Subscribe to Bankless or sign in

![]() Curve Finance is a decentralized exchange (DEX) protocol built for efficient crypto trading. It also features its own isolated lending market platform, Curve LlamaLend, along with a native stablecoin, crvUSD.

Curve Finance is a decentralized exchange (DEX) protocol built for efficient crypto trading. It also features its own isolated lending market platform, Curve LlamaLend, along with a native stablecoin, crvUSD.

Key takeaways

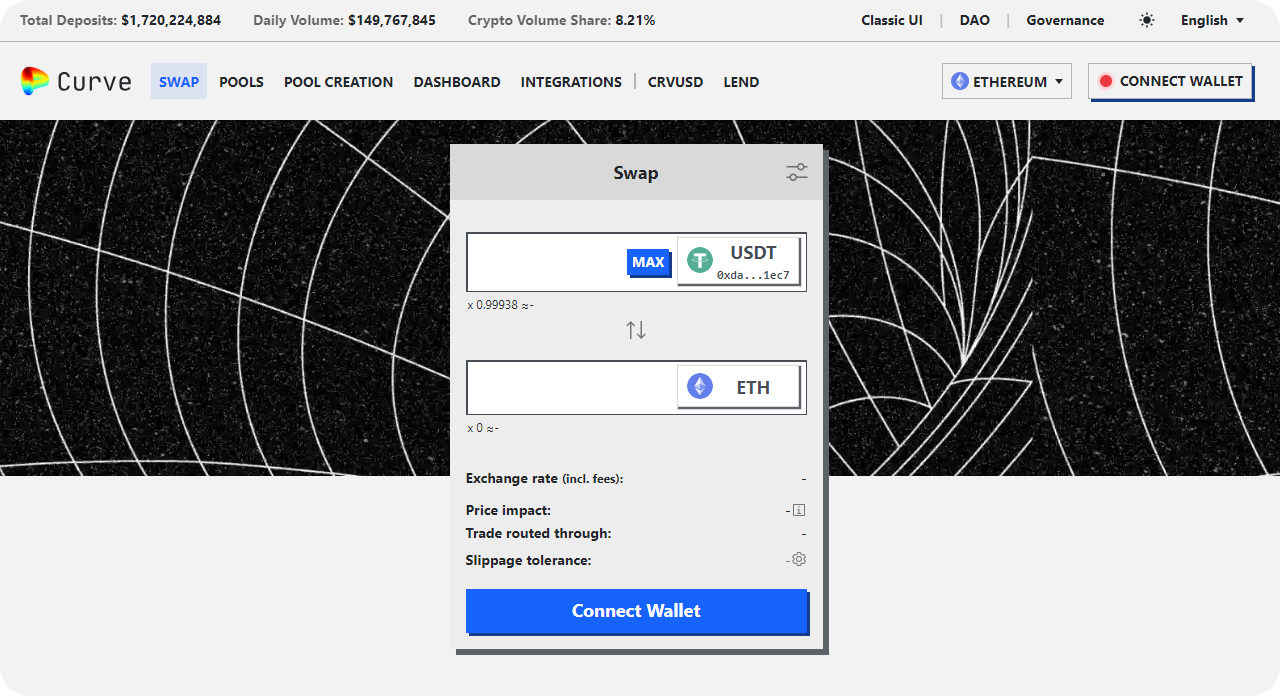

- Curve's bread and butter is its automated market maker (AMM) model, specifically optimized for low-slippage swaps between "pegged assets" like stablecoins (e.g. USDC and USDT) plus swaps between more volatile assets such as ETH, WBTC, and others.

- This AMM approach lets Curve users earn passive income by providing liquidity to the protocol's liquidity pools, which in turn allows traders to swap between top DeFi tokens with minimal price impact.

- Curve incentivizes its liquidity providers with trading fees and token rewards distributed in its native CRV token.

- As of September 2024, Curve has over $1.83 billion in total value locked (TVL) across multiple networks, including Ethereum, Arbitrum, and Polygon.

What is Curve?

Curve Finance is a decentralized exchange that has become a cornerstone of the DeFi ecosystem.

Unlike traditional DEXs, Curve specializes in facilitating efficient swaps between assets with similar values, particularly stablecoins and wrapped versions of cryptocurrencies like WBTC. This focus allows Curve to offer trades with minimal slippage and low fees, making it a popular platform for large-scale transactions.

crvUSD is Curve's native stablecoin, designed to maintain a 1:1 peg with the US dollar. What sets crvUSD apart is its innovative minting mechanism, which utilizes the Lending-Liquidating AMM Algorithm (LLAMMA). This algorithm enables a novel approach to collateralization and liquidation, aiming to provide more stability and efficiency compared to traditional overcollateralized stablecoin models.

