Subscribe to Bankless or sign in

Crypto is building its own – better – banks.

From EtherFi to Plasma and beyond, teams are working to bridge crypto balances to real-world spending through cards, savings accounts, and all the financial services you'd expect from a bank. They're pushing beyond all of that too.

It makes a lot of sense. As financial services platforms that provide traditional banking features — saving and spending — packaged neatly into digital platforms (most commonly mobile apps), neobanks fit well into crypto’s digitally-native and semi-nomadic user base.

Couple all this with the fact that crypto...

- Is killer at payments

- Has created a new swath of people who hold wealth onchain but need ways to use that money offchain

- Sees its highest level of adoption in areas without stable banking infrastructure

...and the need for neobanks becomes clear.

If you want to dive even deeper on crypto neobanks, make sure to check out the podcast David Hoffman just recorded with Frax’s Sam Kazemian.

Ripe Timing

While infrastructure hurdles once held crypto-native products back from matching banks' service offerings, stablecoin and card infrastructure has become increasingly commodified — available through white-label, plug-and-play suites from platforms like Bridge.

Regulatory clarity has helped accelerate this shift too.

The GENIUS Act's framework for stablecoin issuance and usage has given both builders and users more confidence — clarifying how stablecoins can be created, what they can do, and opening the door for integrations like funding brokerage accounts or conducting interbank settlements with them. As a result, there's less and less that crypto can't do compared to banks, and more that today's banks don't do compared to crypto.

Cards, rewards programs, modern conveniences like free peer-to-peer transfers, investment options, and cashback rewards — these are all standard features among top crypto neobanks.

What sets them fully apart is full self-custody, letting you exist in this state of being both "banked" and "bankless" at the same time.

While the synergies are clear in theory, it's important to drive home that crypto neobanks aren’t languishing in the pre-product hell of “this makes sense, but it doesn’t make dollars.”

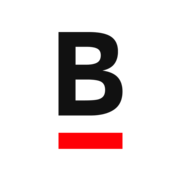

Among leading platforms, usage has been growing at a rapid clip. For example, EtherFi has been averaging over $1M in daily spend volume, up around 2x in the past two months alongside transaction volume, while euro-centric crypto neobank Monerium has shown strong growth in the issuance of its EURe stablecoin, as well as its burn (when it's off-ramped and spent offchain).

Non-Custodial Options

If you’re interested in taking a neobank for a test run, just know that not all are created equally.

Many exchanges or “wallets” have popped up offering comparable services or full "banking" apps entirely, but lack the self-custodial nature which, for those wanting to actually go bankless, proves necessary. This is not a knock on these products, and there are certainly many reputable options to choose from such as Coinbase or Galaxy, but, once again, you’re sacrificing true ownership over your holdings.

To make it easier to compare these non-custodial options and pick one that fits your needs, I've outlined the key details for a series of what I believe to be the stronger options below.

Let’s take a look 👇

💳 EtherFi

The most "credit card-esque" out of the available options, EtherFi's Cash feature lets you load from a non-custodial wallet and spend directly from it at 100M locations worldwide, including via Apple Pay or Google Pay. The real perk is that you can borrow against ETH or stablecoins without selling, and yields auto-compound on holdings (though you are at risk of liquidations). Savings rates include up to 10% APY on spendable stablecoins and variable restaking rewards on EtherFi's derivative ETH and BTC tokens (around 3-5% currently). FX fees are 1% for conversions.

EtherFi operates on a tiered membership system based on spending activity, with higher tiers unlocking additional perks like priority support, greater cashback, hotel discounts, event passes, and more. All tiers offer airport lounge access via LoungeKey and purchase protection up to $10K.

- Pros: High yields you can spend directly, borrowing options that let you keep your crypto, no spending limits, and extensive travel and lifestyle perks at higher tiers.

- Cons: Bridging funds can add a step for beginners, the 1% FX fee is higher than some competitors, and top-tier benefits require significant spending to unlock.

Cash has distributed nearly $4M of cashback on spend in the first 1M transactions since launch.

— ether.fi (@ether_fi) October 24, 2025

That's almost $4 per swipe in cash back in your hands.

Hodl. Earn. Spend.https://t.co/Q3fKrgeQXw pic.twitter.com/OE1AcHXqDN

🔓  Gnosis Pay

Gnosis Pay

Gnosis Pay uses Safe smart accounts for self-custody, allowing you to create virtual or physical Visa cards quickly with programmable spending limits. It supports multiple chains like Ethereum and Polygon and integrates with Apple Pay. Yields come from DeFi integrations like sDAI on stablecoins, typically 4-6% APY depending on market conditions. FX conversions use DeFi rates with no fees, particularly attractive for EU residents who travel frequently in and out of the Eurozone. (This is all powered by Monerium, which I touched on earlier.) Cashback ranges from 1-5%, though it's paid out weekly in GNO tokens based on your holdings.

- Pros: Strong privacy features, zero FX fees, and easy SEPA transfers for Europe-based users.

