Subscribe to Bankless or sign in

Looking back at crypto's 2025 growth, it's impossible not to fixate on Hyperliquid.

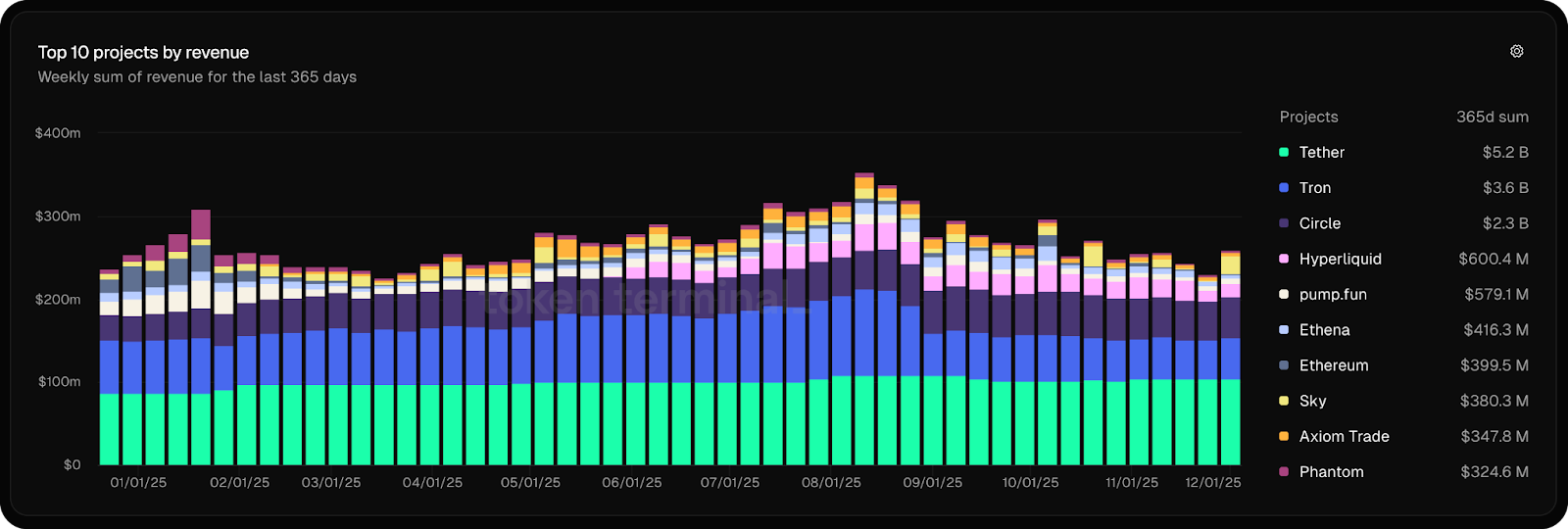

The exchange closed out 2024 with an epic airdrop and price action that coaxed plenty on Crypto Twitter to give the product a second look. It's closing 2025 as something else entirely — a breakout platform ranking 4th for revenue across all of crypto, having generated over $650M, and at times commanding 70% of perps volume.

If you haven't been tracking Hyperliquid's every move, this breakout success may seem like it came out of nowhere. But the chain's conquest has emerged as a product of careful design, unconventional growth tactics, and well-deserved outside recognition.

Here's how it all unfolded in 2025 (and why it will truly be put to the test in 2026) 👇

Q1 2025: The Crypto-Native Advantage

Hyperliquid's year of breakneck growth kicked off with a reminder of what it means to truly have your finger on the pulse.

When TRUMP launched in January, ![]() Hyperliquid had perps go live almost immediately, beating other exchanges to the punch and beginning its streak as the place for pre-launch tokens. Sure, it was able to move quickly because it stands somewhat unimpeded by the corporate guardrails “protecting” larger exchanges and their users. But a significant element was being emphatically “in the know” — spotting opportunities due to its team being tightly interwoven with the goings-on onchain, and recognizing the advantage they’d gain by listing these tokens first. It cemented Hyperliquid's reputation as the go-to venue for trading new assets before the incumbents catch up.

Hyperliquid had perps go live almost immediately, beating other exchanges to the punch and beginning its streak as the place for pre-launch tokens. Sure, it was able to move quickly because it stands somewhat unimpeded by the corporate guardrails “protecting” larger exchanges and their users. But a significant element was being emphatically “in the know” — spotting opportunities due to its team being tightly interwoven with the goings-on onchain, and recognizing the advantage they’d gain by listing these tokens first. It cemented Hyperliquid's reputation as the go-to venue for trading new assets before the incumbents catch up.

