Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

- 🌎

Tether tops $10B in 2025 profits through Q3. The stablecoin issuer hit $10B in profits in 2025's first 9 months, though its growth was outpaced by USDC.

Tether tops $10B in 2025 profits through Q3. The stablecoin issuer hit $10B in profits in 2025's first 9 months, though its growth was outpaced by USDC. - 🏦

Coinbase Reports Its Q3 2025 Earnings. It was an overall mixed day for COIN despite meeting analyst expectations.

Coinbase Reports Its Q3 2025 Earnings. It was an overall mixed day for COIN despite meeting analyst expectations. - 🤔 SBF Says FTX Solvent, Blames Bankruptcy Team. Sam Bankman-Fried claims FTX had $25B in assets to cover withdrawals but bankruptcy lawyers forced losses, delaying repayments.

| Prices as of 3pm ET | 24hr | 7d |

|

Crypto $3.67T | ↗ 1.6% | ↘ 1.6% |

|

BTC $109,396 | ↗ 2.4% | ↘ 1.3% |

|

ETH $3,849 | ↗ 3.2% | ↘ 2.0% |

As Bitcoin’s Genesis block makes clear, crypto was born from a monetary crisis.

Satoshi’s embedded message of "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" speaks to the fact that fiat currency has become structurally unreliable, manipulated by central banks to rescue failing institutions. Hence his creation of Bitcoin, an alternative form of money, one immune to debasement.

In the sixteen years since Bitcoin’s creation, its founding premise has become an increasingly observable reality in global markets and assets.

As I covered last week, central banks are quietly exiting the Treasury-reserve era and reallocating into hard assets like gold. Regardless of whether foreign holdings of gold have indeed surpassed U.S. Treasuries or not, what’s clear is that there’s been a tectonic shift in how the world stores value.

While many may dismiss gold’s appreciation as a temporary "inflation trade," financial researcher and investor, Luke Gromen of FFTT, believes it is actually something far more “structural debasement trend,” driven by fiscal realities that cannot be reversed.

Below I’ll walk you through the crux of the argument he laid out recently with David and Ryan on the Bankless podcast, explaining what debasement is, why this is a structural shift not a circumstantial one, and how the implications stretch far beyond gold.

As always, I recommend listening to the full podcast (available in Early Access to Citizens only!) to best understand the complete context around debasement but, for now, I’ll give you a strong starting point. Let’s begin. 👇

Bitcoin & The 100 Year Reset on Bankless

Bitcoin & The 100 Year Reset on Bankless

What Debasement Actually Means

Debasement happens when the money supply expands faster than productive output. The result: each unit of currency buys less over time. Prices rise in nominal terms, but purchasing power erodes when measured against hard assets.

In practice, this means maintaining negative real rates, where the interest paid on government debt sits below the rate of inflation. Think of it like this. If the rate of inflation, 5% a year for example, is higher than interest rates, 4% for example, then someone holding a Treasury paying this amount is effectively losing 1%. As a result, savers lose purchasing power while those who issue debt, primarily governments, gain relief, as the real value of what they have to pay has been reduced by inflation. As long as debt levels demand this arrangement, debasement persists as policy rather than accident.

