Mantle - Mass adoption of token-governed tech

Mantle - Mass adoption of token-governed tech

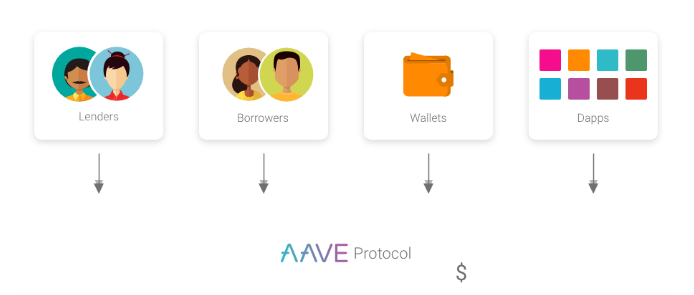

Aave is a decentralized finance (DeFi) protocol that allows users to borrow, lend, and earn interest on various cryptocurrencies. For this reason, the project is commonly referred to as a “borrowing protocol,” a “lending protocol,” or a “decentralized money market.” For its part, the Aave team refers to the project as a liquidity protocol.

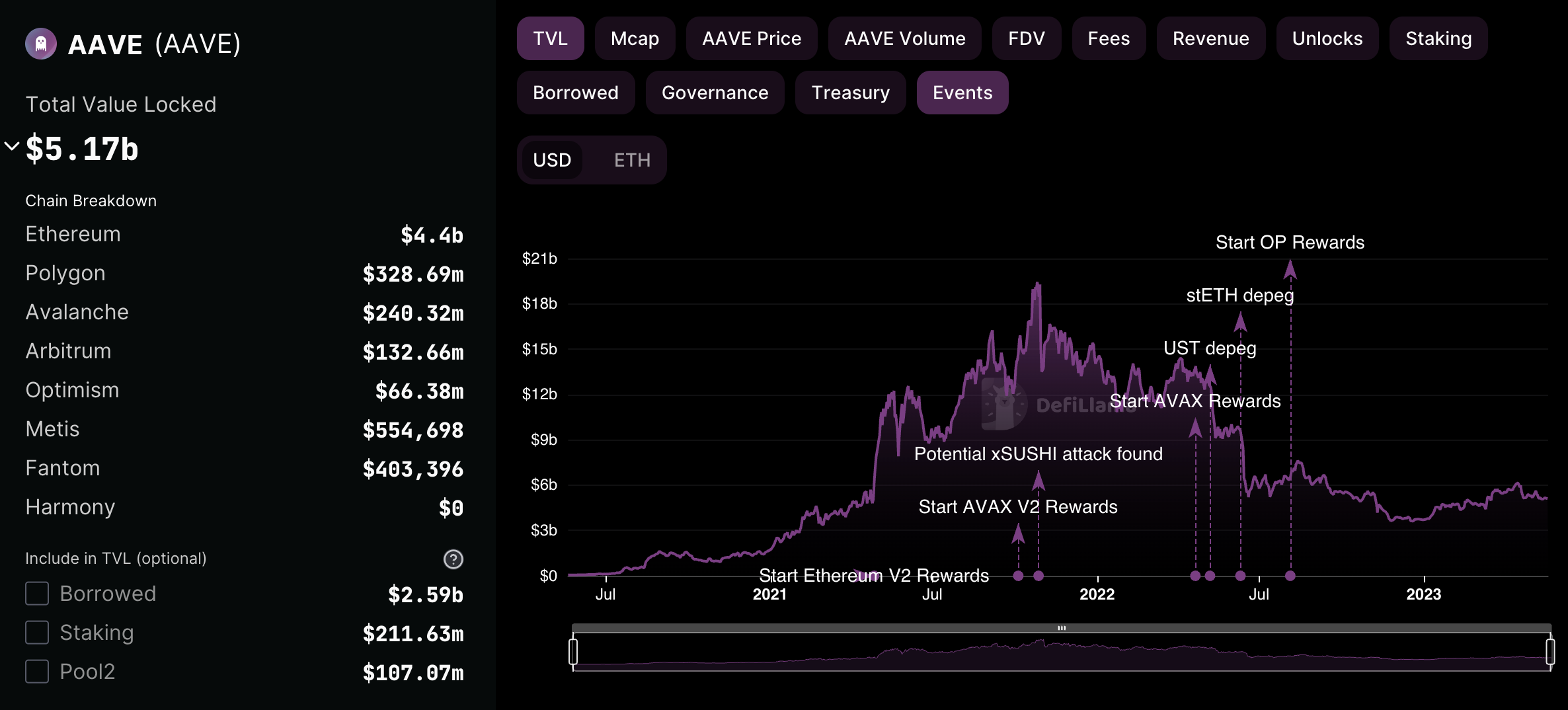

First built on the Ethereum blockchain but now deployed across five chains and counting, Aave uses smart contracts to facilitate borrowing and lending transactions without the need for a middleman financial institution, providing a secure and transparent way for users to manage loans.

