Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

Most DeFAI projects we’ve covered in this column focus on capital: routing it, compounding it, and letting agents be smarter with it on your behalf.

Cysic is doing something different. It’s targeting compute. And last week the project entered primetime upon debuting its mainnet and its native utility token, $CYS.

The basics to know here:

- The core idea behind Cysic is straightforward. GPUs, ASICs, and servers shouldn’t live in closed, centralized silos. Instead, they can form an open marketplace where compute can be requested, executed, and paid for onchain. Think things like ZK proofs, AI inference, mining, and beyond, all coordinated by one protocol.

- Under the hood, Cysic acts as a coordination layer between three parties: compute providers who supply hardware, requesters who submit workloads, and verifiers who ensure results are correct. The protocol itself handles scheduling and settlements.

- Powering all of this is $CYS, which plays several roles. First and foremost, it secures the network via “Proof-of-Compute.” The token is also used to pay for workloads and to reward providers and verifiers.

- Plus, by staking $CYS, users can mint $CGT, a non-transferable governance token that confers voting power over network parameters and compute allocation. It’s a dual-token setup designed to separate economic activity from long-term governance. Staking is the bridge between the two.

- All that said, $CYS has traded up modestly from roughly $0.27 to $0.29 in its first week post-launch. That’s not a euphoric surge by any means, but in today’s environment, being up a week after TGE is something of a rarity. Green is green, right.

As for the long-term prospects? That’s an open question. But if you think stuff like AI inference and ZK proving will have teeming onchain economies in the future, Cysic’s an early infra play in that direction. At the very least, it’s worth understanding and tracking.

I wrote in October about x402's pending upgrade — a rewrite which would clean up the messy, yet successful proof of concept that was V1.

In that article, I made clear that, while x402 held tremendous potential, excitement should be tempered until V2 matured the protocol.

This happened last week — on a much shorter timeline than I expected.

x402 V2 is here, ready to use, and improves upon elements of the original protocol's design that made it a headache — all the more frustrating I'd imagine since developers, while being those forced to deal with the mess, are also those who can best attest to its potential.

To get us all up to speed, whether you're a developer or not, I'm going to run through and break down what's arrived in V2 and what's been improved upon.

At its core, I'd break these down into three developments:

- The standardization of payment formats

- The creation of a standard extension format for plug-ins

- Added support for wallet-based access and reusable sessions

Here's what I mean by this:

The Standardization of Payment Formats

Unlike V1, which required repeated protocol-level updates to support new chains, V2 standardizes how payments are represented at a fundamental level, making x402 multi-chain by default.

This means it works across  Ethereum L2s and

Ethereum L2s and  Solana without special-case code, and supports stablecoins, tokens, and even traditional payment rails using the same underlying structure. Things like ACH, SEPA, or credit cards can now plug into the model without introducing new protocol features. Payment routing is also more dynamic in V2, so the destination of a payment can change per request. That enables revenue sharing, shared APIs, and dynamic pricing without changing the API itself.

Solana without special-case code, and supports stablecoins, tokens, and even traditional payment rails using the same underlying structure. Things like ACH, SEPA, or credit cards can now plug into the model without introducing new protocol features. Payment routing is also more dynamic in V2, so the destination of a payment can change per request. That enables revenue sharing, shared APIs, and dynamic pricing without changing the API itself.

A Standard Extension Format for Plug-ins

Previously, as evidenced with the above description of standardizing payments, extending x402 often meant updating the core protocol or SDK, a tedious and unrealistic condition.

In V2, those changes move out of the core and into standardized extensions. The protocol now supports and expects plugins, so new functionality can be added as optional extensions without requiring a system-wide upgrade. This also enables automatic discovery: services can publish machine-readable metadata that describes their paid APIs (what they do, what they cost, and what payment options they accept), and facilitators can ingest that data into an API-first directory that agents and SDKs can query to find, compare, and route to the right paid API — without anyone needing to coordinate integration details by hand. The core stays stable while features evolve at the edges, and the SDK can dynamically select chains, assets, and facilitators based on simple developer preferences. The result is far less friction, since the protocol no longer needs to change every time someone wants to add a new payment model, chain, or routing mechanism.

Wallet-Based Access and Reusable Sessions

The third major change is wallet-based access and reusable sessions, which brings x402 in line with how access works on the modern internet.

In V1, believe it or not, every API call or visit required completing the full payment flow, which effectively enforced a pure per-request micropayment model. That's just not how most users or agents expect systems to work today, where subscriptions and session-based access dominate. V2 effectively brings x402 into the modern age, preserving the balance-based model while enabling reusable access after purchase — cutting latency and avoiding repeated onchain calls. This makes subscriptions, sessions, and repeated access patterns possible for both humans and agents, without sacrificing the core x402 payment semantics.

