View in Browser

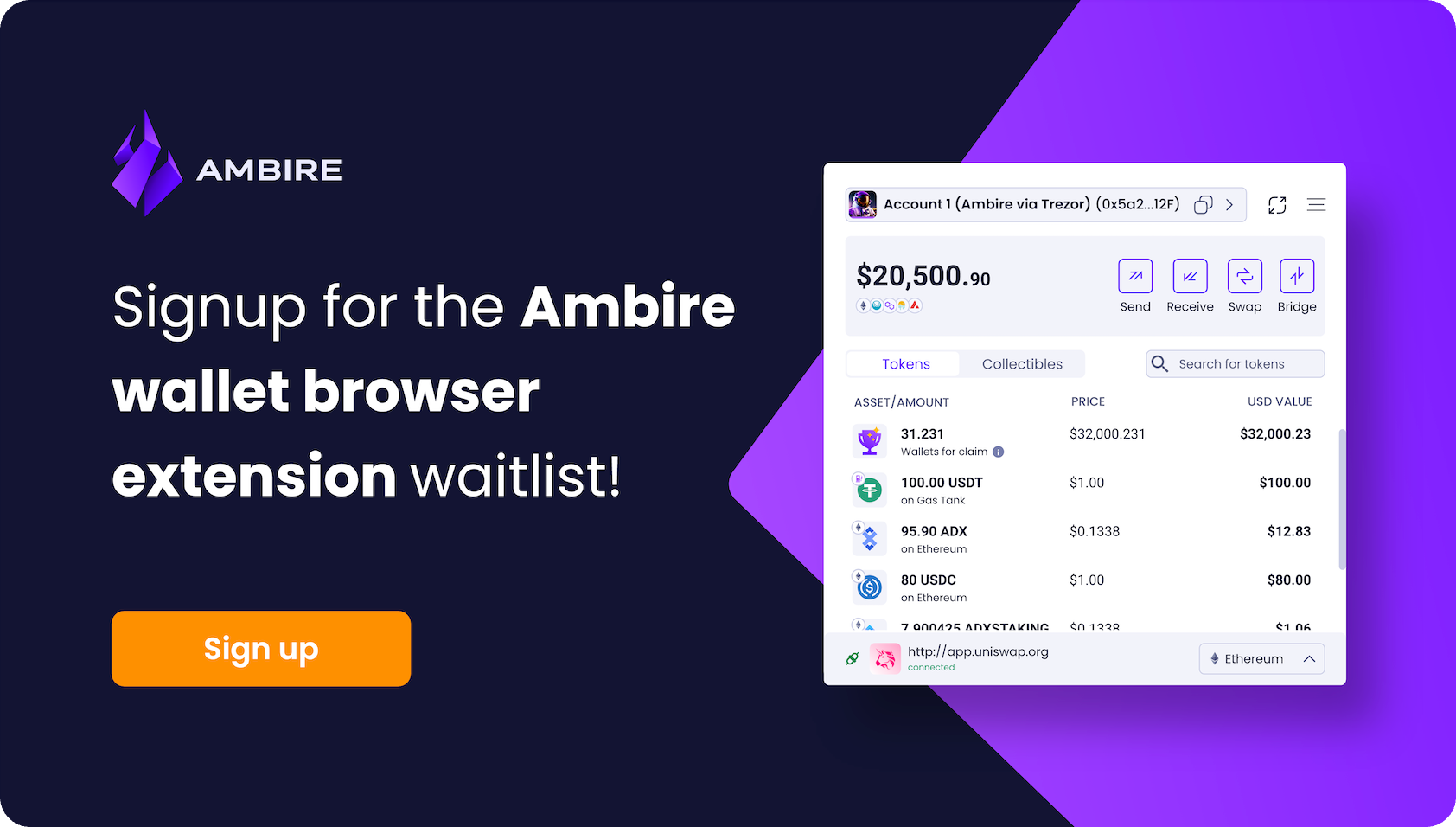

Sponsor: Ambire — Sign up for the Ambire wallet browser extension waitlist!

This time last year, the shadows of FTX's downfall loomed large, casting a pall over the crypto world.

Our wounds were fresh, the outlook grim. The stage seemed set for a deluge of stifling crypto regulations, feeding into the narrative of an industry on the brink.