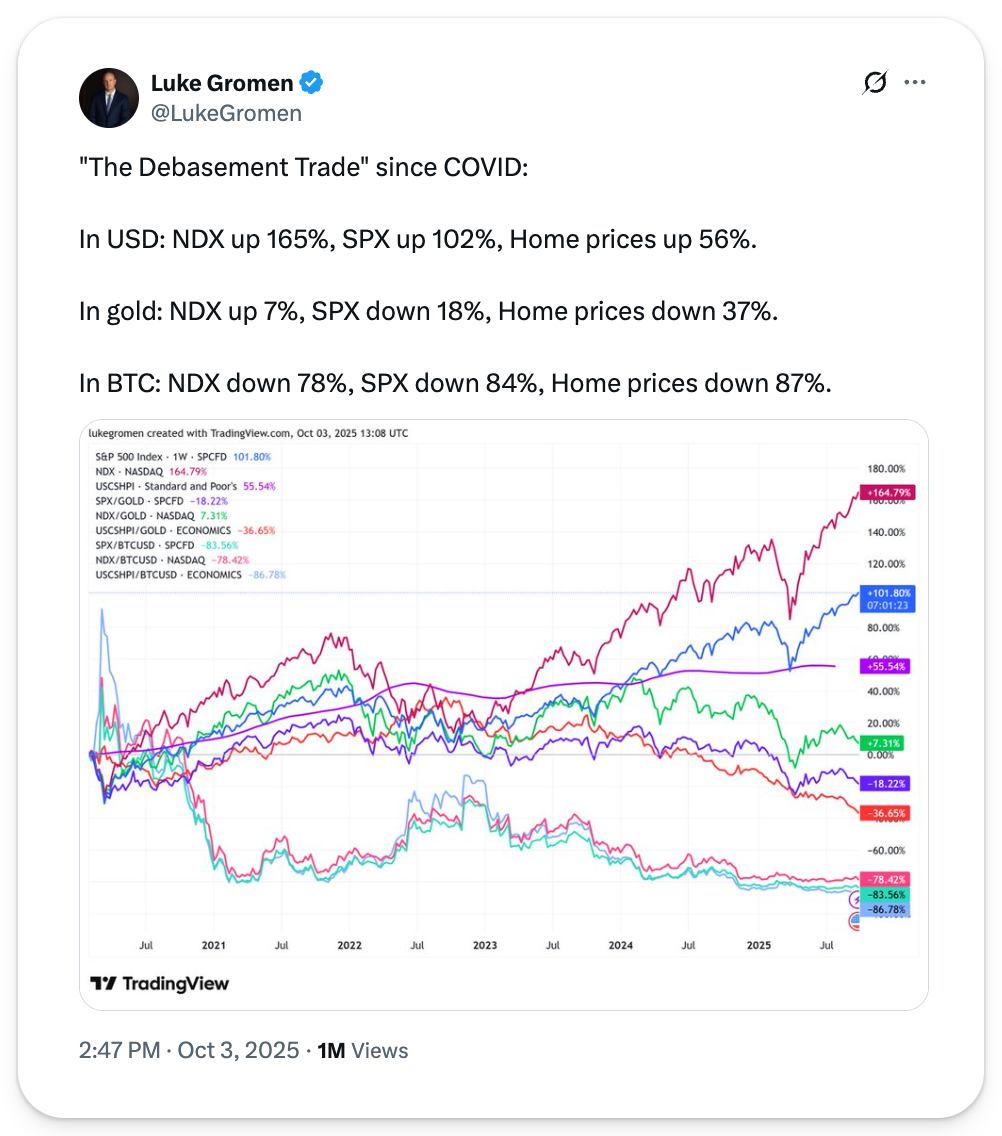

The gap between perception and reality shows up starkly when you change the measuring stick. Gromen recently shared data showing the S&P 500, NASDAQ, and U.S. home prices over the past few years.

- Against Fiat: Measured in dollars, the results look impressive: stocks up triple digits, home prices up double digits.

- Against Hard Assets: Measured in gold, those same assets are flat or negative. Measured in Bitcoin, they've declined steeply.

This means the nominal wealth reflected in dollar terms becomes illusionary when priced against hard money. Fiat assets are inflating against themselves, not generating real gains.

Why This Is Structural, Not Cyclical

As is obvious by the appreciation of metals like gold, as well as silver, this debasement has clearly become an investor trade, with analysts comparing it to the inflation cycle of the 1970s and early 1980s that ended when Fed Chair Paul Volcker raised rates aggressively to break inflation. But to Gromen, debasement is not merely a short-term trade, but a long-term trend.

Why? The U.S. cannot repeat that playbook. Raising rates meaningfully today would destroy equity, housing, and Treasury markets simultaneously.

The reason comes down to fiscal dominance. When government deficits and debt grow large enough, they begin dictating what central banks can and cannot do. The Federal Reserve loses the ability to fight inflation independently because raising rates would make the government's debt burden unsustainable. Instead, the Fed must keep rates low enough to allow the government to service its debt, even if that means accepting persistent inflation.

Central banks must keep real rates negative or risk a debt crisis. There's no way out that keeps the current system intact. Negative real rates have become the default setting, turning debasement from a temporary problem into a permanent feature of the monetary system.

The Global Response: De-Dollarization and Hard Assets

While Treasuries once were the unchallenged top reserve asset for central banks globally, these negative real yields are destroying their attractiveness as reserve assets.

Why hold bonds that guarantee you lose purchasing power? Add to this the weaponization in recent years of the dollar system through sanctions, tariffs, SWIFT exclusions, and asset seizures, and foreign central banks have accelerated their search for alternatives.

The response has been clear and measurable. Many nations, but most notably China and Russia, have steadily increased gold reserves while reducing Treasury holdings.

Gromen sees this shift as representing more than just a portfolio rebalancing, but an overall loss of confidence in dollar-denominated paper assets and a return to hard money as the foundation for reserves. Gold's price surge over the past year reflects this repricing of global monetary confidence.

What This Means for Crypto

Gromen expects Bitcoin to continue its surge right alongside gold, emulating the metal’s “hard money qualities” and building on it with all the advantages that come with belonging to the world of bits, rather than atoms. For him, it’s simple:

- Both represent assets that cannot be printed by governments.

- Both gain value when real rates remain negative and fiscal dominance locks in.

Between these two, Luke believes that each will ascend to be dominant reserve assets, but play different roles depending on where one is in the world. For those in the west, Bitcoin will reign supreme given its digital edge, while gold will rule the eastern world. He also sees a path for gold to reach $20K/oz as it continues to be adopted as a neutral reserve asset at a larger and larger scale.

For more on Luke Gromen's views on this path to $20K, what it means for markets, and, more importantly, what it means for “money” overall, it’s best to listen to the full podcast.

Unichain offers the most liquid Uniswap v4 deployment on any L2 – giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

Luke Gromen makes the case that “debasement” isn’t a trade, it’s the new regime.

We unpack why assets look strong in dollars yet stagnate in gold/Bitcoin terms, the global reserves shift back toward gold, how a U.S. gold reprice to $10k–$20k could fund a balance-sheet reset, the risks of “paper gold,” Bitcoin’s potential catch-up (and a possible East=gold, West=BTC split), AI as an accelerant, and a pragmatic portfolio framework for navigating a 100-year reset.

Listen to the full episode 👇

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png?class=ppsmall)