Additionally, as a non-custodial lending protocol Aave ensures users can put their crypto to work while still maintaining full control over their funds, a dynamic that mitigates the counterparty risks associated with centralized financial services.

History of Aave

Aave was founded in 2017 by Stani Kulechov under the name ETHLend.

The project was initially envisioned as a peer-to-peer (P2P) lending platform, but it eventually shifted to a pool-based approach and rebranded to Aave in early 2020. Later that year, the Aave team introduced the protocol’s V2 system with new and improved features, like credit delegation and flash loans.

In March 2022, Aave V3 was unveiled and with it a slate of new functionalities, like optimization for layer-two (L2) scaling solutions, Aave Portal (an interface for seamlessly moving assets in V3 markets over different networks), and Isolation Mode (a limits system to mitigate risks from newly listed assets).

GHO, a reference to the Aave “ghost” mascot, is a decentralized stablecoin that Aave first announced in early 2022. Poised to serve as the native stablecoin of Aave, the token was officially launched on Ethereum in July 2023.

While Aave has already risen into the position of being among the largest and most popular protocols in all of crypto, the arrival of the GHO stablecoin presents an opportunity for a new chapter of self-sovereignty in the project’s DeFi journey.

The pulse of Aave

Since launching, Aave has seen significant growth in both user base and total value locked. As of September 2023, the platform had over $4.64 billion in TVL across its various lending pools, making it the third-largest DeFi platform in the space at the time.