What the Data Actually Shows

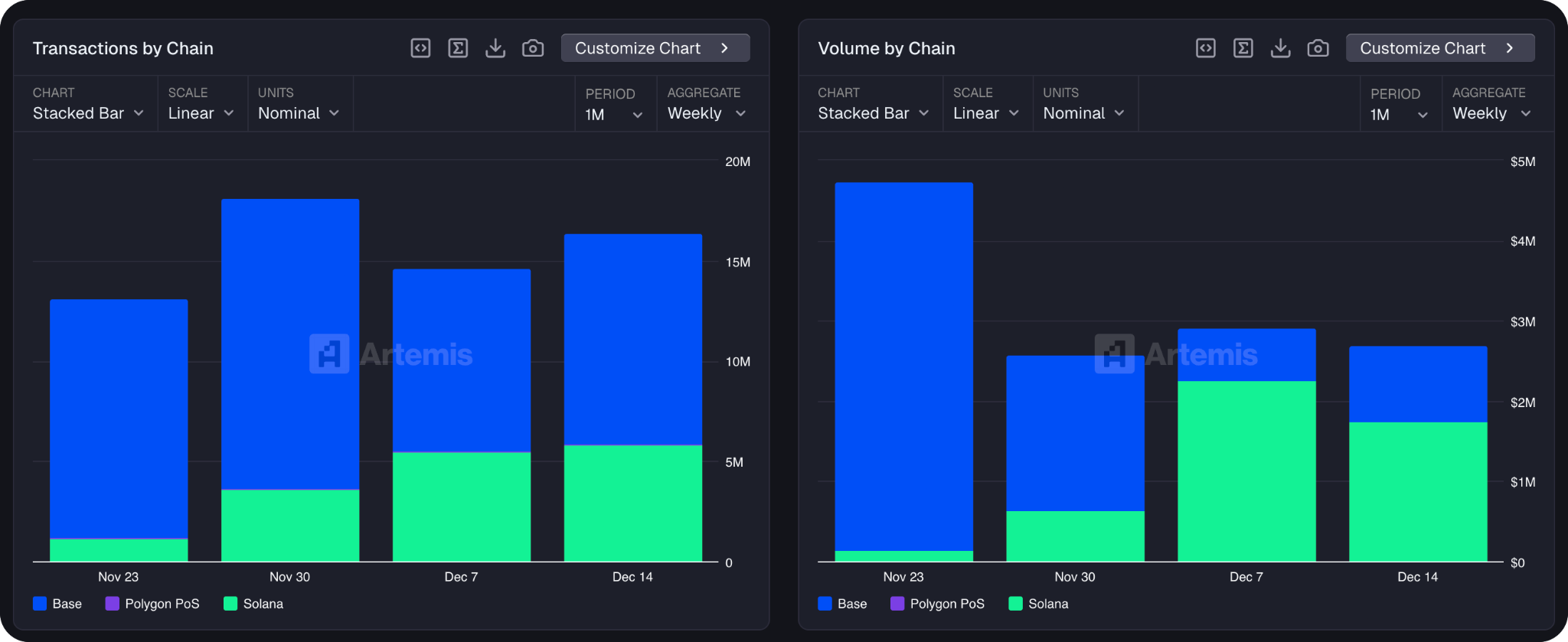

So the protocol has improved. But is anyone actually using it? Given the hub-bub on Twitter and the continued “all time highs” of transaction volumes advertised in posts, you’d think yes. And to an extent, you’d be right. But, as with many network metrics in our industry, they need to be sterilized and re-reported once gamed or meme-related volume has been removed.

In the case of x402, Lucas of onchain data provider Artemis believes this illegitimate activity to account for 47% of all x402 transactions to date, mostly from teams gaming leaderboards to climb x402scan rankings.

That sounds damning, but it represents only 14% of total dollar volume, and gamed activity correlates strongly with legitimate transaction activity. Some of it is also just teams testing infrastructure so there’s not much need for concern. Further, as projects move from testing to production, these percentages should decline — and the data already shows average transaction size trending downward alongside gamed volume.

Where Real Usage Lives

For the 53% of transactions that Artemis classifies as legitimate, those come from servers offering high-frequency, low-cost services where micropayments make sense. Artemis highlights AISA, x402secure, LucyOS, AgentLisa, and Heurist as exemplars — processing millions of micropayments with near-zero artificial activity. I’ll also note that, while in October and November the vast majority of these occurred on Base — 86% of transactions and 89% of volume, to be exact — in December, activity’s migrated to Solana which processes ~36% of transactions and ~72% of volume. The services responsible for this activity are X, Y, and Z — largely agent-to-agent services.

Looking Forward

Overall, sift through the spam transactions and you’ll see a lot’s going right for x402.

What’s still to come is verifying the legitimacy of agents and services — which ERC-8004 will help with but still remains in its early stages — as well as service providers adopting x402.

We'll probably overestimate how fast agentic commerce takes off in the short term, but do the opposite for its growth in the long term.

- In the meantime, if you’re a builder, tinker around with V2, share what you make in the x402 builders chat — also DM me on Telegram at davidscreenname, would love to see what you make.

- If you’re an investor keep a level head about the technology. If x402 memes are your thing, there’s no shame in that but if you’re looking for a long-term bet it’s best to hold off as the technology itself has some proving to do.

Plus, other news this week...

🤖 AI Crypto

- Aster — AI leads humans in trading competition, -3% to -27% ROI, as of time of writing

- Mode — Launched Trade AI Agents V3, automated trading assistants powered by x402 that execute rules-based trades 24/7 with multi-LLM support

- Tether — Released QVAC Health, a private, entirely-local AI wellness app

- 🔥 World — Integrated with Tinder for verified human badges and privacy-preserving age checks

📣 General News

- 🔥 Google — Launched Gemini 3 Flash, a speed-optimized version of its flagship that matches or exceeds 3 Pro across benchmarks at ¼ the price and 3x the speed

- Klarna — Launched the Agentic Product Protocol, an open standard allowing AI assistants to discover 100M+ products across sellers

- Merriam-Webster — Crowned "slop" its 2025 Word of the Year

- OpenAI — Released Image-1.5, though vibe checks from Twitter, Reddit, and Discord favor Nano Banana Pro, also opened its ChatGPT app directory to third-party developers, creating a browsable hub for integrated services

- NVIDIA — Debuted Nemotron 3 family of open models for building agentic systems across industries

📚 Reads

- Decentralised — Payments in the Agentic Economy

- The Economist — The Next Version of the Web Will Be Built for Machines, Not Humans

- 🔥 Miguelrare — Vibecoding: A 2026 Thesis

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower onchain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.