for ecosystem incentives, before eventually scaling to 70% for the Assistance Fund (Hyperliquid’s source of token buybacks), 25% for growth, and 5% for

PayPal partnership, adding promises of HYPE listings on PayPal/Venmo, free global on/off-ramps, and $20M in incentives. Further, they introduced a new tiered revenue system which would start with them collecting 0% fees until $1B TVL, splitting the profits between buybacks and a pool for ecosystem incentives, before eventually scaling to 70% for the Assistance Fund (Hyperliquid’s source of token buybacks), 25% for growth, and 5% for  Paxos (in HYPE) once USDH exceeds $5B.

Paxos (in HYPE) once USDH exceeds $5B.

Paxos offers durability and regulatory strength from weathering federal lawsuits over a decade, with TradFi muscle for conventional venues — yet remains more corporate than ecosystem-native.

It's been a crazy couple days. We're extremely excited and fully committed to support the Hyperliquid ecosystem with our addition to the proposal.

— David Weber (@webergems) September 10, 2025

With @PayPal , Hyperliquid gets distribution to 400m+ users, 35m+ merchants and a whole new ecosystem of payments.

Hyperliquid. https://t.co/xJlHesl5nJ

Who Wins??

Regardless of who wins, these last few days have been something incredible to watch and should be seen as a moment of triumph for the crypto space.

Crypto has built a product so sought after and desired that we have institutions powering up Discord and writing out lengthy proposals, recognizing the enormous opportunity that is Hyperliquid, as well as the model that it sets.

hyperliquid got so much motion i'm reading stablecoin governance proposals

— threadguy (@notthreadguy) September 9, 2025

Since USDH’s entry to the mainstage, we've seen  MegaETH announce a native stablecoin as well, something which I expect we’ll see more and more of as ecosystems follow USDH’s suit and attempt to ingest, rather than pass on, the yield being generate by titans like

MegaETH announce a native stablecoin as well, something which I expect we’ll see more and more of as ecosystems follow USDH’s suit and attempt to ingest, rather than pass on, the yield being generate by titans like  Tether or USDC for themselves. It’s perhaps most surprising that we haven’t seen more of this previously.

Tether or USDC for themselves. It’s perhaps most surprising that we haven’t seen more of this previously.

Whether Hyperliquid’s community backs Native Markets’ grassroots alignment, Ethena’s DeFi sophistication, or Paxos’s TradFi bridge, the choice will ripple far beyond a single stablecoin. If executed well, USDH won’t just bolster Hyperliquid — it will extend the exchange’s track record of showing how far crypto can go when something truly valuable is built organically.