Sponsor: KGeN — KGeN is building the Verified Distribution Protocol for the next Web3 wave.

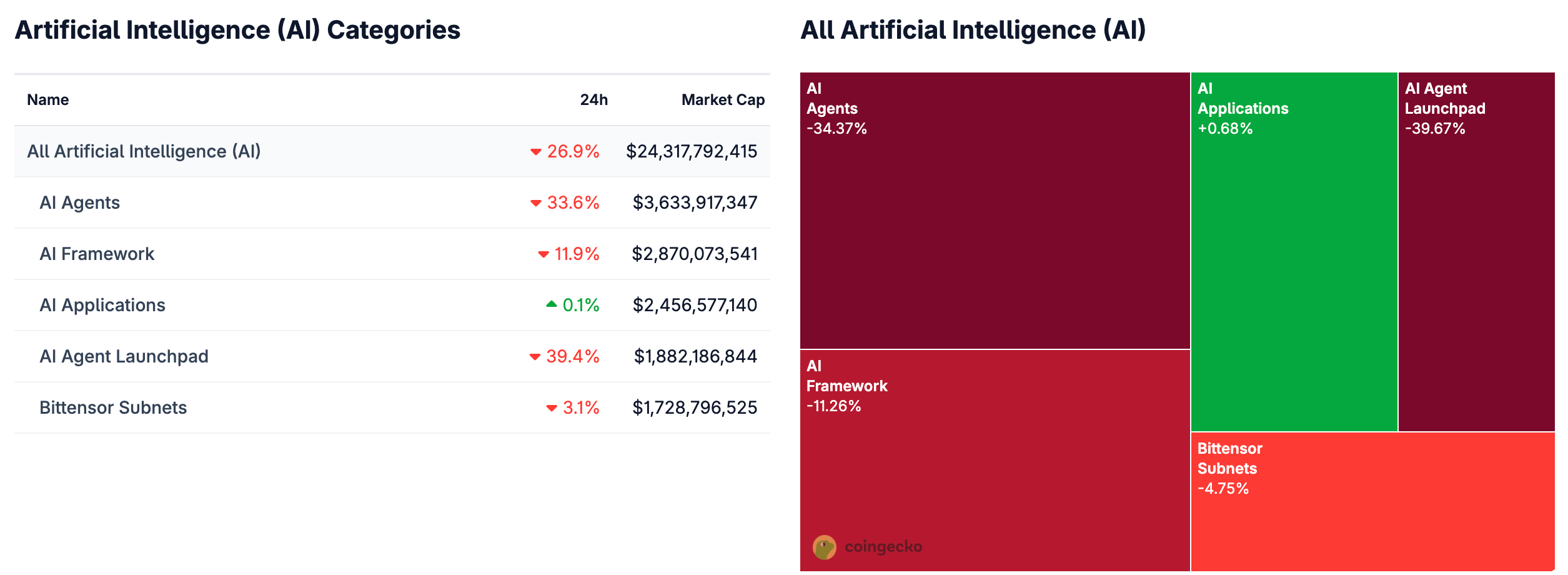

Few things escaped the red this week — especially after Friday. Amid the drawdown, a handful of tokens tied to prediction markets and autonomous agents still managed gains, signaling early momentum around x402 and the "agentic" narrative taking shape.

- Bettensor ($SN30), a

Bittensor subnet for decentralized betting and prediction tools, stayed green and closed Friday up 15%. The rally followed intensifying rivalry between Kalshi and Polymarket, plus surging developer interest in layering derivatives and prediction tools atop these platforms.

Bittensor subnet for decentralized betting and prediction tools, stayed green and closed Friday up 15%. The rally followed intensifying rivalry between Kalshi and Polymarket, plus surging developer interest in layering derivatives and prediction tools atop these platforms. - Daydreams ($DREAMS), the utility token powering an on-chain generative AI agent library and framework, ended the week up roughly 15%. Momentum stems from spotlight on x402 — (the A2A payments protocol) — and a growing ecosystem building agentic tools for on-chain commerce. Daydreams stands out as both a key enabler and the best liquid proxy for this trend so far.

