Dear Bankless Nation,

Solana has been through it. The alternative L1 blockchain has captured the ire of regulators after an already bumpy year recovering from FTX's collapse. Even Vitalik feels bad about the way things have gone down.

Despite plenty of death blows, the network is still showing resilience. Today, in our latest Bankless Guide, we show you how to get more familiar with the Solana network.

- Bankless team

The Bankless Guide to Solana

First launched in 2017, Solana is a blockchain that has been designed to offer unparalleled “base layer” throughput and scalability compared to other popular layer-one (L1) blockchains like Ethereum and Bitcoin.

While at the time of writing, Bitcoin was facilitating ~5 transactions per second (TPS) and Ethereum ~30 TPS, Solana was facilitating ~4,000 TPS, and the network can theoretically support transaction levels in the range of 65k-75k TPS.

Accordingly, Solana’s ability to power near-instant transactions in extremely inexpensive fashion has made the network an attractive alternative to Ethereum for some web3 developers and users.

However, the Solana ecosystem faces real competition from other L1s like Avalanche and Fantom, as well as from Ethereum’s blooming L2 solutions like Arbitrum, Optimism, and Polygon zkEVM. Additionally, Solana has faced significant challenges to date like the collapse of FTX, which was a major stakeholder in many early Solana apps, periodic network outages and unwanted attention from regulators who recently designated the SOL asset as an unregistered security.

Altogether, though, Solana remains one of the most popular DeFi and NFT chains in the cryptoeconomy, and its native SOL token is still among the top 15 cryptocurrencies per market capitalization right now. And while the network is presently monolithic in how it handles its own transaction execution, security, and data availability needs, it may become increasingly modular over time if Solana-based L2s start gaining traction.

How Solana works

Solana uses a unique consensus mechanism called Proof-of-History (PoH), which is a variant of Proof-of-Stake (PoS).

PoH optimizes the transaction process by assigning a timestamp to each transaction, allowing Solana to process transactions as they arrive instead of organizing them into blocks. This style of consensus, combined with the blockchain’s Tower Byzantine Fault Tolerance (BFT) algorithm, creates a meld of security, efficiency, and speed.

In contrast to Ethereum's use of the Ethereum Virtual Machine (EVM) for executing “smart contracts,” Solana employs a different model that executes "programs." These programs are written in the Rust programming language and compiled to the WebAssembly bytecode format (WASM), enabling Solana to achieve high performance and parallel processing capabilities. This distinctive approach to smart contracts contributes to the high transaction throughput and low latency that Solana is known for.

Additionally, while Ethereum wallets primarily support ERC20 tokens and Ethereum-based applications, Solana wallets like Phantom are tailored for Solana Program Library (SPL) tokens and Solana-based apps. There are some projects like Neon Labs, though, that are currently working on bringing EVM-compatibility to the Solana network so Ethereum-based transactions can occur directly on the alternative L1.

The pulse of Solana

As of the latest update to this guide (June 30, 2023), the total value locked (TVL) in the Solana DeFi ecosystem was worth the equivalent of ~$266M USD according to DefiLlama. That current TVL level pales in size compared to Solana’s last TVL peak of ~$10B, but nevertheless it still made the network the 11th-largest DeFi network at the time of writing.

