Subscribe to Bankless or sign in

Stablecoins are the plumbing of DeFi – yet most of today's stablecoin supply streams are tethered to a world defined by TradFi approaches.

When a stablecoin is custodial, you inherit the issuer’s worldview and legal pressures, and the blacklisting risks that come with them. And if a stablecoin has external reserve dependencies, like being backed by real-world assets (e.g. U.S. Treasury bills), holders don't get direct, onchain redemption rights to the underlying asset.

This is why trust-minimized stablecoin protocols matter:

- They run on immutable code.

- They use crypto-native collateral.

- And they offer redemptions via onchain mechanisms.

We've seen various trustless stables projects over the years, including Maker's Single Collateral DAI, Reflexer's RAI and HAI, and Curve's crvUSD, but none have seen breakout success so far.

But this niche is getting interesting again as newer designs are paving fresh paths forward. Today, we're taking a look at three of the more recent shots on goal in this vertical: ![]() Liquity V2, Money League, and Polaris.

Liquity V2, Money League, and Polaris.

💧 Liquity V2

Liquity V1 earned its reputation by being stubbornly narrow. It runs on immutable contracts, only supports ETH as collateral, and largely eschews governance.

Liquity V2 kept that DNA but widened the design space when it launched in 2025. Now, the borrowing protocol lets users deposit ETH or liquid staking tokens like WETH, wstETH, and rETH to mint BOLD, a USD-pegged stablecoin.

Beyond this expanded collateral support, the V2 also introduced user-set interest rates.

Instead of governance deciding borrow rates, V2 borrowers choose their own, and the protocol uses those market rates as a core stabilizer for BOLD. You can think of this like a market-driven monetary policy system that responds to BOLD being above or below $1.

Additionally, the V2 routes its economic flows back to users, and does so via two avenues that are meant to be sustainable:

- Stability Pools (“Earn”): Deposit BOLD here to earn yield sourced from borrowers' interest payments plus liquidation gains.

- Protocol-Incentivized Liquidity ("PIL"): A hard-coded slice of revenue supports BOLD liquidity, directed by LQTY stakers via gauge voting.

The result of these elements is a project that aims to turn stablecoin stability into a competitive onchain market. The model is readily extensible, too, via Liquity's Friendly Forks program, which allows other teams to deploy their own licensed stablecoins using the V2 framework.

💸 Money League

Want to deploy a custom stablecoin, but you don't have the technical know-how to manually fork the Liquity V2 codebase or you don't want to enter a licensing agreement to do so?

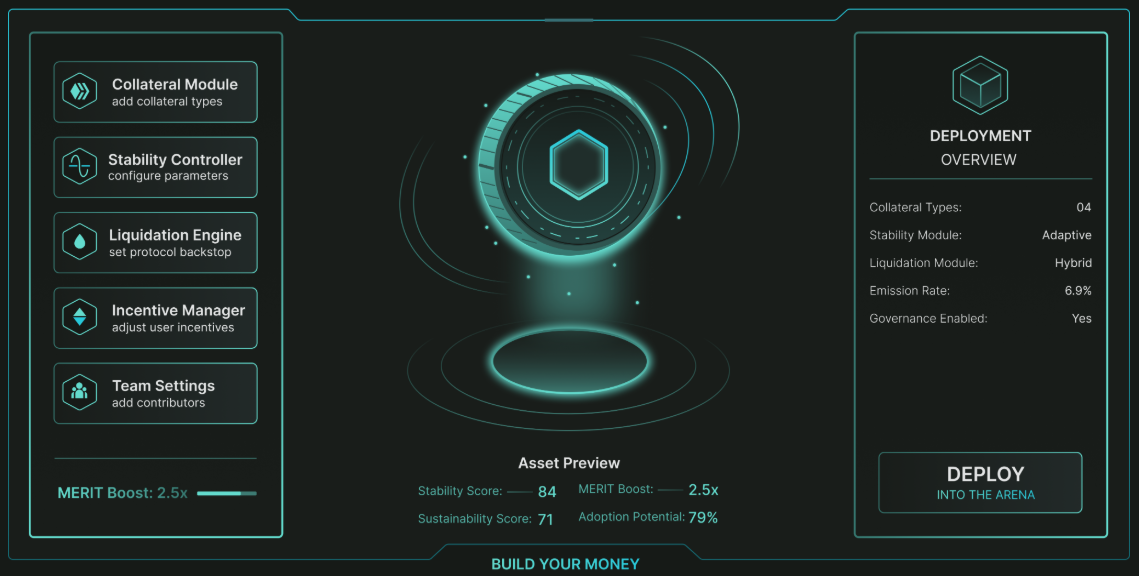

This is where Money League has positioned itself. It's an EVM platform that's being designed so anyone can readily deploy censorship-resistant stablecoins through a factory model.