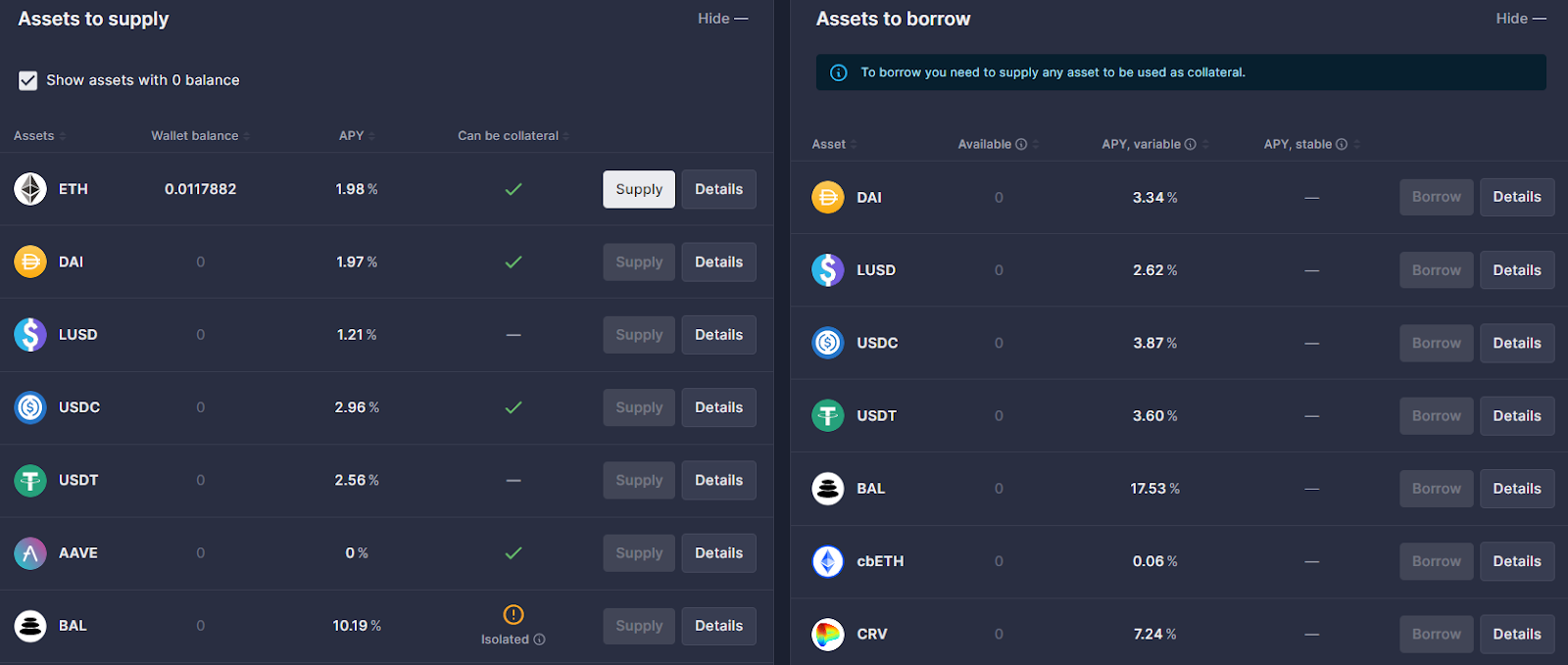

Currently, Aave's lending pools support a range of cryptocurrencies, though the precise tokens supported vary between Aave’s deployments. For instance, the Ethereum deployment supports tokens the Arbitrum deployment doesn’t, and so forth. Some tokens that are currently both borrowable and lendable on Aave’s Ethereum deployment include ETH, DAI, USDC, USDT, LDO, LINK, and UNI.

aTokens and the AAVE token

There are two different types of tokens that are indispensable to the operations of the Aave protocol: aTokens and AAVE.

Simply put, aTokens are interest-bearing tokens pegged to an underlying asset and are issued when a user deposits a cryptocurrency into the Aave platform. As interest accrues on the deposited assets, the balance of the corresponding aTokens increases in real-time, allowing users to track and withdraw their earned interest seamlessly. This innovative mechanism enables Aave to facilitate decentralized, transparent lending and borrowing markets.

On the other hand, AAVE is the native governance and staking token of the Aave platform. First, it allows holders to participate in the project’s decision-making processes by voting on proposals and protocol upgrades. Second, AAVE is used for staking, enabling token holders to earn a portion of the platform's fees by providing additional security through an insurance buffer to the protocol. This way, if Aave ever does suffer a shortfall event, the protocol can be recapitalized with these emergency-only funds.

According to CoinGecko, AAVE was the 46th-largest token in the cryptoeconomy per its $911M USD market cap at the time of this guide’s latest update.

What you need to use Aave

- 👛 A wallet — since Aave is deployed on Ethereum and many other Ethereum Virtual Machine (EVM) compatible networks, any Ethereum-compatible wallet (e.g. MetaMask, Coinbase Wallet, etc.) should work fine for using with the protocol

- 🪙 Starter gas — you’ll need some ETH to cover the gas costs of transacting on Aave (of course, if you’re transacting on a separate L1 like Polygon you’ll need some MATIC as the gas token, if on Avalanche then AVAX, etc.)