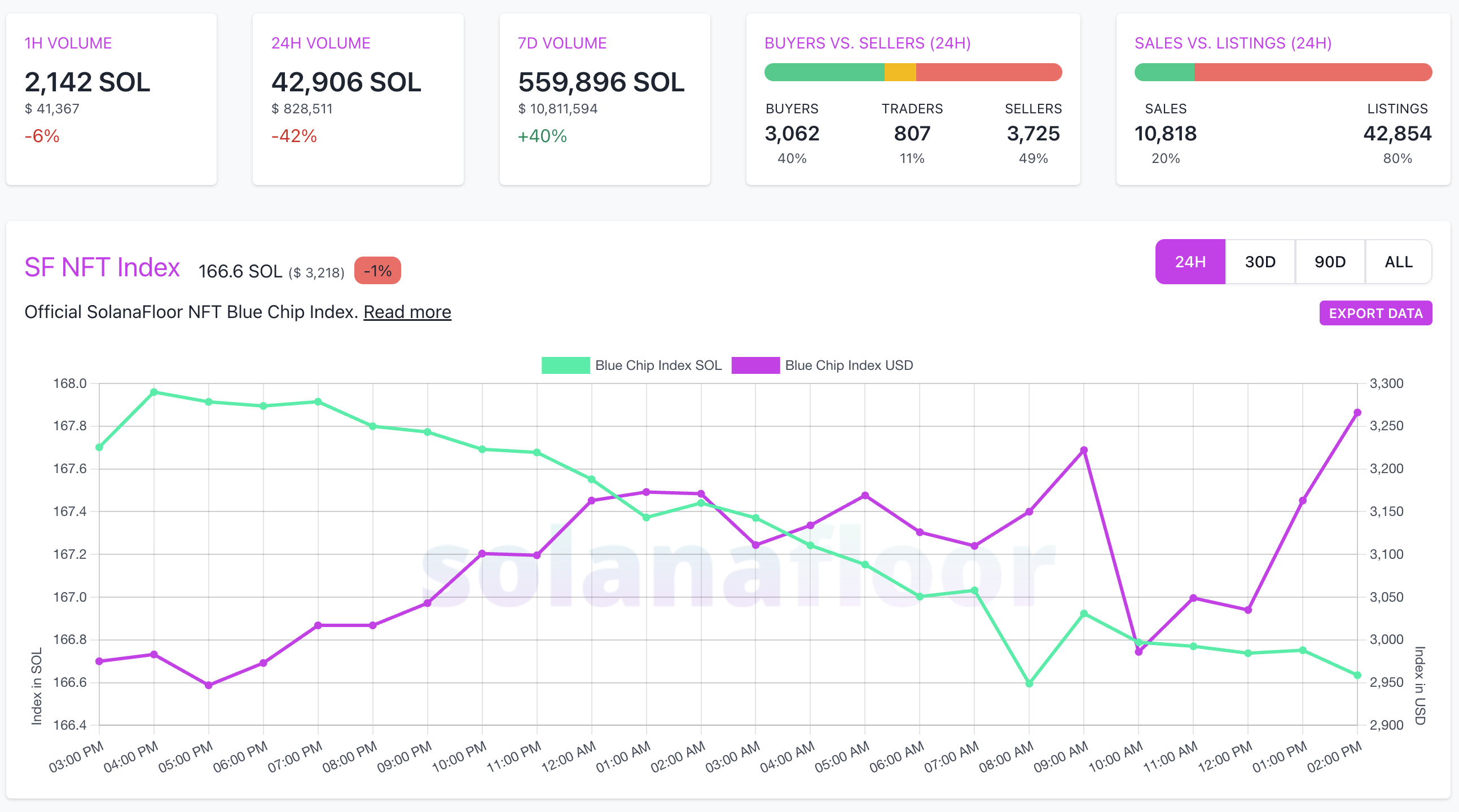

Also, Solana has one of the more teeming NFT scenes in the cryptoeconomy at the moment, albeit its NFT ecosystem is understandably much smaller than Ethereum’s in activity and breadth as things stand. Regardless, if you want to zoom in and take the pulse of the Solana NFT ecosystem at any given time, check out analytics platforms like SolanaFloor to dive deeper.

The SOL token

SOL is Solana's native token that is used for various purposes within the network’s ecosystem, such as paying for transaction fees, participating in Solana staking, and as a medium of exchange for DeFi apps.