February brought the HyperEVM launch — the general-purpose smart contract layer built on top of HyperCore, Hyperliquid's exchange engine. While it took time to find its footing, it did so without any top-down incentive programs. That meant once it hit its stride in Q2, it had built a core user base who were there, not to farm rewards but because they believed in the chain's vision and wanted to leverage its unique features — like interplay with the HyperCore — rather than just extract incentives.

HyperEVM Feb 2025 is pretty unrecognizable compared to HyperEVM Dec 2025

— Charlie.hl (@0xBroze) December 9, 2025

A case study on how much an ecosystem can change in less than a year. Funny to read this a year later and see all the change in the Hyperliquid ecosystem + what pieces remain

On the lending side, we had:… https://t.co/OLjHWlOlqf

Q2 2025: Breaking Out

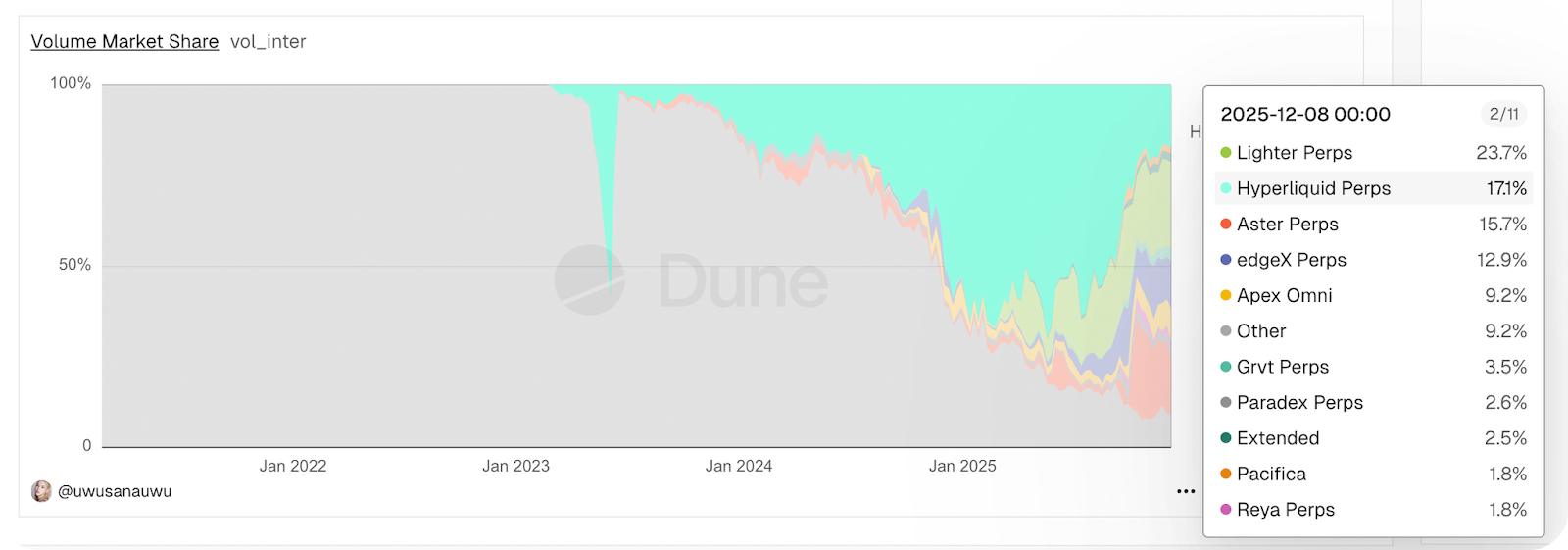

Traction came faster than most expected. Beyond HYPE climbing nearly 4x off its April lows, by May Hyperliquid commanded 70% of all onchain perps volume — a staggering figure for a platform with zero VC backing and no token incentives.

As the market roared back to life, Hyperliquid's smooth UX and deep liquidity captured the order flow, with total volume climbing to $1.5T. As mentioned, the HyperEVM hit its stride alongside, growing TVL from $350M in April to $1.8B by mid-June as projects launched and users explored new earning opportunities through Kinetiq, Felix, and Liminal — all while burning HYPE in the background.

Amid this breakneck growth, Hyperliquid seemed to be everywhere. Publicized on national TV. Profiled by Bloomberg. At the center of policy conversations with the CFTC. The exchange had become impossible to ignore.

CNBC did an interview with @novogratz and he was asked about altcoins:

— steven.hl (@stevenyuntcap) May 16, 2025

+ New ecosystems need strong narratives

+ He used Hyperliquid as an example: a decentralizedBinance that transparently uses exchange profits for token buybacks

+ Note: Galaxy Digital owns HYPE

Hyperliquid pic.twitter.com/aVnPKqOy7H

Q3 2025: Peak Momentum & Splintering Begins

Q3 opened with a signal that Hyperliquid's infra was becoming essential outside its own ecosystem.