How to use Aave

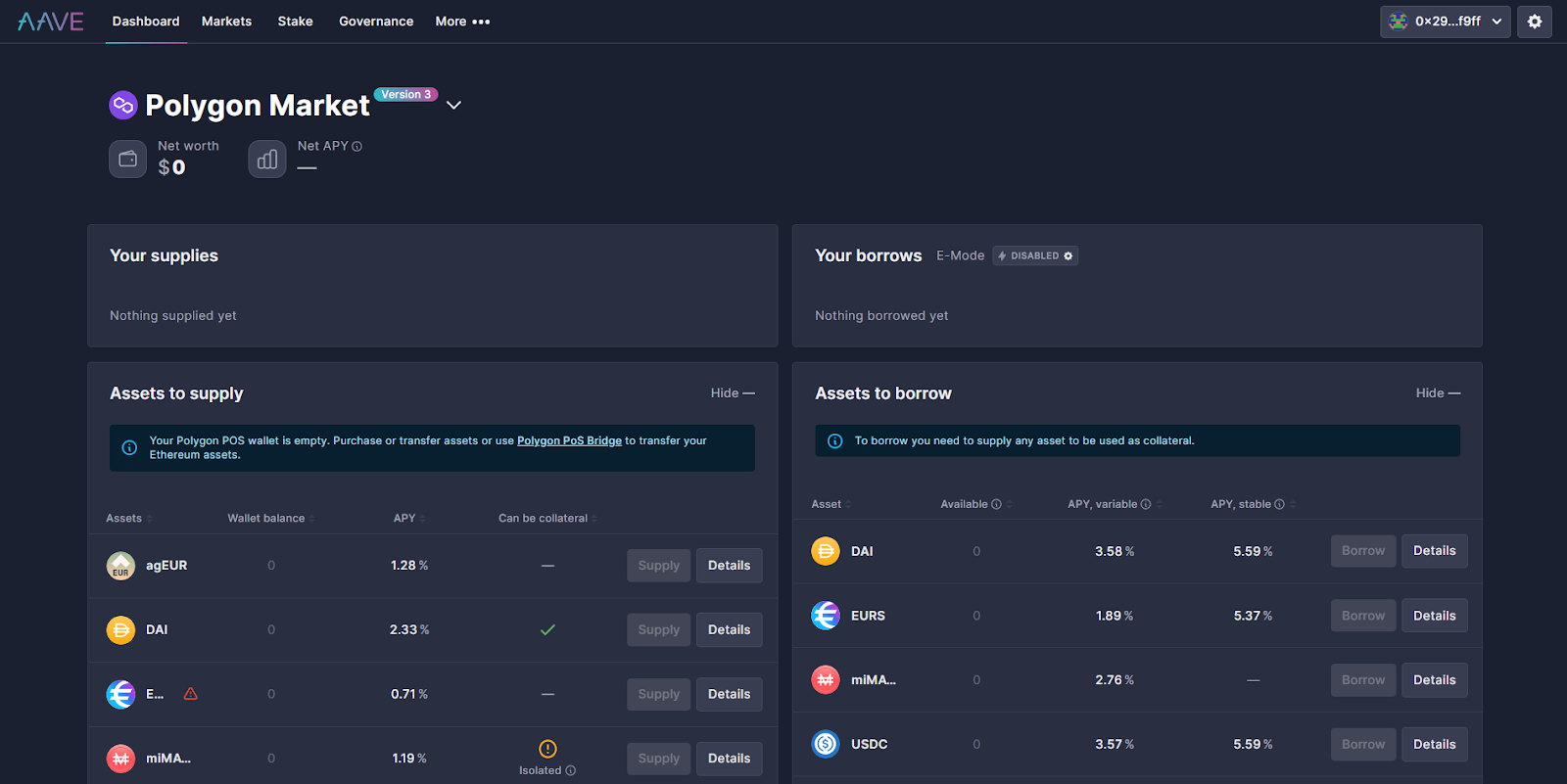

To use Aave, start by connecting your Ethereum-based wallet to the platform at app.aave.com.

Once connected, use the networks tab to pick your desired chain (e.g. Ethereum, Polygon, Arbitrum, etc.), at which point you will be able to deposit assets to lend them for interest via “Supply” or lend and then borrow against your assets via “Borrow.”

If you do open up a borrow position, make sure to monitor your collateral and health factor levels to avoid liquidation.

Additionally, if you’re interested in staking your AAVE tokens in the Aave Safety Module system to earn Safety Incentives, a.k.a. further AAVE rewards, you can deposit at https://app.aave.com/staking/. Just keep in mind that your stake can be slashed by 30% in the case of a protocol shortfall event.

Risks of Aave

Similar to other DeFi platforms, utilizing Aave comes with specific risks:

- Liquidation risk: If your collateral's value drops significantly, your borrow position may be liquidated.

- Regulatory risk: The regulatory landscape for DeFi platforms like Aave is uncertain and subject to change.

- Smart contract risk: Aave’s smart contracts could be subject to hacks or exploits.

DeFi competitors to Aave

Aave faces competition from other top DeFi lending protocols, including:

- 🪙 Maker ($4.65B USD TVL)

- 🧱 Compound ($1.9B USD TVL)

- 🌊 Liquity ($619M USD TVL)

Additional Aave resources

For more information and resources about Aave, visit:

Zooming out

Aave has emerged as a leading DeFi protocol, empowering users to lend, borrow, and earn interest on crypto without the need for intermediary financial institutions.

Since its inception as ETHLend, Aave has evolved and released innovative features, such as aTokens and the upcoming GHO stablecoin, while expanding across multiple blockchain networks. And despite competition from other major DeFi lending protocols, the platform continues to innovate and deliver a secure, transparent, and non-custodial lending experience to its users, making it an ever important player in the rapidly evolving DeFi ecosystem.

However, users must remain aware of the associated risks, such as liquidation, regulatory, and smart contract risks, while navigating this decentralized frontier. Never deposit more funds than you can afford to lose into any protocol!

Bankless

Bankless