Your Free Tokens Are Not Available

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

EigenLayer’s token drop was announced on Monday, but plenty of users across the globe were disgruntled that the claim page for EIGEN is "Not Available" to them!

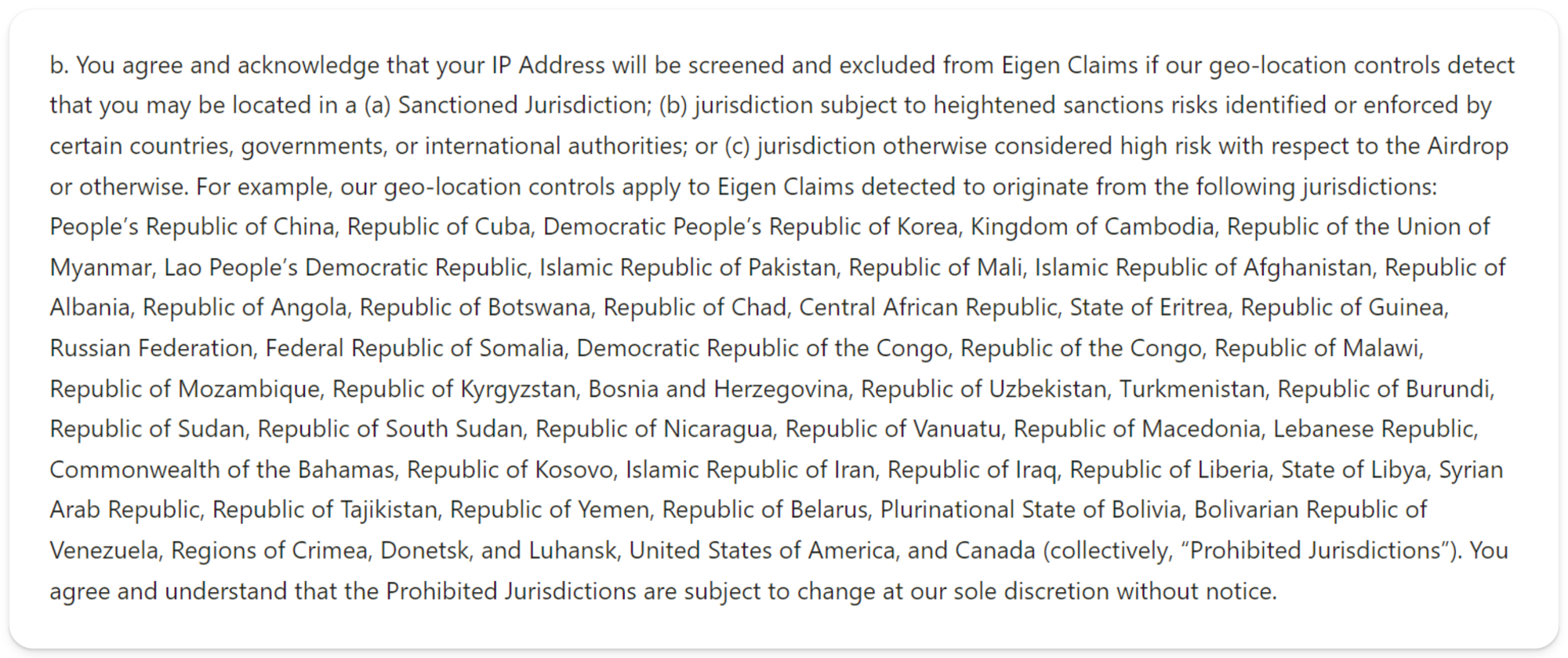

Who can't claim?

Not only are residents from a expansive list of nations including the U.S. banned from claiming EIGEN, the claims site explicitly blocks users from interacting with the frontend via VPN or other proxy technologies!

This restriction came as a shock to some existing users due to unfettered access to the EigenLayer frontend otherwise, and limited communication from the protocol on their plans for aggressive geo-blocking.

While EigenLayer is far from the first protocol to pursue some of these limitations in their token distribution, the outsized EIGEN opportunity is leading users in impacted geographies to wonder whether they will continue to be excluded from future gains until regulators get their act together.

The New Normal for Airdrops?

Considering the hostile and unclear regulatory backdrop crypto protocols are forced to operate under, disappointments like the EIGEN claim restrictions are becoming more and more common.

Amid a lack of clear guidance from existing statutes and the refusal of American financial system regulators to provide satisfactory guidelines for digital assets, protocol operators and token issuers are left guessing how to best avoid the scrutiny of agencies such as the SEC.

This lack of regulatory clarity has infested every corner of the crypto industry, making it exceedingly difficult for users to access crypto protocols and often prohibiting users from accessing the free money which their onchain interactions entitled them to claim.

presented without comment pic.twitter.com/KtGLwmqEKF

— Chairman Birb Bernanke (@Bonecondor) April 29, 2024

Because the presence of token distributions to American (and sanctioned) users can easily place crypto protocols within the jurisdiction of various American regulators, projects frequently block IP addresses originating from America and nations sanctioned by the Office of Foreign Asset Control (OFAC).

While teams had historically sought to mitigate potential liability by simply banning IP addresses from restricted nations, a September 2023 settlement made between the Commodities Futures Trading Commission (CFTC) and DeFi derivatives platform Opyn indicates that regulators believed their blocking of IPs was insufficient at prohibiting restricted users from accessing the platform, placing it within the jurisdiction of U.S. regulators.

🚨 BREAKING: CFTC announces THREE ENFORCEMENT ACTIONS against @opyn_, @0xProject, and @DeridexHQ

— Bankless (@BanklessHQ) September 7, 2023

DeFi in the US is under threat! Will DeFi frontends soon be forced to block US users?

The CFTC has leveraged tokens squarely in its… pic.twitter.com/tsY6yrAg4n

This approach is not unique to EigenLayer and has been adopted for numerous airdrop distributions, such as Celestia’s TIA, and implemented by certain bluechip protocols to prevent unauthorized access to their frontends, including MakerDAO’s Spark lending protocol.

To minimize the potential for American regulators to target their projects while still preserving access to their decentralized protocol and maintaining the ability to launch tokens, many projects have now resorted to completely banning VPNs, eliminating any possibility that users from restricted nations can access their products.

Thankfully, there are still avenues for restricted users to access these protocols, either via directly interacting with smart contracts onchain or physically changing their location, but unfortunately, it appears highly likely that the stringent combination of geoblocking and VPN restriction will be the norm for the majority of token issuers going forward.

Airdrop hunters would be keen to anticipate and prepare for geographical token claim restrictions whenever engaging with early stage projects, regardless of whether they can interact with the underlying protocol via its frontend.

Jack Inabinet

Jack Inabinet .png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)