With Kalshi and Polymarket now launching competing grant programs, expect more opportunities around "agentic" or "AI-enhanced" tokens backed by either market. Worth keeping your eyes open and doing research while prices sort themselves out.

After months of experimenting with its launchpad Genesis, ![]() Virtuals has rolled out Unicorn — a new mechanism that replaces presale pledging with immediate market access, seeking to address what the team views as Genesis's core flaw: it became a farming game rather than a conviction engine.

Virtuals has rolled out Unicorn — a new mechanism that replaces presale pledging with immediate market access, seeking to address what the team views as Genesis's core flaw: it became a farming game rather than a conviction engine.

According to Virtuals, Genesis started with the right premise — fair access gated by contribution through a points system, a novel and refreshing mechanism amidst the deluge of generic launchpads coming to market at the time. But in practice, as Virtuals puts it, users rotated between launches, farming points to flip allocations in new tokens rather than backing projects long-term. Quality founders struggled to raise meaningful capital since the system lacked built-in fundraising beyond small trading fees.

Unicorn is their answer: a model designed to reward early conviction, fund serious builders, and make ownership meaningful again. Below, I'll walk through what changed, how the new system works, and whether it actually solves the problems it claims to address.

What Unicorn Changes

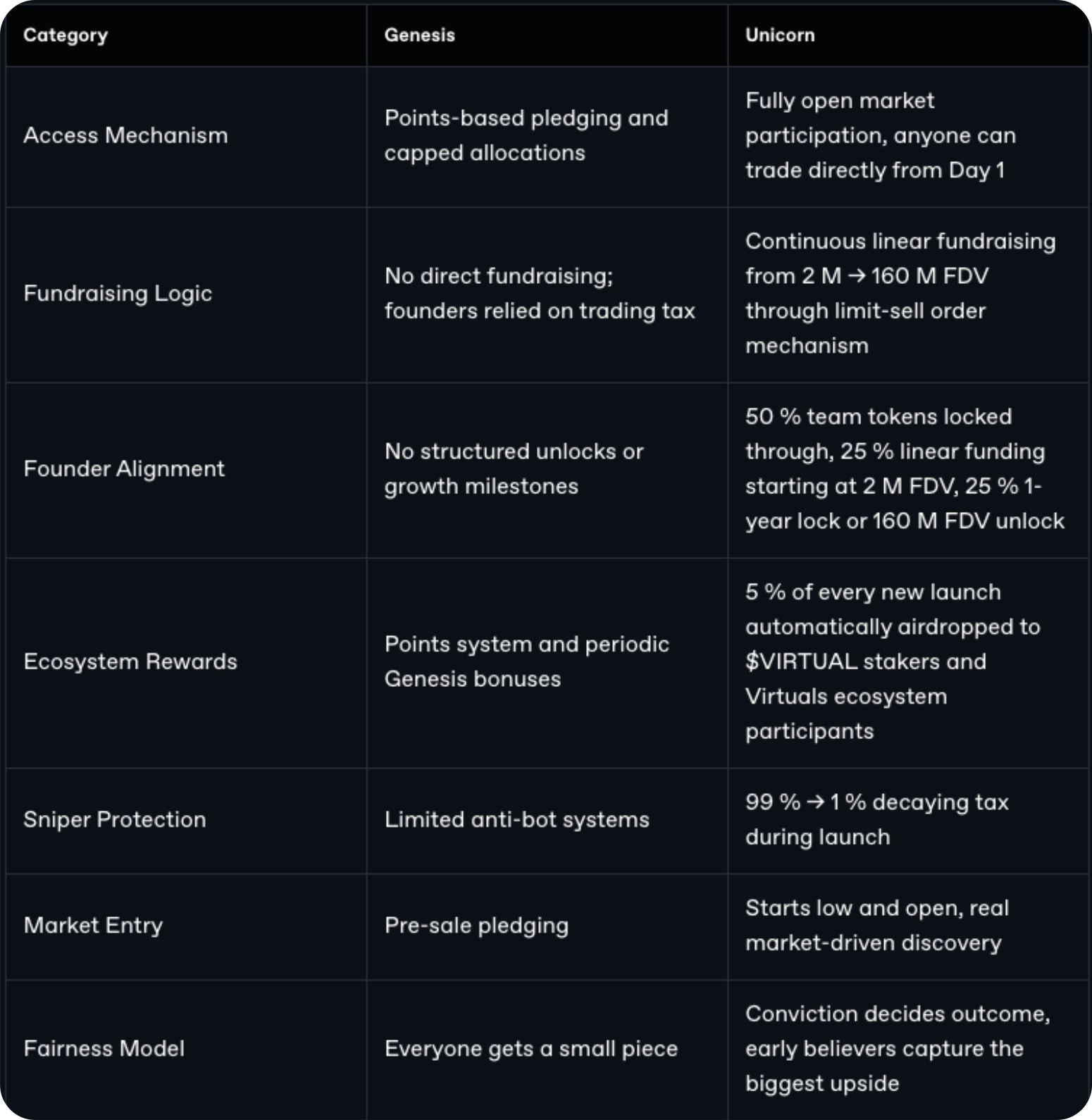

Where Genesis operated through presale pledging with points and $VIRTUAL, Unicorn opens trading immediately at a low valuation — no presale, no gating, just direct market participation from Day 1, sort of like MetaDAO (which I wrote about earlier this week).

The shift centers on three core changes:

1. Market Access and Participation

- How it Worked in Genesis: Previously, users had to accumulate points through staking, holding, or content creation, then pledge those points alongside $VIRTUAL during a 24-hour presale window. These points were use it or lose it, expiring after 30 days and requiring active management. Participation was gated behind the presale with capped allocations (max 0.5% per user), and the system had limited anti-bot protections.

