Subscribe to Bankless or sign in

Crypto yield markets have assumed a notably heightened risk profile over the past month following a slew of lending market mishaps, making it more important than ever to understand the mechanics behind the farms you’re depositing into.

Today, we’re breaking down five of the most popular crypto yield opportunities that exist, weighing the risk versus the rewards of each yield generation model.

Read on for core onchain opportunities you can’t afford to not understand👇

🕰️ Pendle

Website | Twitter

Best For: Guaranteed Yield

Risk Level: Variable

Reward Level: Low to High

About:

Pendle is a yield splitting protocol, a special type of DeFi primitive that creates two distinct tokens: principal tokens (PTs) and yield tokens (YTs). The first can be redeemed for an underlying crypto asset at a specified future date, and the second represents a claim to all yield generated from that asset in the interim.

Pendle is a yield splitting protocol, a special type of DeFi primitive that creates two distinct tokens: principal tokens (PTs) and yield tokens (YTs). The first can be redeemed for an underlying crypto asset at a specified future date, and the second represents a claim to all yield generated from that asset in the interim.

Using PTs, Pendle yield farmers can safely guarantee their yields until a specified future date, denominated in units of the underlying asset. PT holders can also redeem early by purchasing an equivalent amount of YTs, which can be used in combination to create a liquidity provider position and redeemed for the underlying.

While Pendle users are responsible for evaluating the safety of the individual yield markets they deposit into, there is zero risk of protocol-wide contagion if the value of any single Pendle-onboarded crypto asset becomes impaired. The Protocol’s smart contract logic is solely responsible for ensuring that users can redeem their tokens for a pre-specified amount of underlying assets, insulating the broader system from any specific asset shocks.

Exponent Finance is a popular alternative to Pendle deployed to the  Solana Network, yet the benefits of network effects and trusted reputation in this sector are undeniable; Pendle’s lesser known competitor safeguards just 2% of the segment leader’s total value locked.

Solana Network, yet the benefits of network effects and trusted reputation in this sector are undeniable; Pendle’s lesser known competitor safeguards just 2% of the segment leader’s total value locked.

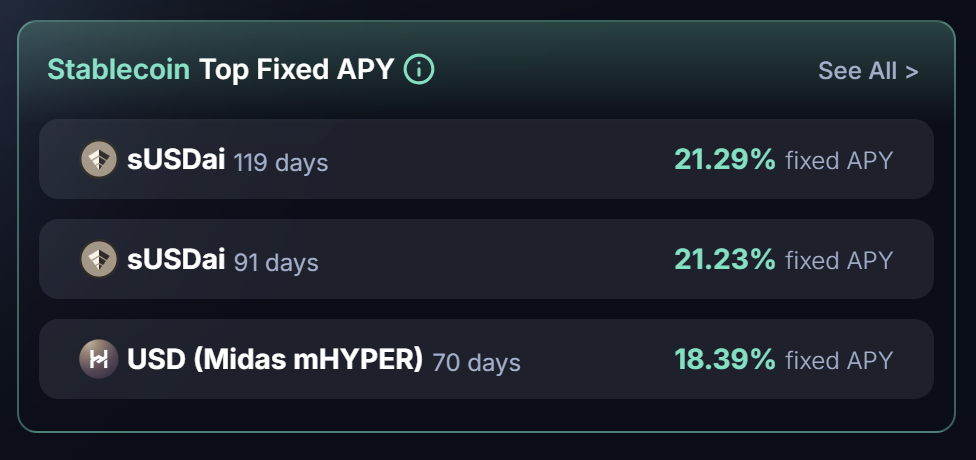

Top Yield Opps:

Get risky and receive a guaranteed 21% APY on sUSDai (a GPU-backed stablecoin) for the next three months, play it safe and lock in 3% APY on Lido’s stETH until Christmas Eve, or select another risk-return combination that meets your needs with Pendle’s principal tokens.

Upgrade to continue reading

- Support the Bankless Movement

- Premium Feed: Ad Free & Bonus Content

- Daily Market Analysis & Research

- Airdrop Hunter: Guided, Vetted Projects

- Claimables: Find & Claim Airdrops + more

- Private Discord w/ David & Ryan