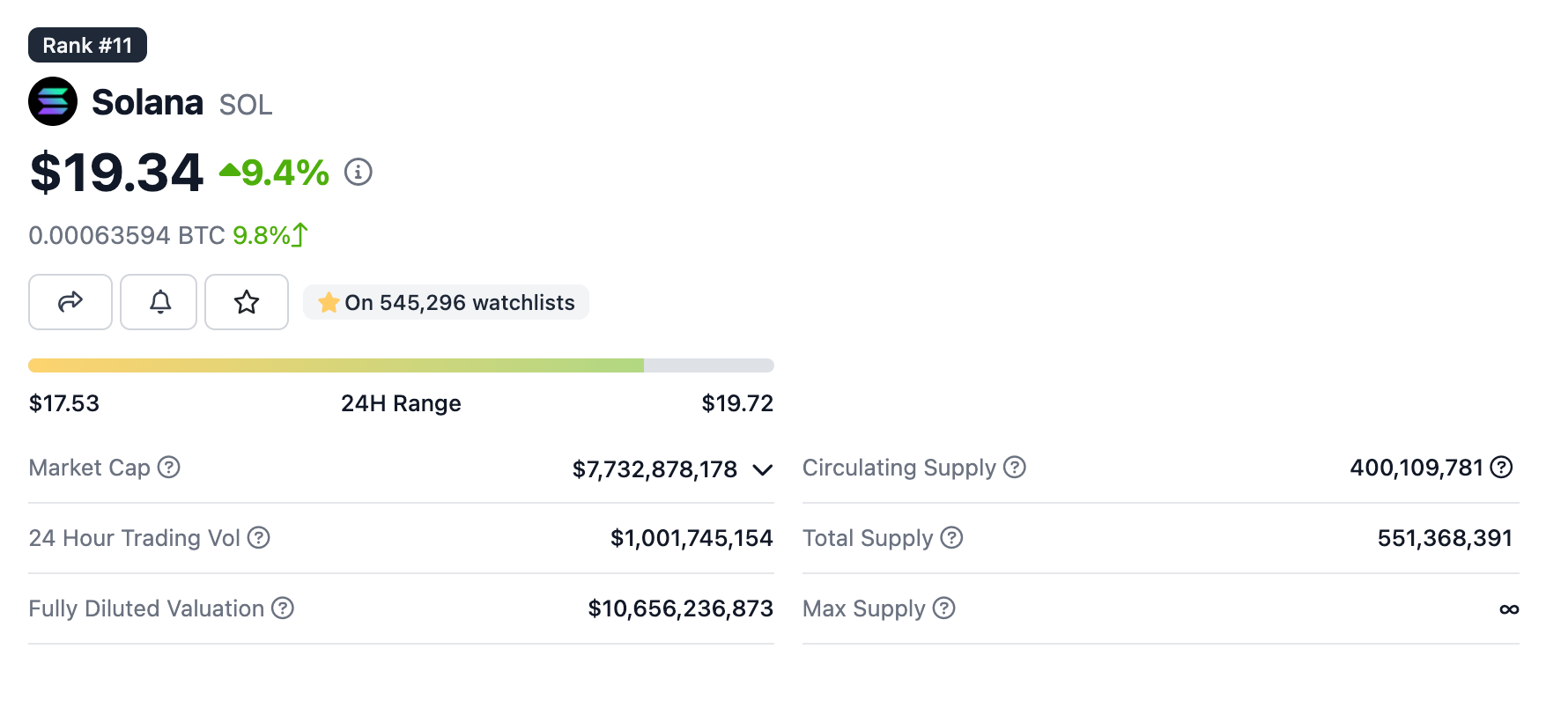

As of the most recent update to this guide, SOL was trading at approximately $19.34 USD, boasting a market capitalization of $7.73B. This positioned it as the 11th-largest cryptocurrency in the cryptoeconomy. At the time, the SOL circulating supply stood at slightly over 400 million, with a total supply of more than 551M that steadily increases per staking rewards.

Moreover, SOL can be traded on major centralized crypto exchanges like Binance, Coinbase, and Kraken, as well as on popular Solana-based decentralized exchanges (DEXes) like Raydium. Since the SEC designated SOL as an unregistered security, it was delisted from Robinhood.