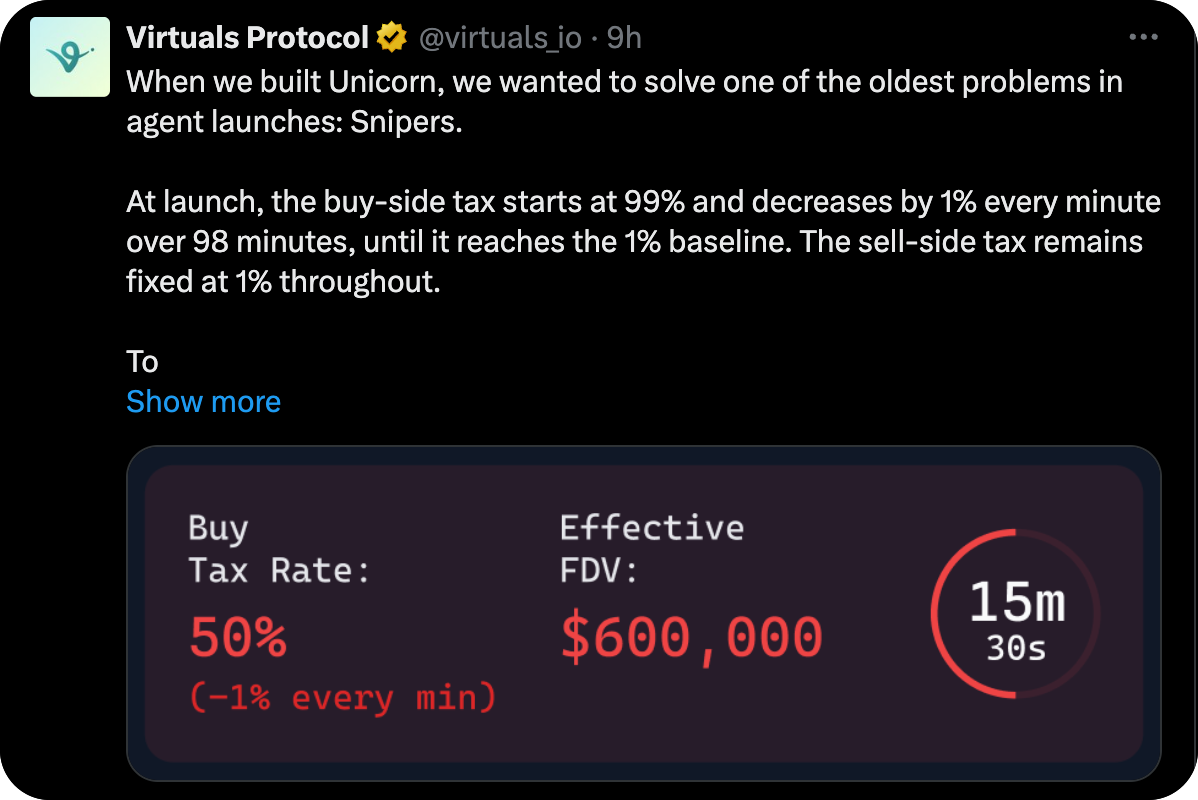

- How it Works in Unicorn: Now, anyone can trade immediately once a project goes live at a low starting valuation — no gating, no caps. A 24-hour evaluation window sits between a launch page's creation and trading, giving the community time to review before liquidity activates. In an attempt to fend off bot activity, an anti-sniper tax starting at 99% and decaying to 1% launches with the token initially, with collected taxes used to buy back the agent token itself.

2. Founder Fundraising and Token Unlocks

- How it Worked in Genesis: In Genesis, there was no direct fundraising path. Teams relied on the 12.5% liquidity pool and whatever trading tax revenue accumulated, leading Virtuals to experiment with alternative funding systems like Project 69. Further, Genesis included a 50% team allocation but lacked structured unlocks or growth milestones.

- How it Works in Unicorn: 50% of supply still goes to teams, but is split between two unlock mechanisms. The first 25% distributes linearly through automated limit-sell orders starting at $2M FDV and continuing up to a $160M FDV. The remaining 25% unlocks one year after launch with a six-month linear vest, or once the project hits $160M FDV — whichever comes first. This creates a direct incentive for teams to demonstrate market traction via their token, since they can't access funds until they do so.

3. Community Rewards Distribution

- How it Worked in Genesis: Previously, rewards came through a points system requiring manual engagement — staking $VADER, holding specific tokens, or creating content. Points expired after 30 days, required constant farming, and were then used to get preferential access to new launches (which were usually dumped as fast as possible).

- How it Works in Unicorn: Now, every launch will automatically allocates 5% of supply to $VIRTUAL stakers (2%) and active Virtuals ecosystem participants (3%). These distribute weekly, meaning every new agent launch directly rewards the broader community without requiring manual point accumulation.

The Transition Period

For current Genesis participants, the shift to Unicorn includes a three-week transition for airdrop allocations.