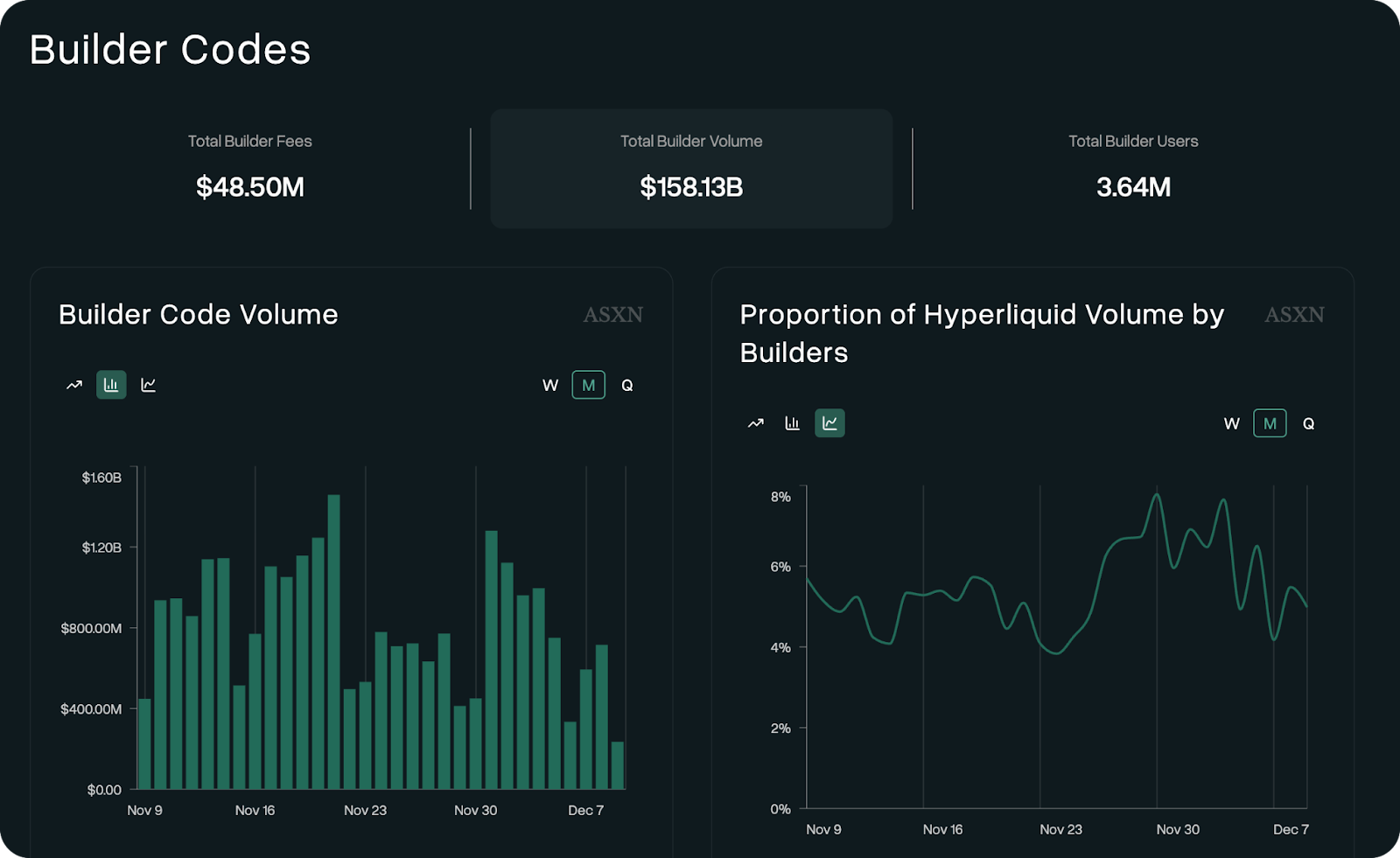

![]() Phantom Wallet passed over Solana-based perps platforms to integrate Hyperliquid via builder codes – Hyperliquid's mechanism for letting external platforms earn fees on trades they route to HyperCore.

Phantom Wallet passed over Solana-based perps platforms to integrate Hyperliquid via builder codes – Hyperliquid's mechanism for letting external platforms earn fees on trades they route to HyperCore.

Rabby followed. Then MetaMask. A myriad of mobile trading apps went live on builder codes. All in all, “partners” have earned nearly $50M in fees through these integrations, routing $158B in volume.

Then, in September, came the USDH bidding war — revealing just how valuable and well-known Hyperliquid had become.