We braced for impact in 2023 accordingly, anticipating new seismic shifts. Instead, what loomed as crypto's darkest hour became an unexpected turning point here.

Fast forward 12 months to today, and Bitcoin is nearing a Spot ETF approval. Solana, once teetering on the edge, has staged a comeback for the ages. In the L2 arena, veteran and newcomer solutions have gained more adoption than ever before.

So, as we gear up to embrace the bull market of 2024, let's turn back once again to see how far we've come. Time to recap the most defining moments of 2023!

Watch the new Yearly Rollup episode to get the full rundown with Ryan and David. In the meantime, read our quick takes on 2023's biggest happenings. 👇

1. Coinbase Introduces Its Base L2

In February 2023, Coinbase advanced on the final prong of its Secret Master Plan in introducing Base, the crypto exchange giant’s layer-two (L2) scaling solution.

Built on the OP Stack–Optimism’s modular, open-source tech stack for creating highly scalable, highly interoperable rollups–Base officially conducted its mainnet launch in August 2023 and has rapidly grown since then.

Now, within Ethereum’s scaling scene, Base stands only behind first-mover L2s Ethereum L2.View Profile" class="stubHighlight">Arbitrum and Optimism in size and activity. This ascension has happened so fast thanks to the Base + Coinbase Wallet combo becoming the premier gateway for Coinbase’s users into the cryptoeconomy’s onchain frontiers.

Accordingly, while it’s fair to say some L2s have arrived to little fanfare so far, Coinbase’s Base launch this year proved to be a prime example of why you should never underestimate the importance of distribution in crypto!

2. Crypto’s Banking Scare

In March 2023, a trio of crypto-friendly banks–Silicon Valley Bank (SVB), Silvergate Capital, and Signature–failed or, in the case of Signature, faced a shutdown from banking regulators.

Described by some as the most significant financial crisis since 2008, the episode erupted after SVB announced it was in dire straits, a move that kicked off a run on the institution’s deposits. In short order, the U.S. federal government was forced to step in and guarantee depositors’ funds.

Unsurprisingly, the dramatic collapses caused chaos in the cryptoeconomy. For example, the popular stablecoin USDC faced a temporary de-pegging incident after news broke that Circle, USDC’s steward, had more than $3 billion USD worth of deposits tied up in the SVB.

USDC recovered, and the storm eventually ended up blowing over, but not before reminding everyone in crypto once more that banks are, in fact, fallible.

3. Big Scammers Pay the Price

Throughout 2023, we had the pleasure of watching all the biggest crypto villains from the 2021-2022 era face justice.

For instance, Terra’s Do Kwon was arrested in March, Celsius’s Alex Mashinsky in July, and 3AC’s Su Zhu in September.

The cherry on top? FTX destroyer Sam Bankman-Fried was found guilty of 7 counts of fraud in November.

These figures' financial crimes were unhinged, but now that they’re all answering for their actions, the crypto ecosystem can finally move on and start its next chapter.

4. Arbitrum’s Airdrop

Wen token? Arbitrum, currently Ethereum’s biggest L2, answered that question in a big way in March 2023 when it unveiled $ARB.

At the time, Arbitrum’s creators distributed $ARB worth ~$1.5 billion to Arbitrum users per the token’s $15 billion opening valuation, making it one of the largest airdrops in history to date.

The release coincided with the launch of The Arbitrum Foundation and DAO governance for Arbitrum’s growing suite of networks, starting with Arbitrum One and Arbitrum Nova.

That said, this is just the start of the $ARB journey, then, as Arbitrum’s new AnyTrust and Orbit tech stacks mean more chains to govern are nigh.

5. Bitcoin Ordinals Revives Bitcoin Building

The current Inscriptions craze can be traced back to January 2023 when Casey Rodarmor introduced Ordinals, a system for creating Bitcoin NFTs by inscribing data across individual satoshis, the smallest BTC denomination.

The arrival of this new onchain storage technique on mainnet led to an immediate explosion of minting activity as people flocked to the novelty of a new kind of native Bitcoin token standard.

Fast forward to today, almost one year later, and Bitcoin has now facilitated over 46 million Inscriptions and counting, with over $105M USD worth of fees spent by users so far for inscribing their data.