Instead of teams needing to design an entire bespoke stablecoin protocol from scratch, Money League will provide standardized plug-and-go modules derived from the RAI/HAI stables lineage.

In other words, the protocol will let you handpick your stablecoin's supported collateral (e.g. ETH only), peg mechanics (e.g. floating), risk parameters, and beyond. From there, your deployment will operate as its own independent stablecoin protocol.

In addition, all deployments will be linked through a shared incentive layer built around the MERIT token, which can be redeemed for Money League treasury assets. Stablecoins will compete for emissions by routing fees or offering incentives to gauge-style veMERIT voters, so successful designs should attract more liquidity and attention.

Instead of yet another stablecoin aiming for perfection, Money League is striving to foster many stablecoin experiments in parallel, creating a market where the best designs win liquidity, legitimacy, and distribution.

💫 Polaris

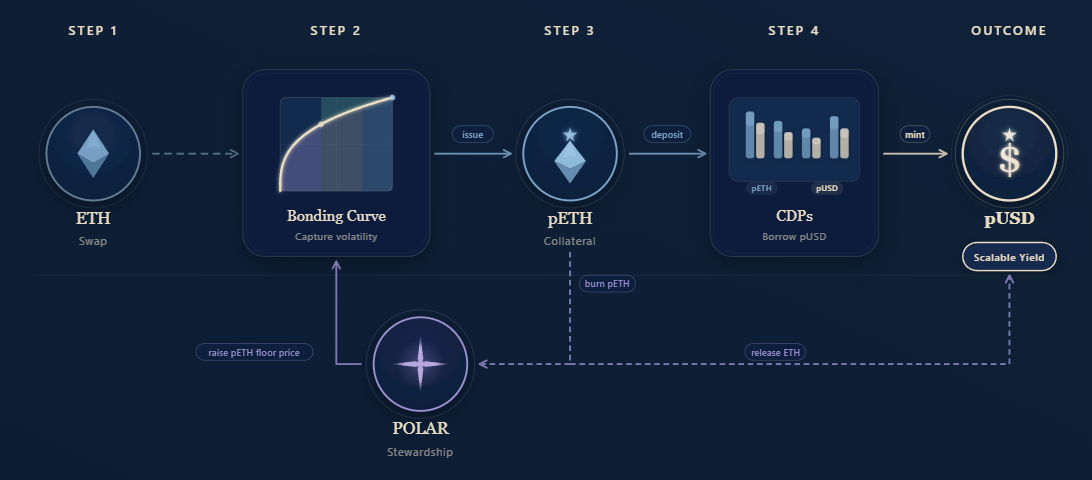

The newest arrival in the trustless stables category is Polaris.

In its early stages, this stablecoin protocol will be fully onchain, and instead of generating yield from external RWAs, it will do so by harvesting internal volatility around its pUSD and pETH tokens through a special bonding curve mechanism.

As adoption around Polaris grows, the system's own onchain activity increases, so the central yield source scales upon expansion rather than being compressed away as is often seen with RWA-centric stablecoins when their deposits grow.

The second central idea here is that Polaris is also openly positioning itself as forkable stablecoin infra, where many stable assets (like pGOLD) can share the same pETH collateral base and grow together as a mutualistic constellation.

For now, we'll have to wait and see how Polaris fares in the wild – how its bonding curve operates, how its system behaves under stress, etc. But the builders are certainly posing an ambitious new crypto-native vision for stablecoins in DeFi, and they're worth rooting for accordingly.

Different Approaches

Looking at these projects side-by-side, it's immediately clear that they’re not clones of each other. They're in the same general ballpark, of course, but they’re different technical attacks on making better DeFi-native stablecoins:

- Liquity V2 wants to make a better trustless dollar stablecoin by letting the market set rates and routing revenues toward stability.

- Money League wants to make stablecoin experimentation cheap and permissionless and to surface the best ensuing performers.

- Polaris wants to escape the yield scaling trap by harvesting its own onchain volatility instead of relying on offchain RWAs.

There’s no guarantee any one of these models wins outright, but that’s besides the point. What matters is that the trustless stablecoins frontier is moving again, and these are the projects that are setting the tone here today and that will (hopefully) inspire the stables of tomorrow during an institution-heavy moment for the sector.