The problem was simple: Hyperliquid held ~8% of Circle's USDC supply in its bridge, leaking roughly $100M annually to a direct competitor (Coinbase) while seeing none of that yield recycled into its own ecosystem. A native stablecoin would fix that, potentially redirecting $200M in annual revenue back to Hyperliquid.

A Request for Proposal was issued for who would steward the stablecoin, and heavyweights threw their names in.

Ethena offered $75M in growth commitments and institutional partnerships.  Paxos dangled

Paxos dangled ![]() PayPal and Venmo integrations, even getting the former to tweet about Hyperliquid. But Native Markets won — a team led by highly respected HYPE contributor Max Fiege, former

PayPal and Venmo integrations, even getting the former to tweet about Hyperliquid. But Native Markets won — a team led by highly respected HYPE contributor Max Fiege, former ![]() Uniswap Labs COO MC Lader, and

Uniswap Labs COO MC Lader, and ![]() Paradigm researcher Anish Agnihotri. Why did a smaller, less capital-strapped team beat the giants? They were favored and fit the ethos: bootstrapped, aligned, and ready to build something organic — just as Hyperliquid itself had been built.

Paradigm researcher Anish Agnihotri. Why did a smaller, less capital-strapped team beat the giants? They were favored and fit the ethos: bootstrapped, aligned, and ready to build something organic — just as Hyperliquid itself had been built.

Hyperliquid currently loses >$200m a year to firms who treat it as an afterthought at best.

— max.hl (@fiege_max) September 8, 2025

I'm co-founding Native Markets to reclaim this value leakage for the ecosystem and to kickstart Hyperliquid's next chapter. pic.twitter.com/oU6RYXE4E9

The ripple effects extended beyond Hyperliquid. MegaETH announced its own native stablecoin initiative shortly after. ![]() Sui followed suit in November.

Sui followed suit in November.

Yet USDH also marked HYPE's peak in mid-September — and the moment competition began to bite. Aster, the CZ-backed Binance-based exchange, and Lighter, an  Ethereum L2 perps platform, both launched with aggressive airdrop campaigns. Volume continued fragmenting and Hyperliquid’s market share splintered, sitting at 17.1% at time of writing.

Ethereum L2 perps platform, both launched with aggressive airdrop campaigns. Volume continued fragmenting and Hyperliquid’s market share splintered, sitting at 17.1% at time of writing.

Q4: Maturation & Growing Pains

In October, the long-awaited HIP-3 went live, opening permissionless listings on HyperCore and advancing both the exchange’s expansion and its decentralization.

Anyone who stakes 500K HYPE could now deploy custom markets such as:

- Equity perpetuals from Unit’s Trade.xyz and Felix Protocol

- Perpetuals markets that use yield-bearing collateral (sUSDE) from Ethena

- Markets for synthetic exposure to private companies like SpaceX or Anthropic, from Ventuals

Yet, despite the launch of HIP-3, HYPE price has dropped nearly 50% from its September peak. Why? Besides market conditions and competition, two developments stand out.

First, the quarter brought Hyperliquid's first ADL (Automatic De-Leveraging) event in over two years. During October 10's market breakdown, over-leveraged positions ran out of margin faster than the liquidation engine and HLP could absorb. The protocol triggered auto-deleveraging over 40 times in a 12-minute span, forcibly reducing the most profitable positions to rebalance the book. While some argued those affected were still "closed in the green," others argued the mechanism liquidated much more than it needed to cover the bad debt. Yes, the system stayed solvent and no outside funds were required, but Hyperliquid, like the market, will likely need some time to recover from the event.

Then, in November, team token unlocks began. Despite lower-than-expected totals, this vesting is likely also contributing to HYPE's underperformance. Selling was minimal — only 23% went to OTC desks while 40% was re-staked — but the pace of future unlocks remains unclear. My read is that the core team may still be determining the schedule to balance contributor fairness with ecosystem health. But from a protocol that's stood out by being transparent and "honest," this lack of clarity is likely causing market unease.

The Perps Proving Ground

While the market and trading activity are down, when attempting to make sense of HYPE underperformance, it's important not to discount how much the perps landscape has evolved alongside Hyperliquid itself.

Lighter and Aster are just examples of onchain competition. And while their volume is likely inflated by airdrop hunting, they offer real alternatives. Offchain, Coinbase’s perps offerings will soon be joined by Robinhood play here. More competitors will emerge as perpetuals continue going mainstream.

In other words, Hyperliquid is in the midst of its proving ground and will continue to be in 2026. The question isn't whether it had a remarkable 2025 — it certainly did. The question is whether the exchange can demonstrate that its model, of growing via integrations like builder codes and decentralization like HIP-3, remains superior as the field gets crowded.

What got them here was building a better product and better ecosystem, and doing so without shortcuts. What keeps them there will be doing it again.