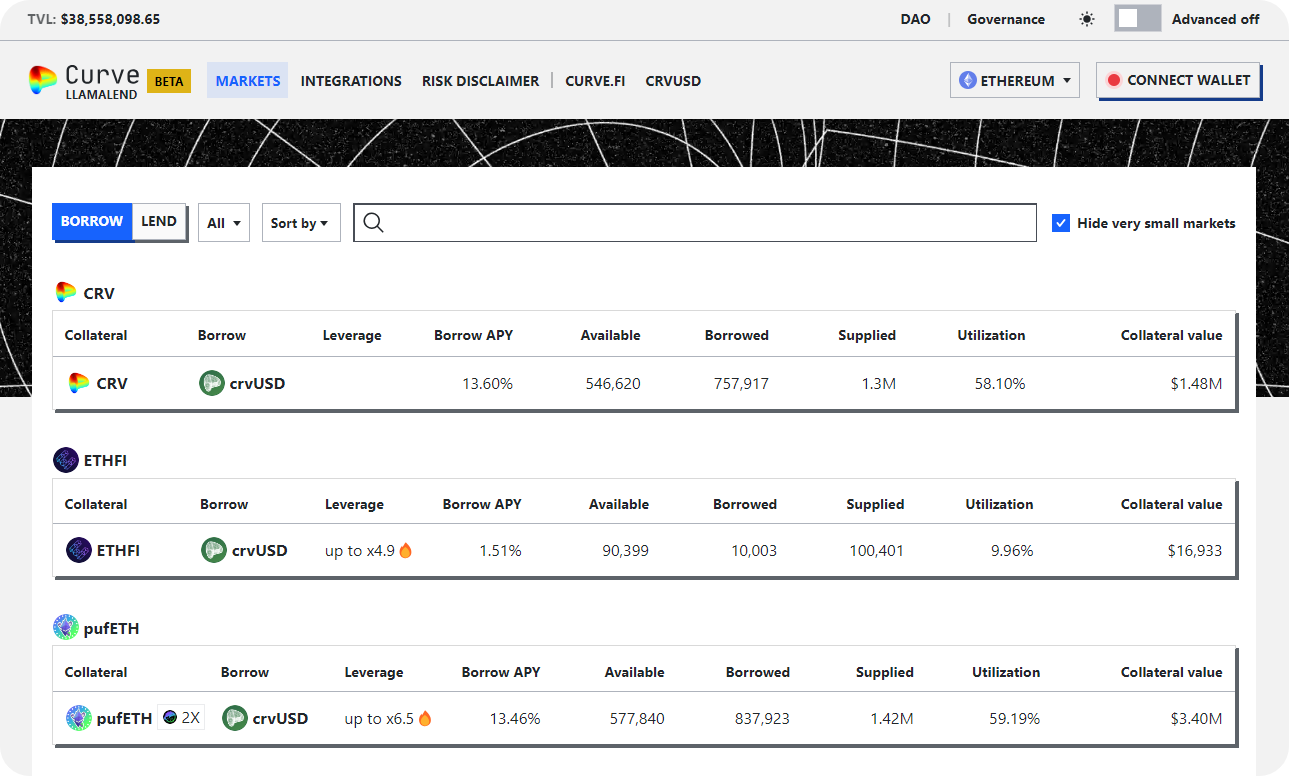

CurveLlamaLend, also known as Curve Lending or simply Curve Lend, is an extension of Curve's ecosystem that leverages the LLAMMA mechanism. It's a permissionless lending and borrowing platform that allows users to borrow crvUSD against various supported tokens, or borrow tokens against crvUSD.

The integration of these components—Curve's AMM, the crvUSD stablecoin, and the CurveLlamaLend platform—creates a flexible DeFi ecosystem. As Curve has evolved, it's positioned itself as not just a DEX then, but as a multi-faceted DeFi hub addressing various financial needs in crypto.

Why Curve?

Compared to centralized financial platforms, Curve offers several advantages:

- Decentralization — Curve operates without intermediaries, giving users full control over their funds.

- Efficiency — The protocol's specialized algorithm provides better rates and lower slippage for stablecoin trades than many centralized exchanges.

- Liquidity — Curve often offers deep liquidity for stablecoin pairs, enabling larger trades without significant price impact.

- Composability — As a DeFi protocol, Curve integrates seamlessly with other decentralized applications, enabling complex financial strategies.

- Transparency — All transactions and pool states are visible onchain, providing full transparency of operations.

How to invest in Curve?

The CRV token is central to participating in the Curve ecosystem. As of September 2024, the current price of CRV is $0.27 per token, with a market capitalization of approximately $319 million.

Investors can acquire CRV through DEXs or major crypto exchanges or by earning it as a reward for providing liquidity to Curve pools. To maximize your involvement, it's also possible to stake CRV tokens by locking them as veCRV (vote-escrowed CRV), which grants participation in governance decisions and boosts reward potential.

As veCRV holders, investors can influence protocol upgrades and "gauge" weights, effectively shaping CRV distribution across various pools. Yield opportunities abound for those who provide liquidity and stake CRV, with potential returns coming from both trading fees and additional CRV rewards.

More about Curve

👉 Bankless Curve Profile

👉 CRV Token Rating