Sponsor: Unichain — Faster swaps. Lower fees. Deeper liquidity. Explore Unichain on web and wallet.

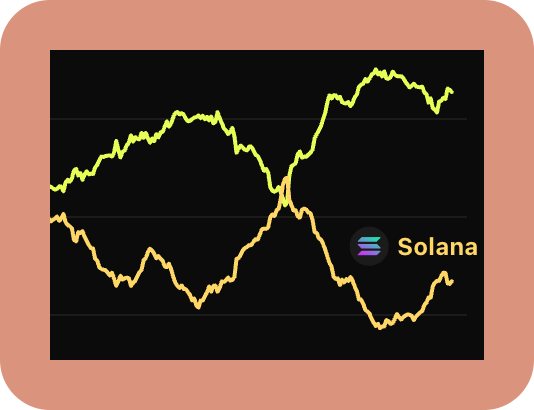

📸 Market Snapshot: Base and other Ethereum-linked AI tokens captured this week's gains, decisively outpacing their  Solana counterparts as strong backing and high-profile endorsements fanned the flames.

Solana counterparts as strong backing and high-profile endorsements fanned the flames.

Standout performances came from:

- Bankr ($BNKR) — up 45%+ on the week after receiving investment from the Base Ecosystem Fund (

Coinbase Ventures). The endorsement triggered downstream effects, with Banker's Debt Relief Bot ($DRB) rallying ~80% — likely serving as a beta play on the broader Bankr ecosystem.

Coinbase Ventures). The endorsement triggered downstream effects, with Banker's Debt Relief Bot ($DRB) rallying ~80% — likely serving as a beta play on the broader Bankr ecosystem. - Talos ($T) — up over 100% after receiving high-profile endorsements, such as a repost from Ethereum’s Twitter. Like with Bankr, “beta” to Talos climbed as well, with Empyreal ($EMP) — the framework token underpinning Talos — up ~35% on the week.

Other Base-linked performers included AI infrastructure token $REI, which continued its strong run, and DeFAI protocol $GIZA, which posted more modest gains. Over the past week, Base's mindshare has pulled ahead sharply of Solana as evident in the chart above.

Yet, DeFAI momentum did spill over to SOL AI tokens — $MOBY climbed another ~70% this week and $EDWIN gained ~20% — despite the rest lagging compared to ETH.

Editor’s Note: David Hoffman wrote an X thread this morning on Talos as well, and while though coordination wasn’t planned, I did want to explicitly note that this coverage is organic and no one here received allocations from Talos. If you have any questions, please reach out to me on X.

On Wednesday, the official  Ethereum Twitter account — typically reserved for protocol updates and ecosystem milestones — reposted about Talos, sending its token $T soaring and drawing fresh eyes to this Arbitrum-backed, AI-powered treasury protocol. Following a week where I noted DeFAI agents like Axelrod and Mamo posting 30-40% gains, this Ethereum co-sign felt like validation of something bigger brewing at this intersection.

Ethereum Twitter account — typically reserved for protocol updates and ecosystem milestones — reposted about Talos, sending its token $T soaring and drawing fresh eyes to this Arbitrum-backed, AI-powered treasury protocol. Following a week where I noted DeFAI agents like Axelrod and Mamo posting 30-40% gains, this Ethereum co-sign felt like validation of something bigger brewing at this intersection.

Recently in Mindshare, I've been calling out how AI, specifically DeFAI, holds tremendous potential for improving how we operate onchain, turning yield farming from a manual grind into a set-and-forget process. It's clear that many companies understand the upside here if they're able to truly provide edge onchain — something which now Arbitrum's taking a stab at too.

What is Talos? The AI Engine at the Core

The first major release from Onchain Labs, a recently established Arbitrum-backed "onchain experience" accelerator, Talos is an autonomous treasury system on Arbitrum, built using Empyreal’s SDK, and steered by tokenholders who guide its AI engine towards generating standout, sustainable yields.

At its heart, Talos operates like a three-part machine: an AI engine that executes strategies, DeFi mechanisms that fuel its growth, and community governance that steers the whole operation.

At its core is the treasury, a shared pool of assets — ETH, stablecoins, yield-bearing tokens — deployed by AI to earn returns via lending, liquidity provision, and other DeFi strategies.

The AI, running within a Trusted Execution Environment (TEE) for security, manages:

- Real-time scanning — Monitors markets continuously and processes sentiment to adapt strategies and manage risks based on alignment with protocol goals

- Automated deployment — Funds flow to ERC-4626 vaults — standardized "digital safes" for streamlined yield farming

- Dynamic rebalancing — Positions adjust automatically based on market conditions

Importantly, all strategies must first be approved by elected stewards before execution — adding a human safety layer. The system can even integrate multiple AI models for different tasks, creating a modular intelligence system.

Further, to fuel this AI engine's growth, Talos incorporates three interconnected DeFi mechanisms, which some veterans might recognize from the previous cycle.

The DeFi Fuel: How Talos Powers Its Growth

Think of these mechanisms as the fuel that powers Talos's AI engine. Each plays a specific role, but together they create a flywheel effect.

Protocol-Owned Liquidity (POL): The Stability Foundation

Like many did during the days of OlympusDAO (OHM), Talos directly controls its own $T token trading pools rather than depending on external liquidity providers who might pull out during market dips.

Here's how POL fuels the system:

- Treasury-fueled growth — As the treasury earns, it deepens liquidity pools helping the token better absorb market shocks.

