Subscribe to Bankless or sign in

Stablecoins have already cemented themselves as a global killer use case for crypto.

Digitized dollars have been a godsend for developing economies, offering reliable access to hard currency in places where inflation, capital controls, and fragile banking systems have long eroded trust in local money.

Equally, these effortlessly portable standards for value exchange stand to revolutionize developed financial markets by scaling money with internet speeds, providing 24/7 transaction settlement in minutes that bypasses the frictions of traditional payments rails.

What began as a crypto-native experiment to store trading profits has evolved into one of the most impactful financial innovations of the past decade, proving out the practical use case of blockchain beyond speculation. Today, we’re tracing the evolution of stablecoins and unpacking the escalating power struggle over onchain dollars – a battle with major implications for crypto markets and investor portfolios.

The Evolution of Onchain Dollars

The idea to create a price-stable stablecoins that could transfer value without exposure to crypto volatility first emerged in 2012, shortly after Bitcoin’s debut.

Early concepts included BitUSD and NuBits, which attempted to maintain a dollar peg through an overcollateralized model, and failed to achieve scale but were important proof-of-concepts for the potential utility of stable digital assets.

In 2014,  Tether (then called Realcoin) would make stablecoin history with the launch of the world’s first digital dollar token seemingly backed 1:1 by traditional fiat currency reserves (like dollar-denominated treasury bonds).

Tether (then called Realcoin) would make stablecoin history with the launch of the world’s first digital dollar token seemingly backed 1:1 by traditional fiat currency reserves (like dollar-denominated treasury bonds).

From 0 to $150B.

— Tether (@tether) May 12, 2025

Born in 2014, Tether didn’t just launch USD₮ — it launched the entire stablecoin industry.

Today, USD₮ is trusted by 400+ million people & powers the digital economy.

To every user, builder & believer: thank you❤️

We’re just getting started#UnstoppableTogether pic.twitter.com/PPC2PUy1Si

While numerous crypto-native competitors would come and go in the years that followed, each hoping to steal Tether’s near-ubiquitous market share, the capital efficiency of Tether’s 1:1 USDT reserve model has stubbornly endured as the market’s preferred method for onchain dollar storage.

Despite challenges from “algorithmic” stablecoins (Terra’s UST briefly became the third-largest stablecoin, but we know how that turned out) and overcollateralized models (MakerDAO’s DAI is the current number three, but remains volatility-constrained and has become a wrapper for other stablecoins), fiat-backed stablecoins have remained on top by virtue of their effortless scalability and near-absolute parity with dollar reserves.

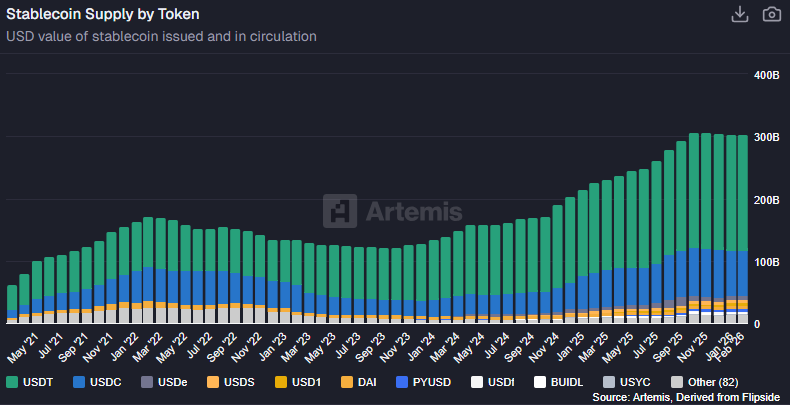

The contemporary stablecoin landscape remains dominated by fiat-backed issuers, with just two stablecoins – Tether’s USDT and Circle’s USDC – collectively accounting for more than 85% of onchain dollars in circulation at the time of this analysis.

TradFi in the Arena

Crypto got its initial look at external stablecoin innovation from fintechs, with payments players ![]() PayPal and Stripe (facing fewer regulatory barriers than banks) launching stablecoin-centric products in 2023 and 2024, respectively.