- Cons: Bridging to Gnosis Chain can be cumbersome, and it's not available in the US; cashback is token-specific and limited.

🦊 MetaMask

MetaMask's Card connects directly to your self-custodial wallet, enabling spends with a variety of stablecoins anywhere Mastercard is accepted with instant onchain settlements.

The free virtual version offers 1% USDC cashback on all purchases, while the $199/year Metal upgrade boosts it to 3% on the first $10K spent annually (then 1% after), plus waived ATM fees. Yields on holdings like ETH or mUSD run 3-5% via Linea-based DeFi. FX fees are 0% on Metal cards but 0.1% on virtual swaps.

The card does come with spend limits — $10K per transaction and $15K daily on the virtual card ($20K/tx and $30K/day for Metal) — as well as ATM withdrawal fees of 2% (with no fees up to $1,200 monthly on Metal, then 2% after).

- Pros: Smooth for existing

MetaMask users, with extras like merchant rewards and NFT perks, as well as the potential added benefit of possibly helping you qualify for their airdrop.

MetaMask users, with extras like merchant rewards and NFT perks, as well as the potential added benefit of possibly helping you qualify for their airdrop. - Cons: The cashback cap limits value for high spenders, the U.S. pilot program is currently closed, and yields require additional DeFi setup for the best returns.

⚫️ UR

Mantle’s neobank UR provides a single onchain account for managing crypto and fiat, with self-custody via Turnkey wallets and settlements on its L2.

It includes a Mastercard debit card compatible with Apple Pay, Alipay, and others, plus multi-currency support (USD, EUR, SGD, etc.) across 45+ countries. Savings offer up to 5% APY on USDe stablecoin holdings, credited weekly without staking. FX uses bank rates with low fees (zero on off-ramps and transfers via the free three-month Pro upgrade for new KYC users until January 2026). No cashback yet, but direct USDe spending is coming soon.

- Pros: Zero-fee ramps, high transaction limits (~$125K monthly on Pro), and instant peer-to-peer transfers.

- Cons: Requires KYC, unavailable in the US, and lacks cashback or broader yields beyond USDe.

Introducing UR — your go-to unified crypto and fiat account with 0 off-ramp fees and access to multiple fiat currencies.

— UR (@UR_global) October 7, 2025

Bringing back the freedom, transparency and ownership that money was always meant to offer. pic.twitter.com/t64TFZivsE

💸 Fuse Wallet

Expanding beyond ETH, "smart account hub" Fuse Wallet offers a robust option for SOL users, boasting a virtual Visa prepaid card (Fuse Pay) for spending stablecoins in 18+ countries. It delivers variable DeFi yields on USDC at 4-8% and SOL staking rewards, with minimal FX fees through stablecoin conversions. There's no dedicated cashback, though yields help offset costs. Fuse waives token swap fees via Jupiter, making it somewhat trader-centric. Its "Fuse Plus" premium membership — activated by depositing $100+ into Fuse Earn — eliminates network fees on transactions and provides free off-ramps up to $25K USDC monthly to your bank account (compared to 0.5% without it, or 0.1% after hitting the limit with Plus).

- Pros: Fast

Solana transactions, robust security including multi-factor authentication and recovery keys, straightforward integration for trading, saving, and spending, and significant fee reductions through Fuse Plus.

Solana transactions, robust security including multi-factor authentication and recovery keys, straightforward integration for trading, saving, and spending, and significant fee reductions through Fuse Plus. - Cons: Virtual card only with no physical alternative, restrictions in select U.S. states, and yields that can vary with Solana's market conditions.

signed up and got a @fusewallet

— Cubs (@JussCubs) October 21, 2025

within minutes I now have a virtual checking account with routing/account number, virtual debit card connected to Apple Pay, and earning 7%+ yield on USDC in the wallet

unbelievably frictionless

Good Options Getting Better

Thanks to recent progress with payments infrastructure, crypto neobanks can match the original neobank pitch — cards, yields, rewards, peer-to-peer transfers — but with advantages fiat-centric finance can't provide.

Self-custody means you actually own your funds. Stablecoin rails enable near-instant cross-border payments with minimal forex fees — a large reason for Revolut’s original success given the complexity of European currencies. And DeFi integration opens up yield opportunities that blow away traditional savings rates, all accessible from your phone without needing a bank's permission.

The synergies are clear, and the early traction is real, though we’re still in the land grab phase. With more competitors launching weekly and established wallets like MetaMask and Phantom expanding into card services, the market is getting crowded fast.

Not every platform will survive, and many offer similar feature sets with only minor differentiations. It'll take time before the best rise to the top — likely those that nail the UX, maintain consistently competitive yields, and build genuine trust around security and reliability. (I’d recommend scanning Social Graph Ventures’ analysis of what they believe a crypto neobank must “have to win”.)

For now, the options above represent some of the strongest self-custodial choices available. Each has its own strengths depending on whether you prioritize borrowing power, zero FX fees, high cashback, or specific chain ecosystems. There are certainly more but I share these because they have established themselves, and because they clearly prove crypto neobanks are already operational.