- Recycled profits — Trading fees flow back into the treasury, providing an additional source of yield and capital growth.

- Token buybacks — Excess profits repurchase $T tokens, helping control supply.

As a result, Talos can be thought of as its own market maker, helping stabilize its token and recycling profits into its treasury.

Staking: Cooperation as Rocket Fuel

Second comes staking. Rather than just allowing holders to earn yield though, staking in Talos directly amplifies the AI's capabilities, drawing from the "stag hunt" game theory model: cooperate (stake) for huge rewards, or go solo (just hold) for smaller gains.

The mechanics create a direct feedback loop:

- High participation (more stakers) — Unlocks advanced AI strategies, delivering "top-tier" rewards.

- Low participation (less stakers) — AI plays it safe, yielding modest returns.

- Defense agents — Monitor sentiment and price action to optimize emission rates for resilience.

Crucially, staking emissions flow only to stakers and those delegating their voting power to Twitter-registered "stewards" — community experts who help guide protocol decisions — ensuring only aligned participants receive inflationary rewards and bonuses.

Bonding: The Growth Accelerator

The final feature fueling Talos's treasury growth is bonding — where users swap ETH for discounted $T tokens that vest over time, injecting fresh capital and rewarding long-term investment.

How bonding feeds the engine:

- Discounted entry — Swap ETH for $T below market rates.

- Instant deployment — Bonded ETH immediately goes to work in yield vaults.

- Sentiment-aware — Can halt bonds during instability or increase during growth phases.

These three mechanisms work together to create a self-reinforcing cycle. Each dollar bonded strengthens the treasury, each staker empowers the AI, and each trade captures value for the ecosystem.

The Steering Wheel: Community-Driven Governance

Now, with AI serving as the engine and DeFi mechanisms as the fuel, governance steps in as Talos's steering wheel. Here, the protocol blends onchain mechanics with social validation through Twitter.

The governance flow works like this:

- Stake or delegate $T to Twitter-registered stewards

- Submit proposals for protocol improvement, stylized as Talos Improvement Proposals (TIPs)

- Steward review ensures alignment before AI execution

- Community validation through public Twitter polls

This enables "nomic evolution" — where the protocol can modify its own rules through governance — as the community can propose AI tweaks, new strategies, and enhanced capabilities. Further, anyone can contribute new skills, workflows, or datasets. Whether Twitter polls are ideal for complex financial decisions is debatable, but it does make participation accessible.

The Bottom Line: DeFAI's Natural Home

While only in the first stage of its phased evolution (meaning many features aren't live yet), the vision proves quite compelling.

With the Ethereum ecosystem boasting the most mature, battle-tested onchain liquidity and yield opportunities, if DeFAI can truly provide an edge in capital allocation — AI agents working 24/7 as tireless fund managers, optimizing yields and charging performance fees — it offers something traditional finance struggles to replicate.

Not because TradFi lacks AI or algorithms, but because their siloed systems and regulatory constraints prevent the permissionless composability that lets an onchain AI seamlessly move capital between protocols, rebalance positions in seconds, and access global liquidity pools without waiting for approval from intermediaries. As RSA put it, this always-on approach to treasury management "is why Ethereum wins."

Will all these mechanisms come together to fuel Talos's growth as promised? Time will tell. But given Ethereum's position as the institutional chain of choice and its deep liquidity pools waiting to be optimized, DeFAI overall seems to have a natural home on Ethereum.

Plus, other news this week...

🤖 AI Crypto

- Bankr — Launched automations: turn any prompt into a recurring action, from daily buys to scheduled market alerts in Base group chats

- 🔥 Gaia — Announced $20M raise to develop a decentralized, censorship-resistant AI stack + a privacy-first smartphone with fully local, user-owned AI

- Poseidon — raised $15M led by a16z to build a decentralized data layer for training AI on physical-world data, built on Story Protocol

📣 General News

- Alibaba — unveiled "Qwen3-Coder," a coding AI model with 480B parameters, 256K context, open-source CLI, and top marks on SWE-bench

- OpenAI — gearing up to launch GPT-5 in early August

- Meta — poached three Google researchers behind a gold medal-winning AI model

- 🔥 White House — released new AI action plan calling for increased support of open-source AI development, among other things

💻 Vibe Coding

- 🔥 Amp (guide) — How to Build an Agent

- Github (tool) — Launched Github Spark, a vibe-coding tool built directly into Copilot

- MyShell.AI (tool) — Releases ShellAgent 2.0, an agent for vibe-coding

📚 Reads

- Anthropic — Build AI in America: Energy Report

- Hack VC — Proof of Work #1: Monthly Crypto x AI Newsletter

Unichain offers the most liquid Uniswap v4 deployment on any L2 - giving you better prices, less slippage, and smoother swaps on top trading pairs. All on a fast, low-cost, and fully transparent network. Start swapping on Unichain today.

In this episode, Ejaaz and Josh break down the AI flex behind ![]() OpenAI and Google’s historic gold medal wins at the International Math Olympiad, from the tech breakthroughs powering their problem-solving dominance to what it means for the future of education.

OpenAI and Google’s historic gold medal wins at the International Math Olympiad, from the tech breakthroughs powering their problem-solving dominance to what it means for the future of education.

They also dig into the deeper questions around how AI is reshaping our definitions of intelligence — and the escalating rivalry as the two giants chase supremacy in the AI game of thrones.

Catch the full breakdown on what this means here👇

Bittensor

Bittensor