Subscribe to Bankless or sign in

THIS JUST IN: Analysts call for Category 5 airdrop event; wallet users should brace for MASK, RABBY, RNBW, other tokens to make landfall in the immediate future!

Crypto Twitter has been inundated with confirmations of wallet token launches in recent weeks, and while the broader onchain ecosystem is enthusiastic about the prospect of another widespread free money airdrop, many still hold onto reservations, questioning why crypto wallets need tokens in the first place.

Today, we’re combatting the critics, discussing the simple economic bull case for wallet tokens and the powerful use cases they might serve. 👇

What’s the Point of Wallet Tokens?

The current crypto market cycle has been defined by an all-pervasive “revenue meta."

Protocols like Aave, Pump.fun, and ![]() Hyperliquid have stolen the spotlight here, experiencing price boosts from the fact that their underlying applications exhibit product-market fit and produce meaningful revenues.

Hyperliquid have stolen the spotlight here, experiencing price boosts from the fact that their underlying applications exhibit product-market fit and produce meaningful revenues.

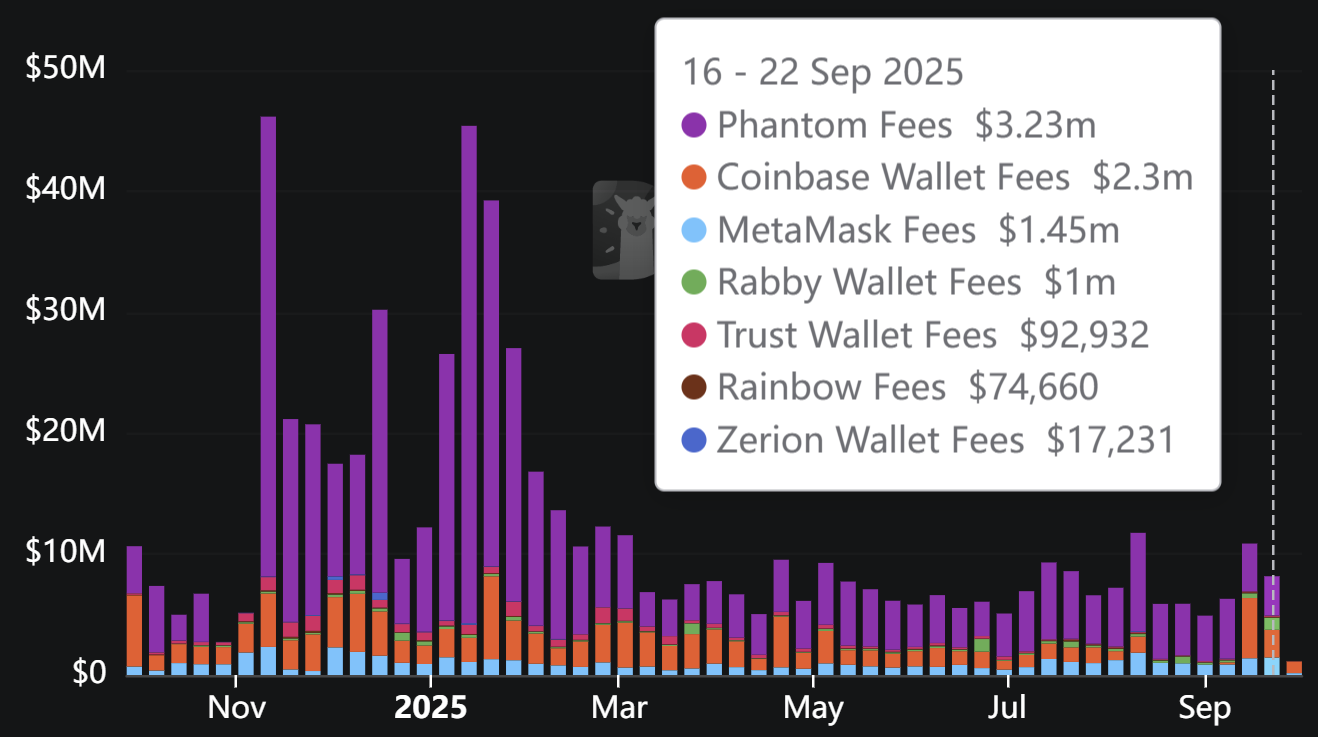

While true that blue chip DeFi produces multiples more revenue than any other sector, wallet providers have steadily monetized their products throughout the years.

Thanks to fees earned on in-wallet services like swap/bridging transactions and perpetual trading integrations, wallets have become some of the most lucrative crypto applications in existence.

At the top of the totem pool is Phantom, which produced $3.2M of revenue in the week ahead of this analysis, ranking it 13th overall among crypto protocols by revenue.

Close behind are ![]() Coinbase Wallet (an admittedly unlikely token airdrop candidate) and MetaMask, which produced a respective $2.3M and $1.5M in the week ahead of this analysis, placing them 15th and 19th among all crypto protocols by revenue.

Coinbase Wallet (an admittedly unlikely token airdrop candidate) and MetaMask, which produced a respective $2.3M and $1.5M in the week ahead of this analysis, placing them 15th and 19th among all crypto protocols by revenue.

While unclear if wallet service providers will retain all fees for their corporate entities (similar to how ![]() Uniswap Labs earns frontend fees while UNI token holders continue to wage a years-long battle for fees), it is possible that their substantial revenues are returned to wallet token holders, potentially through token buybacks, staking programs, or a combination of both.

Uniswap Labs earns frontend fees while UNI token holders continue to wage a years-long battle for fees), it is possible that their substantial revenues are returned to wallet token holders, potentially through token buybacks, staking programs, or a combination of both.

Regardless, even in the event that wallet revenues are not returned to token holders, there remains a glaringly obvious use case for their implementation.

Looking to the Web2 model for inspiration, platforms that own the distribution control the consumer. In crypto, wallets control the distribution being a necessity for accessing blockchains.

Thus, crypto wallets have increasingly evolved into one-stop shops for all your blockchain needs, and their users demonstrate clear willingness to pay premiums for the convenience of in-wallet services, as evidenced by hefty revenue figures.

Under this paradigm, the most compelling bull case for a wallet token may be utility-based. The elimination of wallet-applied service fees for addresses that hold a wallet’s token could itself serve as a powerful driver for token demand.

Beyond discounts, wallets can also provide alternative reward benefits to their token holders.

Holders of the Coinbase One credit can earn up to 4% cash back, but must hold assets on the Coinbase exchange and receive higher rates by holding more assets. What is stopping ![]() MetaMask Card from giving bonus cash back rewards to holders of its eventual token?

MetaMask Card from giving bonus cash back rewards to holders of its eventual token?

Additionally, many crypto wallets are now adding stablecoins to their product lineups. While the subject of stablecoin yield remains a securities law gray area, wallets could potentially create incentives for their token by offering stablecoin yield to holders (along with stablecoin service-related discounts).

Meet

— Phantom (@phantom) September 30, 2025Phantom Cash 👻✨

The power of crypto 🤝 the ease of cash. pic.twitter.com/F7yL7sNxKd

Conclusion

Despite some skepticism for the role of wallet tokens, their use case is clear, anchored by substantial service revenues and underpinned by powerful platform utility.

As these gateways to blockchain adoption evolve into fully fledged financial superapps, the economic logic for wallet tokens may become difficult to ignore. Whether through fee discounts, rewards, or novel incentive structures, wallets have both the scale and the revenue streams to justify meaningful token airdrops.

For analyst-recommended strategies to hunt top wallet tokens ahead of the airdrop, visit the Bankless Airdrop Hunter “All Projects” page and filter for “Wallets.”