What you need to use Solana

- 👛 A Solana wallet — Phantom is currently the most popular browser extension/mobile wallet for creating and managing Solana addresses. After downloading, you’d create your first wallet by backing up your mnemonic seed and creating a password, etc. Then, you'll be ready to receive your first SOL deposit!

- 🪙 Starter SOL — To start making Solana-based transactions, you'll need SOL in your wallet to cover gas costs. An easy way to begin is to purchase a small amount on your preferred central exchange and then deposit it to your Phantom Wallet address.

How to bridge to Solana

If you’d prefer to move over assets to Solana from a blockchain like Ethereum rather than from a CEX, you can consider using a Solana bridge service like Portal to migrate fungible tokens and NFTs as you please. You simply input your source chain, connect your wallet, complete your desired parameters, and then finish up with your deposit transaction.

Unlock the future of gaming with Immutable. Experience Immutable’s transformative power, where true digital ownership and web3 technology redefine gaming. Join a vibrant ecosystem backed by our leading web3 gaming platform, millions of players and a diverse lineup of 150+ games. Build, play and connect.

What to do on Solana

1. Liquid stake SOL via Marinade Finance

The largest app on Solana today, Marinade Finance is a liquid staking protocol built on the Solana network that enables users to stake their SOL tokens using automated strategies. By staking SOL with Marinade, users receive "staked SOL" tokens (mSOL) that they can utilize in DeFi or unstake at any time to exchange back to SOL. As a non-custodial and permissionless protocol, Marinade ensures that users always maintain possession and access to their tokens.

Liquid staking serves as an alternative to traditional staking, allowing users to stake any amount of SOL and unstake without the typical 1-3 day waiting period for stake warming up or cooling down. With Marinade, staking and unstaking SOL can be done instantly, eliminating the waiting time associated with traditional staking methods. However, immediate unstaking incurs fees ranging from 0.3% to 9%. Users can also opt for delayed unstaking without any fees, but they will have to wait 1-2 epochs to retrieve their SOL and accumulated rewards.

2. Trade Solana tokens on Raydium

Raydium is a DEX built on Solana that offers rapid trades and yield farming features. Users can take advantage of Raydium's trading interface to swap SOL and SPL tokens through liquidity pools or perform more advanced trading with limit orders. Additionally, the platform provides multiple opportunities to earn RAY tokens, such as providing liquidity to trading pools or staking, making Raydium an attractive choice for users beginning to start their DeFi journey on Solana.

