.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Dear Bankless Nation,

“Has the market bottomed yet?” is the billion dollar question.

If you spend any time in the Web3 echo chamber, you’ll see that hopium is still in high supply. The crypto collective conscious wants to believe that the recent drawdown over the past few months is ‘transitory,’ and that market prices will bounce back imminently.

Admittedly, that optimism is hard to sustain.

Market prices tell a worrying tale: Bitcoin is down 58% today from all-time-highs (ATH) of ~$67,000, Ether 62% from an ATH of ~$4700, and the overall crypto market cap down 58% from 2.8 to 1.2 trillion.

Both the Fed and BoE are in the midst of a rate-hike bonanza to stave off inflation, with plans to embark on quantitative tightening. The implosion of the fifth-largest blockchain Terra — considered by many to be a “blue-chip” — didn’t help.

To boot, there are significant layoffs in the crypto industry. Coinbase has dramatically rescinded job offers. Robinhood, Gemini, Brazilian crypto unicorn 2TM and Mexico-based Bitso are all reportedly axing ~10% of their workforces.

Should we be worried that crypto winter is coming? What defines a crypto winter anyway?

Consider the market conditions of 2018’s bear market. In early 2018, Bitcoin dumped 69% from its 2017 all-time-high of $19,783 to $6,155 in the span of seven weeks. Total crypto market cap plummeted from $830 billion to $120 billion by the end of the year.

The seeds of DeFi were planted in the debris of ICO Mania, but it wasn’t quite a thing yet. The average corporation viewed cryptocurrencies not with opportunity, but skepticism, and it was fashionable for policymakers and CEOs to dismiss the sector as one big scam.

…But price signals and headlines don’t tell the whole story.

2022 is not 2018

Look around the crypto landscape today. By all measures, the state of crypto today is vastly superior to where we were in the aftermath of 2018’s bull market.

First, the state of DeFi is light years ahead. By the end of 2017’s bull run, only about ~100 dapps were live. Today, there are thousands on Ethereum alone. The NFT and blockchain gaming spaces are two multi-billion dollar verticals, and we’re even seeing early signs of DeFi on the Bitcoin blockchain.

Layer-1s are dramatically scaling transaction throughput, whether through rollup technologies on Layer-2s, Layer-0 interoperability networks (Cosmos, Polkadot) or payment channels like Lightning Network. Ethereum’s total Layer-2 ecosystem today boasts a TVL of $5.1 billion. All of these were abstract, academic ideas in 2018, but are all fully deployed in functioning protocols today.

DAOs were a collection of obscure communities three years ago, but are today a megaforce with $9 billion in treasury backings. It’s no wonder they’re siphoning talent from traditional labor markets. DAOs are rapidly developing infrastructural tooling, and devising credible strategies around governance and treasury management.

With so many more cases for utility in DeFi today, the ability to speculate for a quick profit is no longer the primary reason investors pay attention to crypto.

Second, a slew of large institutional players have one foot through the Web3 door. The biggest suits on Wall Street like JP Morgan, Citi, BNY Mellon and many more global banks are expanding their product offerings into crypto-assets, or directly leveraging on DeFi protocols. Despite layoffs, Coinbase and Robinhood are rolling out their own crypto wallets.

Then there’s Big Tech’s foray into the metaverse: Facebook’s rebrand into Meta; Twitter, Instagram and Spotify’s integration of NFTs; Google and Microsoft are spinning off their own Web3 research units or actively investing into Web3. Giant retail and fashion brands are all pivoting their business strategies into Web3: Walmart, Warner Bros, Gucci, Louis Vuitton, Nike, just to name a few.

