.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Dear Bankless Nation,

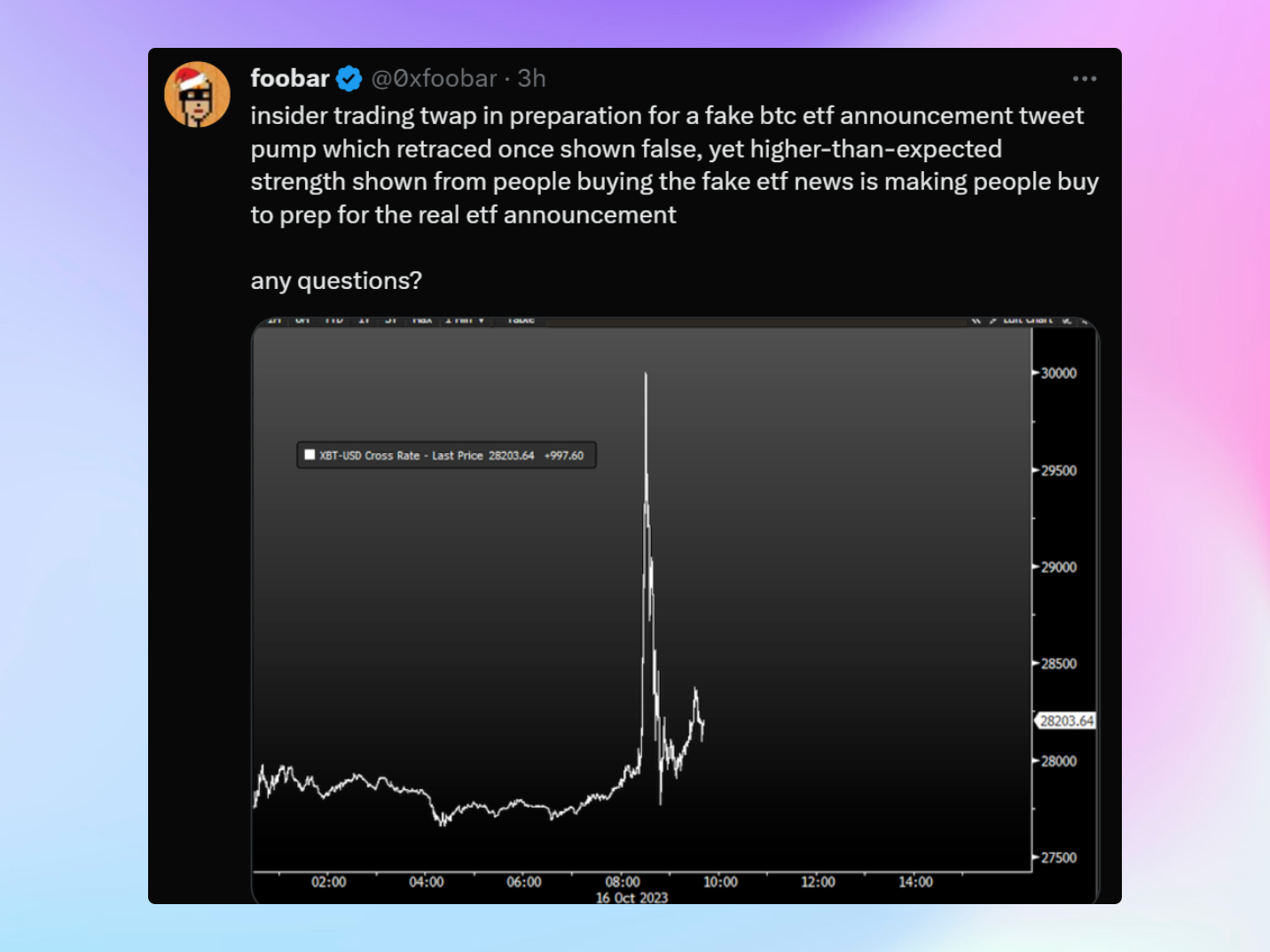

It was a chaotic morning for crypto as some fake news around the status of a spot BTC ETF application sent Bitcoin prices skyrocketing (!!!) and then plunging (!!!) – wiping out shorts along the way! This afternoon, we dig into the chaos.

- Bankless team

Crypto started off the week with a bang on Monday when some fake news shared by a crypto media outlet sent the markets into a frenzy.

Here’s what happened:

- A user in a crypto Telegram channel shared the message “BREAKING: SEC APPROVES BITCOIN SPOT ETF.” Other users started clamoring for a source, but no further context was added here.

- Some 40 minutes after that Telegram message was shared (the message was later deleted along with the account that had shared it), the crypto news outlet Cointelegraph ran with the non-story. Note the identical language:

- The problem? The SEC hasn’t actually approved any spot Bitcoin ETFs yet, so the news wasn’t real. Cointelegraph later deleted the tweet and apologized for the inaccurate info.

But for many traders, the admission was too little, too late. In the pseudo-announcement's immediate aftermath, word began to spread and people took action with the Bitcoin price temporarily rocketing up to $30,000, causing BTC short liquidations all along the way.

Watcher.guru reports that some $65 million was liquidated. 🤯

Of course, the initial bullish reaction here comes as no surprise since there is huge anticipation of the first spot Bitcoin ETFs in the U.S. now that the SEC is considering multiple applications.

When the first such ETF is actually approved, we’ll likely see BTC and the other majors like ETH immediately rocket up, just like we saw today. The market seems to have already begun further pricing this in as the initial selloff has already softened with BTC up over 5% today.

Why the buildup? More mainstream adoption, institutional investment, better liquidity, etc.

The person who planted this fake “SEC approves spot Bitcoin ETF” story undoubtedly knew all of this! They knew how the market would react. And presumably, they made some sort of direct bet to capitalize on the chaos. Accordingly, this case likely has “market manipulation” written all over it. We don’t know the specifics yet, and Cointelegraph is still investigating the incident.

Was it the work of a lone trader on Telegram? A rogue intern at Cointelegraph? A coordinated effort by a group looking to profit from the market’s knee-jerk reaction? It’s unclear for now, but that hasn't stopped the speculatooors.

In any case, the episode has drawn a lot of attention to the need for better verification of news sources in crypto. This kind of fumble doesn’t help crypto. And if you think SEC Chairman Gary Gensler isn’t going to use this story as an example of potential market manipulation in the space, you’re fooling yourself.

If there’s a silver lining here, though, we did just get a preview of how the market will react once a spot Bitcoin ETF does get approved, i.e., impressively exuberant.

And why not? Such an ETF would be a game changer for legitimizing crypto in the U.S. It’d lower the operational risk of holding BTC, raise crypto education across the board, and pave the way to later additions like spot ETH ETFs.

And that thinking is exactly what today’s market manipulator was trying to take advantage of. Stay sharp, then, because this may not be the last “false start” we see here accordingly.

William M. Peaster

William M. Peaster

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)