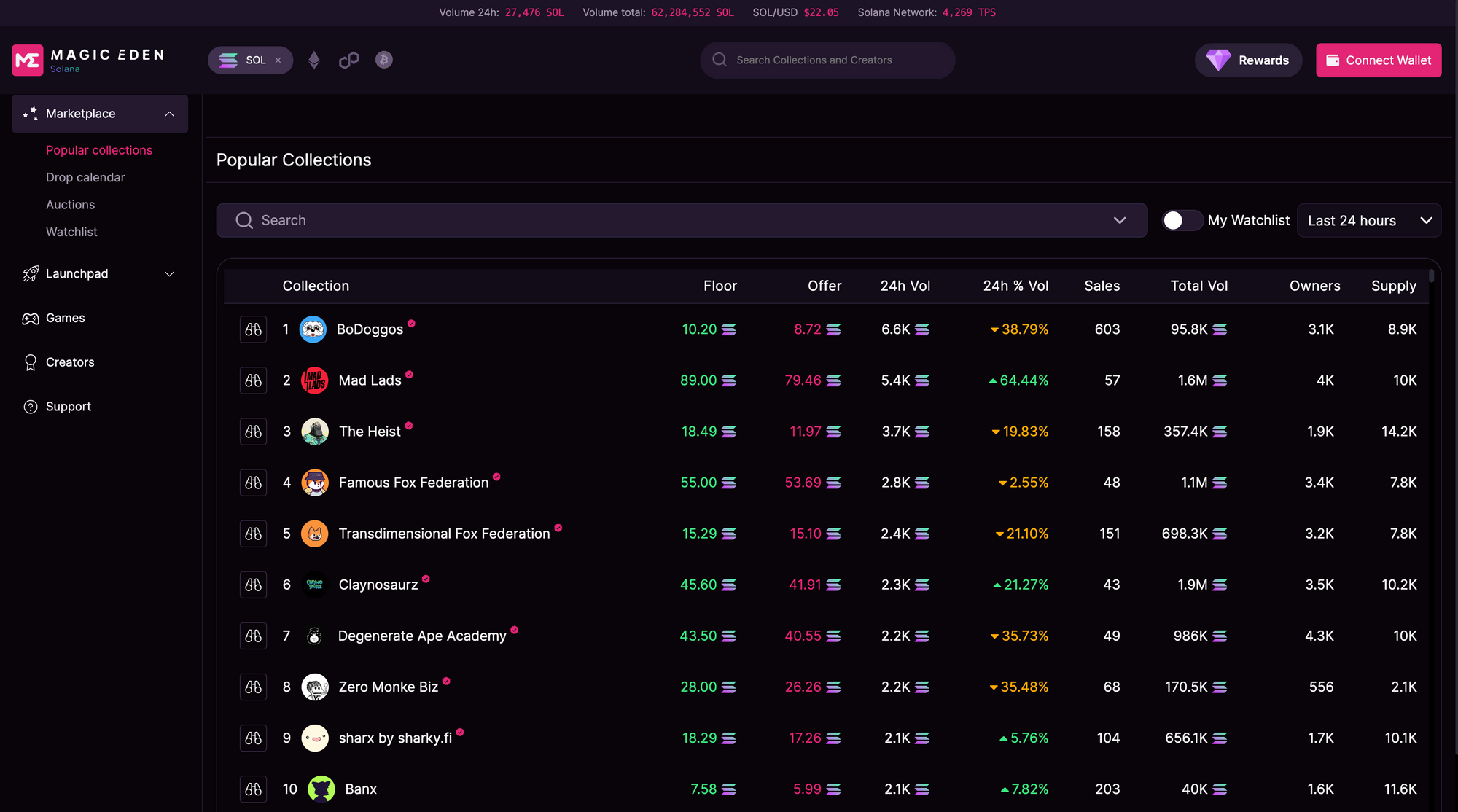

3. Collect NFTs on Magic Eden

With more than 8,000 listed collections, Magic Eden has become the leading NFT marketplace on Solana, offering a one-stop platform for users to discover and trade Solana NFTs. In addition to its core secondary marketplace, the platform features a Launchpad service for exclusive minting projects and partnerships with NFT brands. Users can also explore NFT gaming through Eden Games, which focuses on supporting game creators and their communities.

Additional Solana apps

Ready to explore more of what the Solana app ecosystem has to offer? If you want to dive deeper, these apps represent some of the most popular projects on Solana that you can additionally dig into today:

- 🪙 Lido — Liquid staking | $54M USD TVL

- 💱 Orca — DEX | $36M USD TVL

- ☀️ Solend — Lending | $37M USD TVL

- 🧬 Atrix — DEX | $15M USD TVL

- 🌾 Francium — Leveraged yield farming | $12M USD TVL

Additional Solana resources

If you want to delve in further and enhance your knowledge of Solana in general, numerous additional resources are worth investigating. Here are a few you can use to learn more:

- 📜 Solana docs

- 🕳️ Solana community hub

- 🔑 Solana validator 101

- 🔍 Solana block explorer

- 🦙 DefiLlama Solana dashboard

Zooming out

Solana has emerged as a popular L1 blockchain that addresses the need for scalability, speed, and affordability in the decentralized apps space at the network’s base layer. Its technology stack, like Proof of History and beyond, has paved the way for a growing ecosystem of projects that caters to various interests such as DeFi, NFTs, and gaming.

Action steps

- 📚 Check out the other Bankless Guides

- 👁️ Read 10 Altcoins that will Survive the Bear