This surge has had two main consequences so far: the revival of Bitcoin’s creative builder scene, and the arrival of Ordinals-style Inscriptions on almost every chain of note at the top of the cryptoeconomy.

6. Friend.Tech Catches Fire

friend.tech (FT) is a crypto social app that surged onto the scene after launching on the Base L2 in August 2023.

The idea? Let people buy and sell keys–i.e. chat access tokens offered along a bonding curve–of connected Twitter accounts. In other words, you can buy a person’s key and then get access to a private “super chat” with them.

The project facilitated an absolute frenzy of activity in the weeks following its launch, temporarily surpassing Bitcoin in fees generated at the time. Indeed, it reached the 1 million users milestone within 60 days!

Yet FT also kicked off another major trend, which is the embedded wallets + progressive web app (PWA) combo. This approach allowed the project to offer slick onboarding UX and bypass centralized app stores, and now this has become a model that's increasingly being embraced by upstart crypto apps.

7. SEC Collects Big Court Ls

In 2023, the U.S. Securities and Exchange Commission (SEC) faced notable legal setbacks in two landmark cases, reshaping the crypto regulatory landscape.

First up, July saw Ripple Labs securing a significant victory against the SEC over its XRP cryptocurrency, a decision that set a precedent for future SEC vs. crypto cases. This win was not just a triumph for Ripple but also signaled a potential shift in U.S. securities law regarding digital assets.

Then, in August, Grayscale also won its case against the SEC, enhancing prospects for the approval of a Bitcoin ETF. This court ruling criticized the SEC’s actions as “arbitrary and capricious,” marking a significant step in the crypto market’s favor.

These consecutive defeats for the SEC yet again underscored the need for more nuanced regulatory approaches toward digital assets in the U.S.

8. SEC Sues Crypto Exchange Giants

Despite some big court losses, the SEC stayed on the offensive in 2023 by initiating legal actions against major crypto exchanges like Coinbase and Kraken.

The lawsuits spanned the gamut, too. For example, Coinbase was sued for allegedly failing to register its crypto offerings, while Kraken was sued for its Ethereum staking services.

These actions haven’t led to huge victories for the SEC, but they have highlighted the hostile environment and growing legal complexities that crypto companies have faced in the U.S. under the current SEC Chairman, Gary Gensler.

If nothing else, now we know the Commissioner is definitely out for blood.

9. Binance Hit with Federal Charges

In November 2023, Binance, one of the world’s leading crypto exchanges, and its CEO Changpeng “CZ” Zhao faced a significant legal hurdle as they pleaded guilty to federal charges in the U.S.

The allegations? Violations of anti-money laundering (AML), unlicensed money transmitting, and sanctions laws.

The plea deal saw Binance agree to pay the U.S. Department of Justice (DOJ) a whopping $4.3 billion settlement. Following this, Zhao was released on a $175 million bond, with his sentencing now scheduled for February 2024.

We’ll see what happens next year when CZ appears in court again, but for now, Binance has survived fairly unscathed and will move ahead with a new CEO, Richard Teng.

10. The Return of Solana

Solana, whose community was hit hard by the fallout of the FTX collapse, rose like a phoenix from the ashes toward the end of 2023.

Indeed, after starting the year at $10, the SOL price rallied to as high as $124 in December, buoyed by Solana becoming the newest airdrop frontier and a resurgent app scene centered around projects like Jito, Jupiter, Magic Eden, and beyond.

Combine these dynamics with the network’s low transaction fees, and Solana is now well-positioned for the current crypto bull market. Only time will tell where the L1 goes from here, but it’s undoubtedly emboldened anew heading into 2024.

Ambire V2 is the first smart contract wallet alternative to MetaMask to unlock the full power of Account Abstraction without any compromise on user experience or security. With more than 100,000 users on web and mobile, now Ambire is launching a browser extension and Bankless readers might have the chance to test it before everyone else.

Many Bankless Citizens who completed the Jito quests in our Airdrop Hunter app just earned $10k+ airdrop paydays!

It's airdrop season and plenty of other protocols are preparing to reward early users. Get on their lists. Start hunting!

In this article

Solana

Solana

friend.tech

friend.tech

Ethereum

Ethereum

Jito JTO

Jito JTO