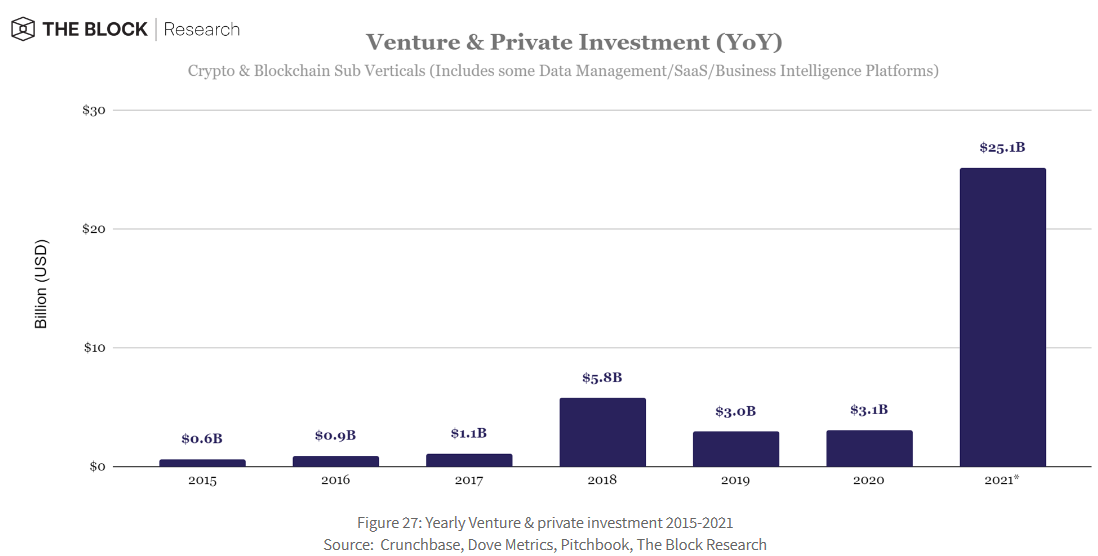

Third, the industry is flush with capital. Unlike 2018’s bear market, there’s little worry that builders will be stalled by a bear. Total funds raised by blockchain startups in 2018 was $5.8 billion, about a quarter of the total $25.1 billion raised in 2021.

We’re halfway into 2022, and VCs have reportedly raised $15 billion this year. This number does not include the monster war chest of $4.5 billion by a16z announced this past week (ICYMI: Check out our podcast with Marc Andreessen & Chris Dixon). Market prices might be down, but abundant capital ensures innovation chugs on.

Finally — and perhaps most importantly — the Overton window for crypto policy is rapidly shifting away from “banning” crypto towards “how to regulate” it. That’s unlikely to placate the most hardcore techno-libertarians, but dealing in absolutes isn’t particularly useful in measuring progress. Within policymaking circles — particularly in the West — condemnations of crypto are starting to sound silly. All good politicians have a nose for opportunity, and they can see that it’s better to be riding this wave rather than standing against it.

The crypto and broader Web3 sector is now impossible to ignore, and perhaps even politically unwise to do so given its unbannable nature. Case in point: China tried to stamp out crypto mining, but it didn’t work. At least 21% of the Bitcoin network’s mining power remains within its borders. Regulatory talk about the banning of cryptocurrencies used to plummet prices, but crypto has grown antifragile to that threat.

Web3 innovation is moving at a faster pace. Corporations are slow, lumbering, risk-averse giants that tread with caution, for fear of disrupting a comfortable status quo. Bull markets uplift public credibility, and heave off organizational inertia and skepticism that hinders entrepreneurial growth.

“Will crypto prices ever recover?” was a question commonplace in previous bear markets.

“When will crypto prices recover?” is a question more befitting today’s bear market.

Therein lies the key to all this. The existential threat with which many of us lived during previous bear markets is a non-starter this time round. Even crypto skeptics can see what we’ve built.

Bear markets are a difficult pill to swallow

Market corrections are painful. But they also represent a necessary precursor to economic progress.

If you've taken any kind of economics class, market competition is typically treated as a settled state of affairs where firms are “price-takers” under assumptions of “perfect competition.” These models net useful insights about how different economic variables play off one another under ceteris paribus conditions, but it also obscures the most important factor of all: Markets are a discovery process for what works.

Free markets let a thousand flowers bloom, but the majority are rotten apples in disguise. Profit and loss signals are an important mechanism to weeding out the rotten apples: the unsustainable, debt-laden losers who take shortcuts from the winners who don’t. Without the trial and error experimentation of market competition — economists call it creative destruction — we will never attain the necessary knowledge to know what does or doesn’t work.

David previously called this the “bear market wash-cycle,” where economic contractions force developers to return to the fundamental drawing board. The path that many Alt-L1s pursued was one of unsustainable growth subsidized by hyperinflationary token emissions. These strategies were obscured by massive capital injections during a bull run. But in hard times, that ugly underbelly is laid bare to all to see.

Booms and busts indicate the healthy functioning of markets. Following every “bust,” markets are better equipped to know what works and what doesn’t.

Closing

Analysts often make bold predictions about market trends.

These types of predictions are freakishly difficult to get right given the multitude of macroeconomic variables in the equation.

For every one they get right, there’s another dozen they get wrong — which are then promptly forgotten. The truth is no one can foresee when exactly crypto markets will recover.

But a sober look at the current crypto landscape finds many objective reasons to be optimistic and patient. In all respects, the “fundamentals” of the current bear market are much stronger than they were in 2018, and the sector is far better positioned to spring out of the current rut.

- Donovan

Donovan Choy

Donovan Choy

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)