Existing Virgen Points won't disappear immediately. A snapshot will capture all point balances before Unicorn launches, and those points will continue generating airdrops during the transition window. Over three weeks, the system will gradually shift from points-based rewards to the new staking and airdrop-based model.

After three weeks, points will stop mattering entirely. Rewards flow exclusively through staking and verified activity. If you've been farming points for months, you have a narrow window to benefit before the system resets.

Whether Unicorn fully solves the farming problem remains to be seen, but the structural changes address Genesis's core issues directly. Open markets from Day 1 remove point gaming entirely, though they do introduce different dynamics for participants to navigate. The fundraising mechanism ties founder incentives to growth in a way Genesis couldn't — and while not every project will reach $160M FDV, the ones that do will have demonstrated real traction along the way.

What Virtuals is betting on makes sense: that conviction-based markets will surface better projects than egalitarian distribution did. If founders respond to the improved fundraising structure and early believers are rewarded for spotting quality, Unicorn could mark a meaningful step forward for how agents launch and scale.

Plus, other news this week...

🤖 AI Crypto

- Bittensor — now requires burning, not just locking, of $TAO for subnet creation

- CrunchDAO — raised $5M co-led by Galaxy & Road Capital for 10K+ ML engineers' decentralized AI prediction network

- 🔥 Ethereum Foundation — ERC-8004 for trustless agents (NFT-based portable reputation) now under official review

- Giza — added support for

Plasma yields to flagship stablecoin agent ARMA

Plasma yields to flagship stablecoin agent ARMA - OpenMind — launched Fabric Identity Network on Base for verifiable credentials and agent use-cases

📣 General News

📚 Reads

KGeN is building the world’s largest Verified Distribution Protocol, a.k.a VeriFi — delivering AI & Human Data-driven intelligence through KAI. With over 200+ enterprise partners, and global human-verified data at scale, KGeN has achieved a massive $33.6M+ ARR as of July 2025.