PayPal and Stripe (facing fewer regulatory barriers than banks) launching stablecoin-centric products in 2023 and 2024, respectively.

Thanks to both the gradual development of regulatory clarity under the Trump Administration and passage of the GENIUS Act, a landmark bill that explicitly enabled banks to issue stablecoins, stablecoin adoption among crypto-external financial institutions has accelerated at an especially rapid pace since the start of 2025.

On March 25, 2025, a partnership between Custodia Bank and Vantage Bank issued America’s first-ever tokenized bank deposit through an interbank, EVM-compatible blockchain in total compliance with applicable bank regulatory requirements.

Not one to be outdone, post-GENIUS Act, JPMorgan Chase & Co. (the largest depository institution in America) launched its own tokenized deposit, JPMD, for institutional clients on Ethereum’s Base L2 in November 2025.

Now, everyone is lining up to get in on the action. Highlights from recent months include:

- BNPL behemoth Klarna deploying “KlarnaUSD” through Stripe’s stablecoin issuance stack on November 25, less than two weeks after JPMD’s debut.

- U.S. Bank disclosing it was testing custom stablecoin issuance on the

Stellar Network that very same day.

Stellar Network that very same day. - SoFi becoming the first national bank to issue a stablecoin with the launch of SoFiUSD on December 18.

- Stock trading platform Interactive Brokers shipping stablecoin account funding on January 15.

- Derivatives giant CME announcing today a tokenized collateral solution, complementing last year's "tokenized cash" partnership with Google.

- Fidelity Investments debuting its FIDD stablecoin on

Ethereum today with a $60M market cap.

Ethereum today with a $60M market cap.

And with comprehensive digital asset market structure legislation in America just off the horizon, stablecoin adoption is likely to accelerate further, unlocking true institutional adoption and a broader role for stablecoins in the global financial system.

The GENIUS Act is going to propel America’s payment system into the 21st century. Let’s get it done! pic.twitter.com/mIGpocZmUs

— Senator Bill Hagerty (@SenatorHagerty) June 4, 2025

The Institutional Squeeze

The regulated future that crypto finds itself hurtling towards presents both opportunities – for institutions that find themselves unburdened by regulation – and challenges – for incumbents that fail to adapt to a new reality.

Although the prospective mass adoption of crypto-native technologies (like stablecoins) will bring new users onto blockchains and inspire an era of unprecedented experimentation, this proverbial rising tide is not guaranteed to lift all boats.

Even after more than a decade of smart contract experimentation, the most advanced and capital efficient stablecoin designs fail to compete with the sheer simplicity of the 1:1 fiat-backed stablecoin model that has cemented itself at the core of digital dollar markets.

Compared to the combined $258B of digital dollars issued by stablecoin standouts ![]() Circle and Tether, synthetic stablecoin pioneer

Circle and Tether, synthetic stablecoin pioneer ![]() Ethena (undeniably fastest growing stablecoin issuer of this market cycle) operates at just 1/34th the scale, and still reserves nearly three-quarters of its stablecoins with fiat instruments.

Ethena (undeniably fastest growing stablecoin issuer of this market cycle) operates at just 1/34th the scale, and still reserves nearly three-quarters of its stablecoins with fiat instruments.

As stablecoins move from the crypto periphery into the heart of regulated finance, TradFi is no longer constrained to watching from the sidelines. Banks make money by controlling money, and as such, are not likely to sit idle once blockchain clarity is delivered.

Banking CEOs are already attempting to preserve their foothold on finance. JPM’s Jamie Dimon and BofA’s Brian Moynihan openly recoiled in recent weeks at the prospect that stablecoins might disrupt their banking oligopoly with yield payments.

Armed with existing access to capital, customers, and regulatory licenses, traditional institutions are uniquely positioned to succeed in a tokenized future by simply repackaging familiar products on new rails. In doing so, they will naturally compete against crypto-native companies for market share, particularly in the heavily regulated financial industry.

The institutionalization of stablecoins so clearly validates blockchains as a core financial primitive, but tragically, in a world where banks are empowered to mint digital dollars at seismic scales, crypto companies that fail to differentiate themselves risk being crowded out from profits on the technology they created.